Cointelegraph 近期報道了Web3 銀行協議Fiat24 與Safepal DApp 錢包的策略合作:Fiat24 為Safepal DApp 錢包推出了in-DApp 的Web3 銀行網關和虛擬加密支付Visa 卡,以增強DApp 錢包的易用性,進一步打通與現實世界的互動。

Cointellect recently reported on the strategy of the Web3 bank agreement Fiat24 and the Safepal Dapp wallet: Fiat24 introduced Web3 bank gateways and virtual encryption for the Safepal Dapp wallet to pay Visa cards to enhance the ease with which DApp wallets can be used and to improve interaction with the real world.

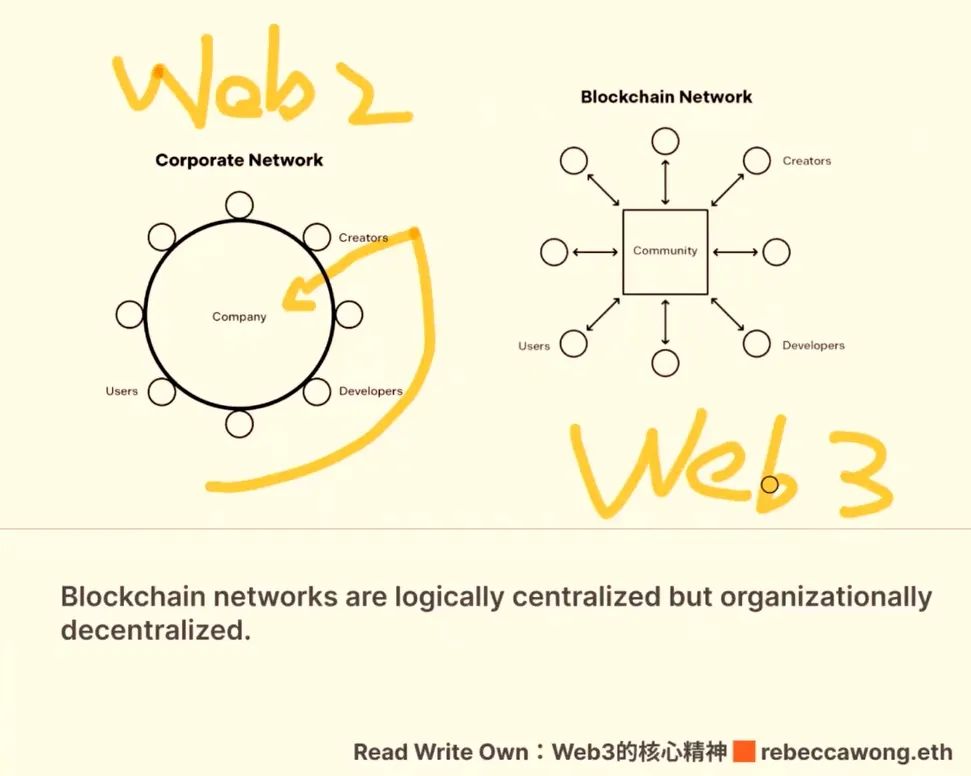

結合我們先前的投研文章《Fiat24:架構在區塊鏈上的Web3 銀行》,可以看到由Web3 銀行協議構建的法幣協議層(Fiat Layer Protocol),正在Blockchain Network 發揮積極的作用:

Together with our previous research article Fiat24: The Web3 Bank on the Sector Chain, we can see the Fiat Layer Protocol created by the Web3 bank agreement, which is playing an active role in Blockchain Network:

1. 將銀行業務邏輯移到鏈上之後,協議層能夠與DApp/DeFi 進行無縫銜接;

1. Having moved the banking logic to the chain, the agreement would allow a seamless connection with Dapp/DeFi;

2. 為使用者帶來基於U 本位的Web3 鏈上銀行服務;

2. Bring a U-based Web3 chain of banking services to users;

3. 為DApp/DeFi 帶來法幣業務的創新邏輯。

3. Brings new logic to French business for Dapp/DeFi.

本文將先介紹Fiat24 與Safepal 的這次策略合作,再來進一步闡釋Web3 銀行協議如何開啟DeFi 樂高遊戲的無限遐想。

This paper describes Fiat24's strategy in collaboration with Safepal, and further elaborates on the limitless idea of how the Web3 bank agreement could open the DeFi Lego game.

(Singaporean fintech launches USDC-powered Visa card with Swiss bank Fiat24)

3 月8 日,由Binance Labs 策略投資的Safepal DApp 錢包已經連接到Fiat24 作為其預設的法幣協議層,Safepal 錢包的用戶可以透過in-DApp 的Web3 網銀入口創建Arbitrum 上的Fiat24 鏈上銀行帳戶,實現:

On March 8th, the Safepal Dapp wallet, invested by the Binance Labs strategy, has been connected to Fiat24 as its default level of French-currency agreement, and Safepal wallet users can create a Fiat 24 link bank account on Arbitrum via the Web3 Web portal at the In-Dap:

1. 基於U 本位的鏈上銀行服務,帳戶自託管,所有相關交易都安全、透明地記錄在鏈上;

1. Bank services based on the U-place chain, account ownership, and all related transactions are recorded safely and transparently on the chain;

2. 錢包內加密資產Crypto 與法幣Fiat 的出入金;

2. The entry and exit of Crypto, the encrypted asset in the wallet, and Fiat in French;

3. Fiat24 鏈上銀行帳戶與實體銀行帳戶的法幣轉帳匯款,Euro/USD 的法幣互換;

3. Transfers of French currency from Fiat24 bank accounts to real bank accounts, exchange of French currency from Euro/USD;

4. 接取虛擬加密支付Visa 卡後,使用加密資產在現實世界中的無縫消費支付。

4. When virtual encryption is paid for Visa cards, the encrypting property is paid for in the real world without a salvaging charge.

(https://www.safepal.com/en/bank)

Safepal 的創辦人& CEO Veronica Wong 表示:「在SafePal 的錢包中建立Fiat24 鏈上銀行帳戶後,用戶能夠將錢包中的任何加密資產兌換成USDC 存入Fiat24 鏈上銀行帳戶,虛擬加密支付Visa 卡還能夠與Paypal、Google Pay、Apple Pay、Samsung Pay 等第三方支付進行鏈接,增強用戶支付的便利性。”

The founder of Safepal & CEO Veronica Wong said: "After the creation of the Fiat24 chain bank account in SafePal's wallet, the user can convert any encrypted asset in the wallet into a USDC bank account in Fiat24, and virtual encryption to pay Visa card can also be linked to payments made by third parties such as Paypal, Google Pay, Apple Pay, Samsung Pay, etc. to enhance user-pay facilitation.”

Fiat24 是一家獲瑞士金融市場監理局(FINMA)發牌的金融科技公司,其推出了第一個將銀行邏輯完全架構在公共區塊鏈(Arbitrum)上,完全由智能合約驅動的Web3 銀行協議,為使用者建立一個鏈上銀行帳戶,提供出入金、加密消費支付、儲蓄、轉帳、換匯等一系列的Web3銀行服務。

Fiat24, a financial technology company awarded by the Swiss Financial Market Supervisory Authority (FINMA), introduced the first of its series of Web3 bank services, such as access money, encryption fee payments, savings, transfer and transfer, to fully organize bank logic on the public sector chain and to be driven entirely by an intelligent contract.

(Temperature Check - [Issue a Visa Card with Uniswap Logo ])

可以將Fiat24想像成DApp/DeFi的法幣協議層(Additional Fiat Layer forDApps)。在法幣協議層,Fiat24為透過KYC的用戶建立鏈上銀行帳戶(Cash Account),該帳戶一方面能夠將Web3支付服務整合其中,例如用戶透過鏈上銀行帳戶直接實現出入金支付以及加密消費支付;另一方面,依托金融科技牌照,鏈上銀行帳戶能與瑞士國家銀行、歐洲中央銀行和VISA支付網絡直連,能夠實現法幣的儲蓄、換匯、商家結算等傳統銀行服務。

Fiat24 將銀行核心營運邏輯(Core Banking System)搬到鏈上,是Fintech 在區塊鏈創新的完美實踐,最大程度地融合了區塊鏈的去中心化帳本技術,在增強便利性的同時也加強了安全性,避免了單點故障的風險。

更難能可貴的是,這種創新的做法獲得了瑞士監管的認可,瑞士監管基於Technology Neutral 的監管原則,保證Fintech 公司在滿足業務基礎功能的前提下進行大膽科技創新。由此,Fiat24 一方面透過區塊鏈實現了銀行的帳本記賬,另外一方面透過NFT 實現鏈上用戶身分的KYC,以滿足反洗錢的要求。

What is even more difficult is that this innovative approach has been recognized by Swiss supervision, which, based on the regulatory principles of Technology Neutral, guarantees Fintech bold technology innovation that meets the infrastructure of the business. As a result, Fiat24, on the one hand, has obtained bank accounts through a regional chain, and, on the other hand, via KYC, the user identity on the NFT chain, to satisfy the demand for counter-money laundering.

Fiat24 的區塊鏈銀行架構將傳統銀行金融服務和Web3 區塊鏈創新無縫融合,獲得了許多頂級資本的青睞,同時也獲得了Qorusand Accenture 授予的2022 最佳新興銀行(Neobanks & Specialized Players)的殊榮。

Fiat24’s chain banking structure has created a new and seamless integration of traditional banking and financial services with the Web3 chain, gaining the distinction of many top capital sources, as well as the distinction of Qorusand Accenture’s 2022 Best New Banks & Specialized Players.

(Qorusand Accenture Announce Winners of 2022 Banking Innovation Awards)

Fiat24先前的創新在於將銀行邏輯上鍊,並獲得瑞士監管的認可。在這之後,Fiat24的創新在於為DApp/DeFi開啟新的法幣業務邏輯。

After this, Fiat24 was created to open a new French business logic for Dapp/DeFi.

由於Fintech牌照的限制,Fiat24並不能夠開展借貸業務,只能做吸儲和支付業務。但是,這些限制反而為採用Web3銀行架構的Fiat24帶來巨大優勢:

Due to the Fintech license restrictions, Fiat24 is not able to open loans, but only to absorb and pay. However, these restrictions have led to huge advantages in the use of Fiat24, a Web3 bank:

A.基於Debit Card的全球發卡支付。 Credit Card本質上屬於放貸,由於Fiat24牌照限制無法展業,且違約催收壓力巨大,一般侷限於固定地域。而儲值支付的Debit Card反倒能夠實現全球網路的發卡支付,且不存在違約問題。

A. Based on Debit Card's global distribution card. Creditcard is a loan in nature, unable to open a business due to Fiat 24 license restrictions, and the pressure of default is very high, usually limited to fixed territory. Debit Card, on the other hand, can be paid for by the global network, and there is no problem of non-compliance.

對於那些希望將加密資產投入日常使用的用戶來說,Fiat24這種為DApp/DeFi提供出入金及加密支付解決方案的革命性能力是一種對傳統支付體系的革新。

The revolutionary ability of Fiat24 to provide access to DApp/DeFi and encrypt payment solutions is an innovation to traditional payment systems for those who want to put encryption assets into everyday use.

B.無縫嫁接DApp/DeFi。由於牌照限制無法開展借貸業務,但是並不妨礙Fiat24銀行協議本身(Fiat Layer Protocol)能夠直接自由嫁接在DApp/DeFi上,透過DeFi智能合約實現鏈上的借貸業務。

B. Uncoolly marry Dapp/DeFi. is unable to open loans because of license restrictions, but may not prevent Fiat 24 bank agreements themselves from freely marrying on Dapp/DeFi and lending through the DeFi intellectual contract.

這裡的重點在於:其作為協議能夠為DeFi帶來法幣的業務邏輯。以最常見的金融活動為例:

The point here is that as an agreement it brings French business logic to DeFi. /Strong, for example, is the most common financial activity:

1.抵押借貸:Bob提供加密資產ETH作為抵押品在DeFi平台上借穩定幣,DeFi協議可以直接調用Fiat24銀行協議來做USD法幣的出借;

1. Mortgage: Bob provides an encrypted asset ETH as collateral to borrow stable currency on the DeFi platform, and the DeFi agreement allows direct transfer of the Fiat24 bank agreement to loan USD French currency;

2.投資/質押生息:Alice提供加密資產ETH去做質押生息,DeFi協議可以直接調用Fiat24銀行協議來做法幣生息資產的發放,這真的能夠躺贏?

Investment/principal interest: Alice provides an encrypted asset ETH to hold interest, and the DeFi agreement can be transferred directly to Fiat24 bank agreement for the release of interest-producing money, which can really be won?

3. 投資理財:Will 提供加密資產ETH 直接投資DeFi 協議的代幣化證券Coinbase,那麼DeFi 協議可以直接調用Fiat24 銀行協議,用法幣去納斯達克買股票。

3. Investment: Will provides an encrypted asset ETH direct investment in the DeFi dollarized certificate Coinbase, so that the DeFi deal can be transferred directly to the Fiat24 bank agreement to buy shares in French currency in Nasdak.

(X@Fiat24)

將法幣的邏輯加入DeFi的想像空間可以很大!同樣,作為協議本身(Fiat Layer Protocol)能夠直接自由嫁接在DApp/DeFi上的能力,亦能夠幫助Fiat24絲滑接入Blockchain Network,並帶來巨大生態價值。

"Strong" adds French logic to the imagination of DeFi! Similarly, the ability of Fiat Layer Protocol to marry Dapp/DeFi directly and to help Fiat24 slip into Blockchain Network and bring enormous living value.

試想一下,中心化的Metamask錢包接入中心化的出入金Moonpay,需要簽訂多少合同,需要經過多少部門討論,需要多少領導簽字?再試想一下,中心化的出入金Moonpay如何與去中心化的DeFi協議簽訂合約? DeFi協議根本沒有法人主體,根本就沒有公章。

Imagine how many contracts will need to be signed, how many departments will need to discuss, and how many leaders will need to sign, for a centralized Metamask wallet access to Moonpay? Again, how the centralized cash access money Moonpay will be signed with deFi, which is decentralised.

而Fiat24銀行協議與DeFi Protocol不存在一點障礙,沒有一點摩擦,just by one Click!

And the Fiat24 agreement with DeFi Protocol has no obstacle, no friction, just by one Click!

大家都沒有法律上的強綁定,而是透過智能合約一起做樂高遊戲,這才是Web3的精髓。

It's the essence of Web3 that no one is legally bound.

現在有兩波人在做Web3 Banking/Payment的業務,一波是傳統跨境支付的人,他們依然沿襲著傳統跨境支付的思路,Crypto只是多了一個幣種,他們透過通路手續費、會員費用訂閱費賺錢,做的是現金流的生意;另一波是Web3 Native的人,他們不太會去動現金流生意的腦筋,而是會直接用區塊鏈去改造舊體制,釋放新的活力,並且去擁抱社區生態,去做一些Blockchain Network的事,做的是生態的生意。

Now there are two waves of people doing Web3 Banking/Payment's business, one wave of traditional cross-border payers, who still follow the traditional idea of cross-border payments, and Crypto, who has only one more currency, who earns money through circuit fees, members' subscriptions, cash flows, and the other wave of Web3 Natives, who do not know much about cash-flowing business, but rather direct chains to transform the old system, unleash new energy, and embrace community life, to do some of Blockchain Network's business, and to do some raw business.

到底誰能笑到最後我們不得而知,但我願意去相信、去參與、去創造Blockchain Network的改變力量!

We don't know who's laughing until the end, but I'm willing to believe, to participate, to create the power of change in Blockchain Network!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论