今日彭博社发消息称:若政府开始调查Tether不法行为,USDT很快就会失去价值。直指Tether公司存在欺诈违法行为,一石激起千层浪,投资者们不约而同的开始出售手里的烫手山芋,转手买入其他币种。从而也形成一个市场现象:USDT被集中性发售,其他主流币种价格普遍上涨。因此有不少人预判,接下来会有一个小牛市的出现。

Today, Bloomberg reports that the USDT will soon lose its value if the government begins to investigate Tether’s wrongdoing. Directly, Tether’s fraud caused thousands of waves, and investors agreed to sell hot potatoes in their hands and buy them in other currencies.

在这市场跌宕起伏的状况下,有人在很着急的高价买入BTC;有人很淡定的在低价收购USDT。而在彼此看来,都觉得对方脑子缺根经。

In this situation of market collapse, BTC has been bought at a very high price; while USDT has been bought at a very low price, it seems to each other that the other has a brain deficit.

对此,不少人愁云惨淡,韭菜们以为买入就会被割,空仓等待最安全,可颠覆三观的是:空仓观望也能把你割了。

A lot of people are sad about this, and they think they'll be cut off when they buy it, and it's safest to wait for it.

如果USDT真的崩了,发生了挤兑,那么一定会一根线咋到底,怎么会有人接盘呢?如果这次是谣言,前段时间大量冒出来的稳定币(USDT竞争币)会获益。大资金可以低价收USDT。Bitfinex发usdt完全是稳赚不赔的买卖,就算是超发,以Bitfinex的资金体量还不能补回来?白白赚钱的生意谁会不做呢?这一波翻倍行情,你抓到了吗?

If the USDT really crashed and there was a run-off, how could there be a connection? If this was a rumour, there would be benefits for the stable currency (USDT) that had come up in large numbers in the previous period. Big money could get USDT. Bitfinex gives usdt a pretty good deal. Even if it's too much, it won't make up for Bitfinex's money. Who wouldn't do the business for nothing? Did you catch the wave?

首先来做一个USDT恐慌分析,USDT在此前本就一直存在信任危机,现在彭博社直指公司不法,导致其他交易所用转手USDT买入其他币种以求保值,从而推动BTC等主流币的上涨。

First, to do a USDT panic analysis, in which there had been a crisis of trust since before, Bloomberg now directs itself to the wrong company, leading other exchanges to buy other currencies to preserve their value, thereby driving the rise of mainstream currencies such as BTC.

当初Tether公司发售USDT30亿枚,以与美元1:1的铆钉价格来说,USDT市值为30亿美金,若是其信任危机不解除的话,按照现在usdt:usd=1:0.9,USDT归零了就是一文不值。

The USDT market value of $3 billion, at the price of $1:1 dollar, was originally sold by Tether. If the crisis of trust is not resolved, the USDT is nothing if it is now usdt:usd=1:0.9.

可如果接下来Tether公司站出来澄清,局面或许还有挽回的余地。泰达公司要么拿出30亿美元的银行存款证明,证明1:1兑换的泰达币有美元存储,而不是网传的凭空发售。要么找到传统银行来做担保,当这接盘侠,解除当前危机。

But there may be room for recovery if Tether comes forward to clarify the situation. Teda will either produce a $3 billion bank deposit certificate showing that 1:1 conversions of tadpoles are stored in United States dollars, rather than online sales.

如果迟迟不站出来澄清,或是澄清在大众看来无效,USDT将不得不走归零之路,如果归零顺利的话,等bfx开始停止取款业务,挤兑效应开始,爆掉所有USDT占比高的交易所(国内就有很多),交易所纷纷破产利空影响比特币,而凭空消失的30亿泰达币更会对比特币造成影响。

If there is a delay in coming forward to clarify, or if there is a general perception that it is ineffective, the USDT will have to go to zero, and if there is a smooth break, then bfx will start to stop the withdrawals, the run-off effect will start, all of the USDT-high-volume exchanges will blow up (and there will be plenty in the country) and the exchange will be bankrupt to the detriment of Bitcoin, while the 3 billion tadcos that have disappeared will have a greater impact on Tetco.

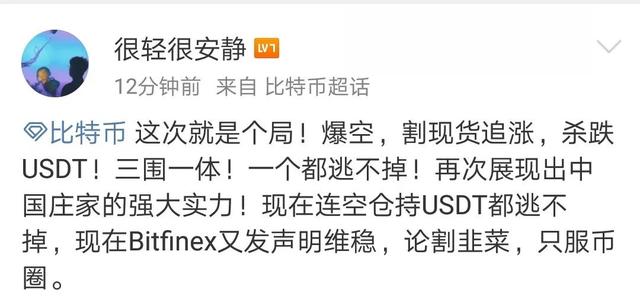

针对于为何出现今日市场的现象,小黑对此有如下猜测:

Black guesses why today's market is happening as follows:

今日USDT下跌或是短期事件,不排除背后势力搞期货市场,制造市场动荡,并由此获利。 Tether公司的确存在凭空发售USDT的行为,从而导致市场行情跌宕。

Today’s decline in USDT, or short-term events, does not preclude the forces behind it from creating futures markets that are volatile and profiting from them. Tether does sell USD in thin air, leading to a decline in market performance.

下午Bitfinex CFO发声:Bitfinex目前的提款一切正常。所有加密货币和法币的提币业务都一直正常处理,没有收到任何干扰。所有法币的提取都正在处理中。某些特定用户群体的法币存款功能暂时关闭了。将在10月16日推出一个新的、更强大的法币存款系统。

In the afternoon, Bitfinex CFO sounds: Bitfinex's current withdrawal is normal. All encoded currency and French money money-transfer operations have been handled without interference. All French currency withdrawals are being processed. The French deposit function of certain specific user groups has been temporarily shut down. A new, stronger French currency deposit system will be launched on October 16.

北京时间17:02,Tether排行榜目前排名第三位的火币钱包地址向排名第十三位1LAnF8h3qMGx3开头火币钱包的地址再度转入近3052万USDT。北京时间13:47,这两个地址也曾互转近3388万USDT,今日已累计互转近6410万USDT。

At 17:02 Beijing time, Tether's third-ranked gun wallet address has been transferred again to the 13th place of 1LAnF8h3qMGx3 with close to 305.2 million USDT. At 13:47 Beijing time, the two addresses have been transferred to nearly 338.8 million USDT, and today cumulatively to nearly 64.1 million USDT.

目前TETHER尚未出面澄清,以至于市场无法平静下来,不过按照USDT绑定美元的说法,如果折价过多,不排除有机构的套利行为,而这种行为如果形成挤兑,对TETHER公司将会形成重大考验。

TETHER has not yet come out to clarify that the market cannot calm down, but, according to USDT, excessive discounts do not preclude institutional arbitrage, which would be a major test for TETHHER.

本文来源:【秃头小黑】版权归原作者所有

Source: Copyright owned by the original author.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论