【编者按】大家好,我是一名币圈老韭菜,今天我想聊聊一个我期待已久的交易委托功能。作为一名经历过币圈2个减半周期的老韭菜,见证过一次次暴跌暴涨...

Hello, everyone. I'm an old-timer. Today I'd like to talk about a transactional commission that I've been waiting for. As an old-timer who's been through two halves of the currency, he's seen a one-time crash.

大家好,我是一名币圈老韭菜,今天我想聊聊一个我期待已久的交易委托功能。

Hi, I'm an old-timer, and today I'd like to talk about a transactional commissioning function that I've been waiting for.

作为一名经历过币圈2个减半周期的老韭菜,见证过一次次暴跌暴涨时自己持仓资产的不断巨大波动,也经历过大行情大起大落时因来不及平仓操作而导致爆仓。每次爆仓过后除了悔恨选择了错误的交易策略,也会思考为如何才能在博取收益时降低风险?

As an old dish that has experienced two half-cycle cycles of currency, has witnessed the constant volatility of its own holdings at a time when there has been a sharp fall and surge, and has experienced an explosion in a time when it is too late to clean up its operations. Each time after the explosion, regret has chosen the wrong trading strategy, it also wonders how to reduce the risk when it comes to reaping the benefits.

遭受今年312暴跌后,在平复心情的同时,我心中涌现出一个疑问:为什么现在的交易平台只有限价委托、计划委托、单向止盈止损委托等机制,没有双向止盈止损委托功能?

After a sharp fall of 312 this year, and at the same time as I am calming my heart, I wonder why the current trading platform is limited in price, planned in nature, one-way out-of-end and loss-of-trust mechanisms, and there is no two-way stop-out and loss-of-trust function.

假如,在3月12日当天,我以7300美元市价持有BTC的仓位,我希望在市价达到8000美金时挂委托卖单,同时,为了预防价格暴跌导致损失,设置止盈单的同时,我还可以设定7100美金止损委托卖单。如果能这样,当价格达到我设定的触发价格时,我在止盈止损2个方向都能挂出预期的委托单。这样,就不至于因为突然的暴跌来不及操作导致爆仓。

If, on March 12, I held the BTC warehouse at a market price of US$ 7,300, and I wanted to hang on to the order when the market price reached US$ 8,000, and, in order to prevent a price collapse from causing a loss, I could set the order at US$ 7,100. If that were the case, when the price reached the trigger price I set, I would be able to place the expected order in both directions to stop the loss. That would not be the result of a sudden collapse that caused the crash.

带着这样的止盈止损委托单功能需求,我找遍了目前主流的几大交易所。在一片失望中,我发现几乎所有主流交易所,都仅仅支持单向的止盈或止损功能。没有哪家交易所同时支持双向止盈止损。询问过几个其他的币圈好友以后,朋友们在愕然之余,也表达出同样的需求。

With this need for a stop-and-lost commissioning function, I looked through several of the major exchanges that are currently in the mainstream. In a sense of disappointment, I found that almost all mainstream exchanges only support one-way stop-and-break functions. No exchange supported both-way stop-and-run losses. After asking a few other friends of the currency circle, friends expressed the same demand.

原来,支持双向止盈止损是广大币圈投资者的共同需求。

Support for two-way stop-out losses was originally a common demand of investors in the broad currency circle.

既然,用户都有双向止盈止损功能的需求的,这个功能也能有效的降低投资者的交易风险,为什么交易所不支持呢?

Since users have a need for both-way excess and lossal functions, which can also effectively reduce the transaction risk of investors, why is the exchange not supported?

具体原因不得而知,不过作为币圈老韭菜,我想尝试开开脑洞,站在投资者和交易所的角度深入分析为什么不支持。经过细细分析,我初步得出以下三个原因:

The specific reasons are not known, but as a coin-column, I would like to try to open my brain and in-depth analysis of why it is not supported from the perspective of investors and exchanges. After a detailed analysis, I draw three preliminary reasons:

1、 用户需求不强烈或者必要性不强。对于大部分投资者而言,大家习惯了现有的一些委托单机制,由于惯性思维会认为当前这些功能就是所有,没有其他的委托单机制。在意识上没有觉醒,导致大部分用户不知道双向止盈止损功能的存在。用户的需求没有有效传导只交易平台,交易平台自然不会主动去增加此项功能。

1. User demand is not strong or necessary. For most investors, there is a habit of using some of the existing commissioning mechanisms, which, because of inertia, are considered to be all, and there is no other commissioning mechanism. There is no conscious awareness, which results in most users not knowing the existence of a two-way out-of-life or loss function. Users’ needs are not effectively transmitted to only trading platforms, which naturally do not automatically increase the function.

2、 相比较于单向止盈止损,双向止盈止损功能复杂,对交易系统要求更高。在没有双向止盈止损功能时,如果我只能挂一个方向的委托单,交易系统记录一个触发价格,一个委托价格即可。现在变成双向了,意味着交易系统的负载翻倍。交易系统的负载增加除了会带来额外的运维成本外,也对系统整体的负载能力以及稳定性要求更高。

2. The two-way excess/terminal loss function is more complex and demanding for the trading system than a one-way gain. In the absence of a two-way stopover, if I can only record a trigger price in the trading system if there is no one-way commissioning function, one-way transactional price is sufficient. Now it is two-way, meaning that the load load of the trading system doubles. In addition to the additional maintenance costs, the load increase in the trading system is more demanding for the system as a whole, as well as for its overall carrying capacity and stability.

3、 交易所与用户博弈,自律性将面临更大挑战。目前中心化交易所都能通过交易系统的数据库,实时看到用户的委托单情况。对于一些无视商业道德频频作恶的小交易所,他们完全可以查看后台数据,根据委托单的分布情况,人为操作某些币种的市场价格,使用户被迫先止损然后在拉升价格,从而获利。这种情况,在合约交易中更有可能发生。

3. Exchanges play games with users, and self-regulation will be even more challenging. Centralized exchanges are now able to see user orders in real time through a trading system database. For small exchanges that ignore business ethics, they are well placed to look at back-office data and, depending on the distribution of the orders, artificially operate market prices in certain currencies, forcing users to cut losses first and then raise prices, thereby benefiting from them. This is more likely to happen in contract transactions.

用户需求未有效挖掘、交易所交易系统存在升级难度,再加之中心化交易所本身因利益诱惑导致的商业道德缺失等原因,可能促使目前众多头部或者非头部交易所不上线双向止盈止损功能的,

The failure of user demand to effectively tap, the difficulty of upgrading exchange trading systems, and the lack of business ethics in the centralized exchanges themselves as a result of the temptation to profit may cause many current head or non-head exchanges to fail to operate in both directions.

交易所作为服务于投资者的平台,能够积极面对并响应用户需求才是一个有品牌,有责任大交易所的本色。内心很期待这样的交易所出现。

As a platform for serving investors, an exchange can respond positively to and respond to the needs of its users in order to be branded and responsible for the nature of a major exchange.

惊喜的是,这一愿望已经实现。

Surprisingly, that wish has been fulfilled.

8月25日,OKEx已完成PC端交易系统的升级,双向止盈止损功能正式上线。怀着尝鲜的心态,我登录OKEx电脑端体验该新功能,功能基本达到此前的预期,而且使用也很顺滑。

On August 25, OKEx completed the upgrade of the PC end-of-trade system, and the two-way out-and-out feature is officially online. In a fresh sense, I log on to the OKEx computer end to experience the new feature, which basically meets expectations and is smooth.

OKEx在PC端的双向止盈止损功能页面

OKEx on a PC-end bidirectional excess/terminal loss page

老韭菜终于要得救了。OKEx上线双向止盈止损功能后,不论行情怎么剧烈波动,我都能在博取预期收益的同时,有效降低本金大幅亏损的风险了。

The old pickles are finally saved. After the two-way inbound OKEx, no matter how volatile I may be, I can effectively reduce the risk of significant loss of principal while generating the expected returns.

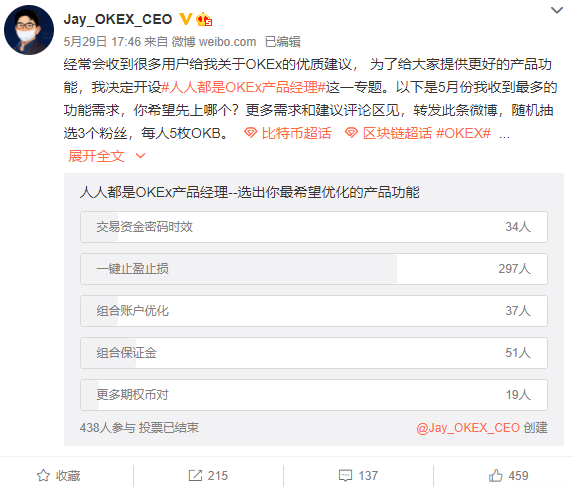

在OKEx的用户社区了解到,原来此前OKEx的CEO Jay曾在微博上开启“人人都是OKEx产品经理”的用户需求调研活动,收集用户需求意见“一键止盈止损”作为得票数最多的需求。

The user community of OKEx learned that formerly the CEO Jay of OKEx had started a user demand research campaign on Twitter entitled “Everyone is an OKEx product manager” to collect user demand advice on “one key to stop the loss and loss” as the largest number of votes.

在此,老韭菜我在把玩一段时间这项双向止盈止损功能后,发现以下细节需要注意:

Here, after playing this two-way end-up function for a period of time, the following details need to be noted:

平仓的止盈止损成功触发之前,会冻结仓位。

The position will be frozen until such time as the winding down of the silo will be triggered successfully.

止盈止损委托不一定成功触发,可能会因为合约处在非交易状态、系统问题等而下单失败。触发成功的限价单同普通限价单,不一定成交,未成交的限价单会显示在当前委托订单里。

A stop-and-lost order may not be triggered successfully, but may fail because the contract is in a non-tradable state, system problems, etc. A successful price limit order may not necessarily be concluded, and an unsold limit order may appear in the current order.

如果委托成交,则会平掉您的现有仓位,如果委托失败,您的持仓仍然存在。

If a commission is made, your existing storage space will be removed, and if the commission fails, your hold will remain.

在触发后,若用户设置的委托价触发了限价规则,那么系统会使用触发时的市场最高限价或者最低限价进行下单。

After triggering, the system uses a market maximum or a minimum price limit at the time of triggering, if the client set the commission price to trigger the price limit rule.

不同合约的市价止盈止损委托单笔数量会有不同的限制(该限制会根据市场变化做出相应调整)

There may be different limits to the number of purchase orders with respect to the market price of the different contracts (which may be adjusted in the light of changes in the market)

目前仅支持PC端使用,APP端暂时还未同步更新。

Only PC-end is currently supported, and the APP-end has not yet been synchronized.

5月29日发起需求征集,8月25日OKEx在PC端双向止盈止损功能正式上线。在2个多月的时间内即完成用户需求调研,组织开发测试、正式上线,这速度让人多少有些意外,可能这也是OKEx作为全球顶级交易平台的实力与用于至上经营理念的体现。

On May 29, a call for demand was launched, and on August 25, the OKEx officially went online on the PC end-of-the-end two-way excess/deficit feature. In more than two months, user needs research was completed, tests were organized for development and official access, which was somewhat surprising, and perhaps also reflected the strength of the OKEx as the top global trading platform and the concept of top-down operations.

投资既考验人性,也依赖平台。经历过币价大起大落合约爆仓后,老韭菜我更期待数字货币交易平台能越来越完善。在根据盈利预期的设定止盈委托的同时,也需要权衡风险,合理设置止损委托。期待OKEx新版本的一键止盈止损功能能够帮助更多投资者走向成熟,理性投资。

Investments test humanity and depend on platforms. After the collapse of the currency contract, I expect the digital money trading platform to become more sophisticated.

愿拥有双向止盈止损的交易世界里不再爆仓。

There will be no more busts in the trading world with a two-way winding-down.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论