,随着比特币的两大核心推动力消退,此前看涨比特币的交易员们似乎已经缩减了对这种全球最大市值加密货币的看涨押注。CryptoQuant统计数据显示,4月19日,比特币融资利率——交易员们在加密货币永久期货市场开设新多头头寸所需支付的溢价,自2023年10月以来首次变为负值。这一指标突显出,在比特币“减半”大事件催化之下,以及一批美国比特币现货ETF将比特币推至创纪录高点之后,市场对比特币的需求有所放缓,至少在短期内盘整或向下回调可能难以避免。

With the two central impulses of Bitcoin retreating, it appears that previously the traders who saw bitcoin rise have reduced their bets on this world's largest encoded currency. CryptoQuant statistics show that, on 19 April, the Bitcoin financing rate – the premium that traders would have to pay to open new multi-head positions in the permanent futures market for encrypted currency – became negative for the first time since October 2023. This indicator highlights that, following the “50-percent” of Bitcoin, and a batch of US Bitcoin spot ETFs that pushed bitcoins to record heights, market demand for special currency has slowed somewhat, at least in the short term, or may be difficult to avoid downward swings.

最近几周,这些比特币现货ETF的资金净流入规模有所减少,而人们热切期待的“减半”这一大事件在上周对比特币交易价格的影响可谓微乎其微。“减半”是比特币市场一个四年一度的大事件,它大幅削减了确保比特币区块链安全的矿工所获得的奖励,并大幅减少了市场上新代币的供应规模。

In recent weeks, the net inflow of these Bitcoin spot ETFs has declined in size, and the much-awaited “half-per-cent” of the price of the Bitcoin transaction last week has had little impact. “50-per-cent” was a four-year big incident in the Bitcoin market, which drastically reduced incentives for miners to secure the Bitcoin chain and significantly reduced the supply of new currency in the market.

比特币交易价格在3月份达到了73,798美元的这一历史最高峰值,但此后已经修正了近13%,比特币价格周四徘徊在63,200美元附近。全球加密货币买家们可谓对原始加密货币的看涨热情已经降温,部分原因是与中东紧张局势有关的风险厌恶情绪日益加剧,以及美联储年内有可能不降息的预期重挫加密市场风险偏好。

Bitcoin’s trading price, which reached its historic peak of $73,798 in March, has since been revised by almost 13%, and bitcoin’s price hovers around $63,200 every Thursday. Global encryption money buyers’ enthusiasm for raw encrypted money has subsided, in part because of growing risk aversion associated with tensions in the Middle East, and the likelihood of unmitigated expectations during the Fed’s year compromising encryption market risk preferences.

在一些加密货币分析师看来,美联储降息预期不断降温可能将导致投资者暂时选择持有高收益率的低风险国债等更加传统的资产,这可能引发加密货币市场大幅波动。加密货币市场可能将受到美联储降息预期不断降温带来的负面影响。毫无疑问,美联储长期维持高利率意味着DCF模型中分母端的市场无风险收益率持续高企,而这一潜在趋势与比特币等加密货币的浓厚看跌情绪,以及投资者对加密货币的整体风险偏好下行有非常密切的关系。

In the view of some cryptographic currency analysts, the Fed’s expectation of declining interest rates may lead to investors temporarily choosing more traditional assets, such as low-risk state debt, with high rates of return, which may cause significant volatility in the cryptographic currency market. Encrypted currency markets may be negatively affected by the Fed’s expectation of declining interest rates.

在评估资产时,投资者传统上非常看重美联储的利率决定以及美联储货币政策预期管理机制。当利率下行的这一市场预期全线升温时,资金有望纷纷涌入高风险高收益资产,而政府证券等传统低风险资产的持有价值通常将大幅下滑,这使得比特币和其他加密货币资产更具吸引力。

In assessing assets, investors have traditionally attached great importance to the Fed’s interest-rate decisions and to the Fed’s expected regulatory mechanisms for monetary policy. When interest rates go down, the market is expected to warm up on a full-line basis, funds are expected to flood into high-risk, high-yield assets, while traditional low-risk assets, such as government securities, typically have a significantly reduced holding value, making bitcoin and other encrypted monetary assets more attractive.

在今年3月,比特币融资利率达到三年以来的最高点,预示着加密市场看涨势力过热,但截至本周二,该利率已降至零以下。CryptoQuant的研究主管胡里奥·莫雷诺(Julio Moreno)表示:“这当然意味着交易员们开设比特币多头头寸的愿望已经大幅减弱。”

In March of this year, the Bitcoin financing rate reached its highest level in three years, heralding an overheating trend in the encryption market, but as of Tuesday it had fallen below zero. The research director of CryptoQuant, Julio Moreno, said: “This, of course, means that the traders' desire for Bitcoin’s multiple positions has diminished substantially.”

通过永久期货看涨比特币的成本下滑

K33 Research分析师维特尔?伦德(Vetle Lunde)表示,目前连续11天从中性到低于中性的融资利率绝对是不寻常的,以往的利率下跌之后可能很快就会出现大量的杠杆押注比例。“在这方面,这波折价交易的长度属性可能指向比特币价格进一步盘整或回调,”他补充称。

K33 Research Analyst Vitel Lunde states that it is absolutely unusual for 11 days now to move from neutral to sub-neutral financing rates, and that a large proportion of leverage will probably occur soon after previous interest rates have fallen. “In this respect, the long-term attributes of this discounted trade may point to further refinement or restatement of Bitcoin prices,” he added.

美国比特币ETF需求出现萎缩信号

需要警惕的是,融资利率下降的同时,美国市场的比特币现货ETF日流入量也在不断下降。

There is a need to be wary that the decline in financing interest rates has been accompanied by a declining daily inflow of spot ETFs from the United States market.

据金融机构最新的统计数据显示,本月迄今为止,11款美国市场发行的比特币现货ETF产品的净流入规模为1.7亿美元,远低于3月份相同的交易日期间的大约40亿美元。

According to the latest statistics of financial institutions, the net inflow to date of 11 spot ETF products from the United States market was $170 million, well below the estimated $4 billion during the same transaction period in March.

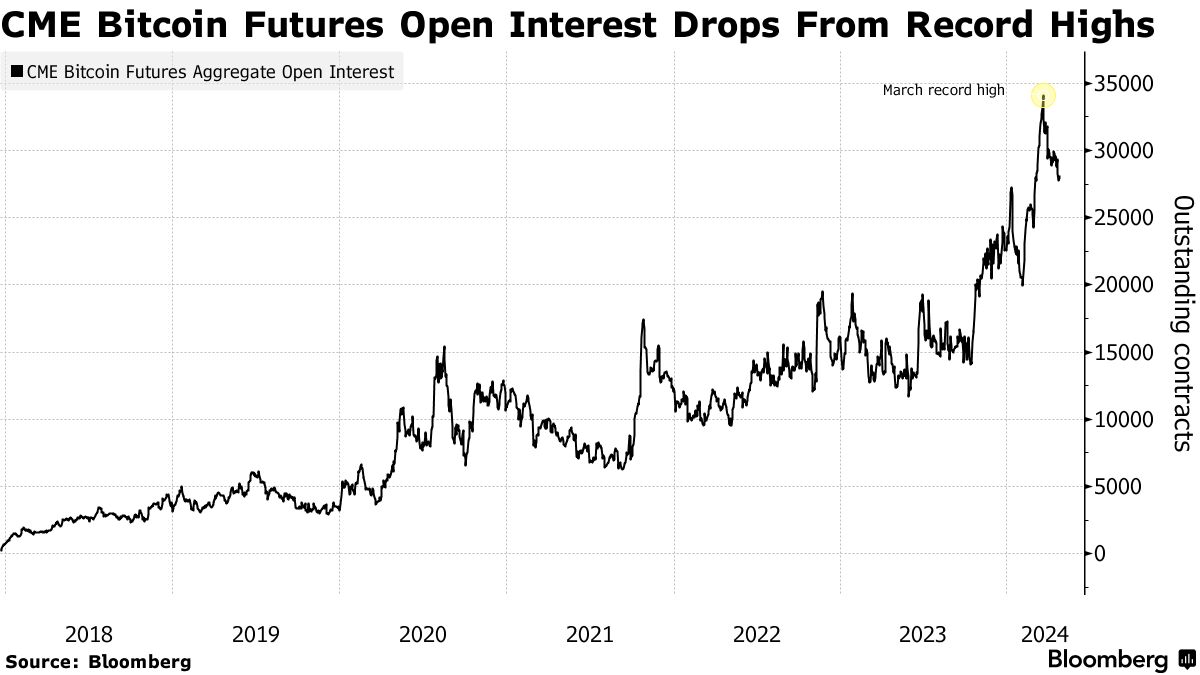

芝加哥商品交易所集团(CME Group)的比特币期货市场的未平仓量规模也较历史高点下降大约18%,这表明一些美国投资机构对比特币的相关配置敞口和对冲的兴趣有所动摇。

The unsettled size of the Bitcoin futures market in the Chicago Commodity Exchange Group (CME Group) has also fallen by about 18 per cent over historical highs, indicating a wave of interest in the associated configuration exposure and hedges of some United States investment agencies.

随着加密市场寻找新的上行推动力,所有人的目光都集中在中国香港,香港预计很快将推出自己的一批香港市场的比特币现货ETF。但是,它们能否吸引到哪怕是美国发行人所享有的一小部分市场需求,仍有待观察。

As the encryption market seeks new momentum, everyone is focused on Hong Kong, China, and Hong Kong is expected to launch its own batch of spot ETFs in Hong Kong soon. But it remains to be seen whether they can attract even a small fraction of the market demand that US issuers enjoy.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论