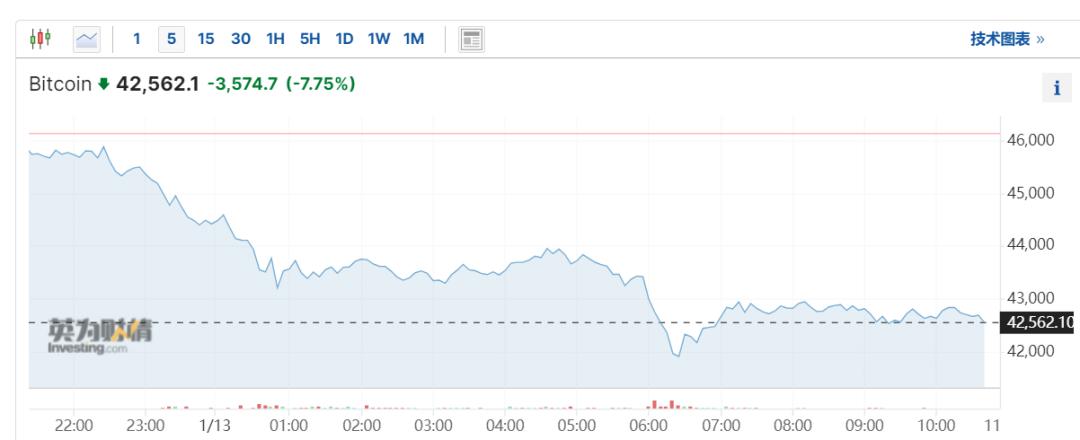

现货比特币ETF上市第二日,数字货币再迎来抛售。比特币一度跌破42000美元/枚,截止1月13日内跌幅超7%,报42562.1美元/枚。

The current Bitcoin ETF is on the second day of the market and the digital currency is sold again. Bitcoin fell by over 7% to $4562.1 on 13 January.

现货比特币ETF普遍跌6%左右。其中,DEFI跌超6.6%,FBTC跌6.4%,HODL和BRRR跌6%,BTCO跌5.9%,BITO跌5.9%。

The spot bitcoin ETF generally fell by about 6%. Among them, DEFI fell by more than 6.6%, FBTC by 6.4%, HODL and BRRR by 6%, BTCO by 5.9%, and BITO by 5.9%.

区块链概念股普遍大跌。其中,亿邦国际ADR跌13.6%,Hut 8跌10.7%,第九城市ADR跌10.2%,微策投资跌8.5%,嘉楠科技ADR跌8.3%,Riot Platforms跌7.4%,数字货币交易所Coinbase跌6.2%,网红券商Robinhood跌5.3%。

The block chain concept has generally fallen significantly. Of these, the ADRs have fallen by 13.6 per cent, Hut 8 by 10.7 per cent, the ninth city ADR by 10.2 per cent, micro-investment by 8.5 per cent, KANIT by 8.3 per cent, Riot Platforms by 7.4 per cent, Coinbase by the digital currency exchange by 6.2 per cent, and the Red Bonder Robinhood by 5.3 per cent.

据证券时报报道,CoinGlass 数据显示,截至北京时间1月13日上午,24小时全网加密货币市场爆仓的投资者超过10万人,爆仓总金额达3.42亿美元(约合人民币24.5亿元)。

According to the Securities Times, CoinGlass data show that, as of the morning of 13 January Beijing time, there were more than 100,000 investors on a 24-hour Internet-wide encrypted currency market, with a total of $342 million (approximately RMB 2.45 billion).

ETF上市次日 比特币“蹦极”

The day after ETF went on the market, Bitcoin's "jumping poles"

美国证券交易委员会(SEC)本周三批准,首批现货比特币于周四1月11日开始上市交易。比特币全天大幅震荡。

This Wednesday, the United States Securities and Exchange Commission (SEC) approved the first spot bitcoin to be traded on Thursday, 11 January. Bitcoin is in shock all day.

美东时间周四上午,比特币盘中涨穿4.9万美元,创2021年12月以来的新高,日内涨约6.8%。不过很快热情退潮,比特币日内转跌,重返4.6万美元下方。相关ETF也随之下挫。

On Thursday morning, the United States of America had four hundred and ninety thousand dollars on the Bitcoin plate, a new high since December 2021, with an increase of about 6.8 per cent in the day, but with a quick retreat of enthusiasm, Bitcoin fell back below $46,000 in the day. The ETF was also frustrated.

比特币现货ETF在美上市后,韩国金融监管机构做出正式回应,警告国内券商,从事任何国外上市比特币现货ETF的经纪活动都可能违法。

Following the listing of the Bitcoin spot ETF in the United States, the Korean Financial Supervisory Authority issued an official response warning domestic bond dealers that any brokering of the foreign market on the Bitcoin spot ETF could be illegal.

比特币在周五美股开盘后加速下行,盘中跌破4.4万美元,较周四ETF上市首日所创的两年来高位回落超过5000美元,抹平本周前几日ETF上市乐观情绪带来的涨幅。目前比特币已跌超7%,报42562.1美元/枚。

Bitcoin went down fast after Friday’s opening, falling by $44,000, down more than $5,000 over two years from the top created on Thursday’s first day on the ETF, quelling the rise in ETF optimism the previous week. Bitcoin has now fallen by more than 7%, reporting US$ 42562.1.

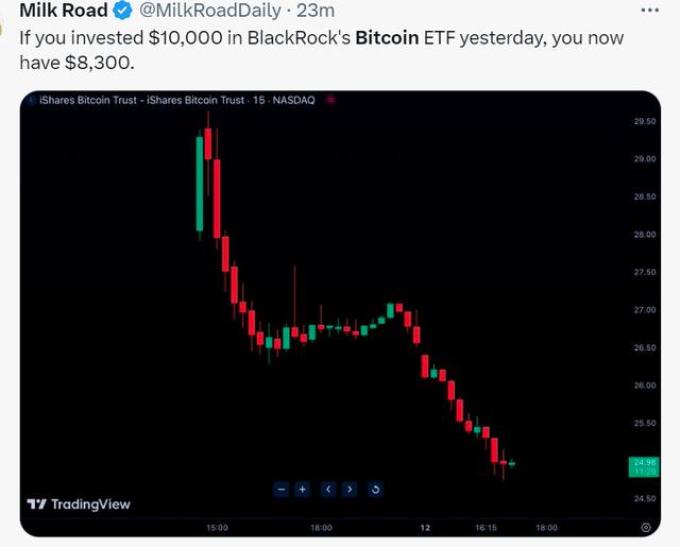

连续两日的表现不佳,令比特币上市首日就冲进去的投资者,损失不小,以贝莱德的ETF计算,周四投进去1万美元,周五只剩下8300美元。

The poor performance of two days in a row resulted in significant losses to investors who were forced into Bitcoin's first day on the market, with $10,000 invested on Thursdays and $8,300 left on Fridays, as measured by the ETF in Belede.

为何大跌?比特币后市如何?

Why did you fall? What about the city after Bitcoin?

美国知名金融评论家Peter Schiff表示:

Peter Schiff, a well-known US financial critic, said:

到目前为止,比特币、比特币ETF和其他与比特币相关的股票的抛售出人意料地有序。我想知道什么时候抛售会变得更加激进。

So far, the sale of bitcoin, bitcoinETF and other bitcoin-related shares has been unexpectedly orderly. I wonder when the sale will become more radical.

从资金流数据看,除了有人直接抛售比特币套现,比特币ETF彼此之间面临的竞争也异常激烈。资金从收费贵的ETF,转入收费便宜的:

From the data on financial flows, in addition to the direct sale of bitcoin, there is an unusually high level of competition between bitcoin ETFs.

虽然昨天比特币ETF的交易量中有近一半来自灰度ETF,也令灰度的这只ETF跻身有记录以来交易量第三大的ETF,但交易量并不代表投资者的资金流入/流出,灰度这只ETF的资金其实是流出的。

Although yesterday almost half of the transaction volume of the Bitcoin ETF came from the Greyscale ETF, which has also led to the third largest transaction since the time it was recorded, the volume of transactions does not represent the inflow/outflow of investors, and the Grey ETF funds are actually released.

华尔街见闻网站此前提到过的,在基金的首次推出优惠期过后,Bitwise旗下的BITB只收取0.20%的费率,为所有ETF中最低的,其资金流入量最大。其余ETF也均有不同程度的资金净流入。

As mentioned earlier on the Wall Street website, after the Fund’s first concession period, Bitwise’s BITB charges only 0.20 per cent, the lowest of all ETFs with the largest financial inflows. The remaining ETFs also have different levels of net inflows.

事实上,比特币近两日表现不佳,有点“卖事实”的走法,一些人并不感到意外。

In fact, Bitcoin's performance has been poor in the last two days, with a bit of a “sale-for-fact” approach, and some people are not surprised.

早前就有分析师警告,市场的兴奋可能为时过早,虽然美国SEC批准了比特币现货ETF的推出,但广大投资界仍认为加密货币存在风险,2022年加密货币交易所FTX倒闭等丑闻提高了投资者的警惕。

Analysts had warned earlier that market excitement might be premature, that although the United States SEC had approved the introduction of the spot ETF in Bitcoin, the risk of cryptographic currency continued to be perceived by the wider investment community, and scandals such as the collapse of the FTX in the crypto-currency exchange in 2022 raised investor vigilance.

加密数据服务商CryptoQuant上个月就表示,期待已久的比特币现货ETF获批将会引发抛售,因为比特币在过去三个月上涨了60%以上,市场已经消化了这一大利好。在现货ETF获得批准后,比特币预计下个月将回调至32,000美元。

CryptoQuant, the encrypted data provider, said last month that the long-awaited approval of the spot bitcoin ETF would trigger the sale, as it had risen by more than 60% over the last three months and the market had already absorbed the profit. With the approval of the spot ETF, Bitcoin is expected to return to $32,000 next month.

比特币再度下跌,还与很多机构尚未进场有关。考虑到比特币本身存在的投资风险,先锋、高盛、美银等其他大机构暂不加入战局。在不同机构购买这些ETF之前,尽职调查审查和平台批准需要时间。

Given the investment risks inherent in Bitcoin, other major institutions, such as vanguard, Goldman Sachs, and the United States of America, are not joining the war. Due diligence reviews and platform approval take time before different agencies buy these ETFs.

此外,虽然美国SEC已经“投降妥协”,但并非所有交易平台都可以交易这些比特币ETF。部分原因可能是这些基金尚未获得券商合规部门的批准。据报道,花旗一位代表表示,该行正在评估面向散户的产品。大名鼎鼎的Vanguard也不例外。昨天就有网友按耐不住,说将养老金里的钱从Vanguard转到Fidelity,只为买比特币ETF。

Moreover, while the US SEC has “surrendered the compromise”, not all trading platforms can trade these bitcoin ETFs. This may be partly due to the fact that these funds have not yet been approved by the securities compliance department.

但从另一方面来看,有投资者指出,由于当前场内的机构数量并不多,以及一些想买还买不了的市场参与者,这意味着未来潜在的增量资金规模大,后续如果随着更多机构加入,或许会引爆新一轮持久行情。

However, on the other hand, investors pointed out that, given the small number of institutions in the current field and the number of market participants who might not yet be able to buy, this would mean that potential incremental capital would be large in the future, and that a new round of protracted movements might be triggered as more institutions joined.

本文不构成个人投资建议,不代表观点,市场有风险,投资需谨慎,请独立判断和决策。

This paper does not constitute a personal investment proposal. It does not represent a point of view. The market is at risk.

原标题:《超10万人爆仓,比特币跳水,发生了什么?》

Original title: Over 100,000 people in the barn. Bitcoin jumped. What happened?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论