记者 |

编辑 | 彭洁云

再次刷新历史新高!比特币于3月14日突破6.1万美元,市值突破1.1万亿美元。

A fresh start in history has been made again. Bitcoin broke through $61,000 on 14 March, with a market value of $1.1 trillion.

在现货市场高歌猛进之时,投资者对于加密货币合约市场也更加疯狂。在这个杠杆倍数小至3倍,高至100倍以上的赌场里,“风险与收益成正比”是大多数合约投资者的圭臬。

At a time when the off-the-shelf market is on the rise, investors are more crazy about the market for crypto-currency contracts. In a casino that leverages as little as three times as much as 100 times as much, the “risk-to-return ratio” is the preposterous one of most contract investors.

数据显示,2020年数字资产市场期货合约持仓量由年初的$3.51B上升至年末的$17.03B,增涨幅度达到384.9%。由于BTC、ETH价格在四季度不断刷出历史新高,数字资产衍生品季度成交量首次超越现货。

The data show that the stock held in the digital asset market futures contract in 2020 rose from $3.51B at the beginning of the year to $17.03B at the end of the year, an increase of 384.9 per cent, as BTC and ETH prices continued to rise over the past four quarters, and the quarterly turnover of digital asset derivatives exceeded the spot for the first time.

在监管缺位的狂热之下,潜伏的不仅仅是高倍杠杆交易的风险,更存在不少“隐秘的角落”。

Under a lack of regulation, it is not only the risk of high-leveraging transactions that lurks, but there are many “hidden corners”.

界面新闻记者了解到,有交易所平台通过宕机、拔网线等手段使交易突然停滞,参与杠杆交易的消费者因无法主动平仓引发爆仓而损失惨重;有一些不满足于仅仅赚取交易手续费的单机交易所,以赚取用户亏损为目的,与带单KOL在下沉市场收割合约小白;同样,由于技术架构水平仍然参差不弃,一场“回滚”也有可能收回你的高额收益。

Correspondents learned that exchange platforms suddenly stagnate transactions through such means as hang-ups, grid-wiring, etc., and that consumers involved in leveraging trades lose a lot of money by failing to take the initiative to level them up; that single-office exchanges, which are not satisfied with merely earning transaction fees for the purpose of earning a loss for their users, have a contract to harvest in the sink market with a single KOL; and that, similarly, a “roll-back” could potentially recover your high returns, given the continuing diversity in the technological architecture.

欢迎来到数字货币合约市场的真实世界……

Welcome to the real world of digital currency contracts.

交易所宕机,我爆仓了,是又“拔网线”了吗?

I'm stung, I'm stung again. "/strung" >

对于两周前的爆仓经历,拥有近两年投资经历的炒币者吴海仍然感到心惊。

Wu Hai, who had a two-year-old investment history, was still alarmed by the explosion two weeks earlier.

2月23日,比特币迎来2021年开年最大回撤,吴海在一家头部交易所开的多张10倍、25倍做多单子全部爆仓。

On 23 February, Bitcoin experienced its largest recovery in 2021, with Wu Hai opening a head exchange 10 times more than and 25 times the size of the list.

在合约交易中,当行情震荡,如果服务器稳定,投资者可通过增加合约保证金来避免爆仓的情况。但在当天晚上8时,该交易所不迟也不早,就在这关键时刻宕机了!

In the case of contract transactions, when the server is stable, investors can avoid the explosion by increasing the bond. But at 8 p.m. that day, the exchange is late and late, and at this critical moment!

吴海在手机和电脑端均无法进行任何追加保证金或者撤单止损操作。在结束长达半小时的宕机之后,他的账户毫无意外地因为爆仓归零了。

Wu Hai was unable to carry out any additional security on his cell phone or on his computer, or to remove the damage. After an hour-long crash, his account was unsurprisingly destroyed by the explosion.

“一定是交易所又拔网线了!”回想起眼睁睁看着被爆仓却无能为力的场景,吴海仍然掩饰不住愤怒。

“It must be the exchange that pulled the net again!” Remembering the scene of the explosion and its powerlessness, Wu Hai still cannot hide his anger.

吴海觉得,如果是因为自己对行情误判,因操作失误导致的爆仓,自己理所当然承担损失,但若是由于交易所恶意拔网线而导致自己无法及时补仓,他难以容忍。

Wu Hai felt that he could not tolerate his own loss if it was due to his miscalculation and the explosion caused by his mishandling, but if it was due to the exchange's malicious exploitation of the net that made it impossible for him to make up for it in a timely manner.

类似的悲惨经历在币圈交易所中并不罕见。

Similar tragic experiences are not uncommon in the currency exchange.

“交易所拔网线不是稀罕事,一般大的行情波动就会这样,防止获利者套现。”有爆仓损失并不惨重的合约投资者好心向界面新闻“科普”。

“The opening of the exchange is not uncommon, as is usually the case with large swings that prevent the realization of the profit-earners.” “Corp” is a good source of interface news for contract investors who have no significant losses.

对于交易所而言,拔网线与技术故障引起的宕机存在区别,前者存在恶意的主观行为,有后台操纵之嫌;而后者是非主观的技术故障,存在提升空间。

For an exchange, there is a distinction between a malicious act of subjectivity involving backstage manipulation and a failure to remove a wire, which is a non-subjective technical failure, and a space for upgrading, caused by a technical failure.

对于交易所是否为恶意宕机,曾就职过两家交易所的资深交易员刘凡向界面新闻给出自己的分析。

Liu Van, a senior trader who served on two exchanges, gave his own analysis of whether the exchange was malicious or not.

他认为,交易所有时候被投资者指认“拔网线”并不无辜。

In his view, exchanges were sometimes identified by investors as “highlines” that were not innocent.

刘凡告诉界面新闻,由于杠杆倍数范围较大,为了应对极端行情带来的穿仓风险,各大交易所运营团队都采用了风险储备金机制来补偿穿仓损失,而合约平台的风险储备金多数源于用户爆仓强平后的,交易所在接管价和强平价之间赚取的价差收益,或者是自动减仓后的资金。

Liufan told the interface that, because of the large number of leverages, in order to cope with the risk of penetrating extremes, major exchange teams had introduced a risk reserve mechanism to compensate for the loss of penetrating, and that most of the risk reserves for the contractual platform stemmed from the price differentials between the take-over price and the strong parity, or from the automatic downswing of funds.

当价格出现剧烈波动时,交易所被迫承接大量爆仓单。若无法马上找到高于成本的对手盘卖出,且巨额损失超出风险准备金的承受能力,那么亏损将由盈利用户承担。但如果让盈利用户承担巨额的抵扣,恐怕会造成用户流失,而交易所又不想承担,所以就“巧合”地宕机了。

When prices fluctuate sharply, the exchange is forced to take on a large number of billings. If it is not possible to find an overcosted counterparty immediately, and if the large loss exceeds the capacity of the risk reserve, the loss will be borne by the profitable user.

此外,交易所的收入往往以币本位计价,如果币价急跌,引发合约市场连环爆仓,有可能造成系统性风险,交易所资产也会迅速缩水。对于交易所来说,拔网线争取爆仓单找对手盘消化的时间,也能够有效抵挡资产抛售引发的急速下跌,控制现货价格,这是一个何乐而不为的生意。

Moreover, the exchange’s revenues are often denominated in currency, which can pose systemic risks if the currency collapses, triggering a spiral of contract markets, and the exchange’s assets shrink rapidly. For the exchange, it can also effectively withstand the rapid drop in asset sales and control spot prices.

但他也向界面新闻补充称,并非所有的宕机时刻都是刻意拔网线行为,也有可能是技术问题。

He added to the interface news, however, that not all of the time was a deliberate attempt to unwieldy the network, but that it could also be a technical problem.

“有老牌交易所,在最早搭建交易的技术架构之际不够完备,随着用户量扩充较快,交易所不得不在原有架构上以打补丁的形式来更新,导致遇到一些极端行情容易崩盘。”

“There is a well-established exchange, which was not perfect at the time when the technical architecture of the transaction was first set up and, as the number of users expanded more rapidly, the exchange had to be updated in the form of patches in its original structure, leading to a number of extreme behaviors that were prone to collapse.”

2月19日,一起交易所集体宕机事件就被归结为AWS东京故障的原因。有媒体报道称,因当天AWS节点冷却系统断电导致温度升高,火币、币安、抹茶、Coinex、库币等一二线交易所均陆续出现小规模故障;而主要使用香港阿里云服务器的OKEx交易所躲过这次宕机事件。

On 19 February, an exchange group crash was attributed to the AWS Tokyo breakdown. Media reports reported that the AWS node cooling system on the same day led to an increase in temperature, resulting in minor malfunctions on second-line exchanges such as gun, currency, tea, Coinex, and banknotes; and that the OKEx exchange, which used mainly the Hong Kong Ali Cloud server, avoided the crash.

但不管是宕机还是恶意拔网线,更多情况下是交易所与投资者各执一词的“罗生门”。吴海的20万投资款在那晚的确归零,至今,他也未收到交易所的任何赔偿金。

But whether it's an attempt or a malicious attempt to unplug the net, it is more often the term “Rosingman” used by the exchange and investors. Wu Hai's $200,000 investment did come to zero that night, and he has not received any compensation from the exchange to date.

“杀猪盘”交易所与带单老师联合做局,我被“割韭菜”了!

>

如果说拔网线尚且还存在客观因素,那么一些单纯以收割投资者为生的“杀猪盘”交易所,则是合约市场中的真实黑暗面。

If there are still objective factors to unwieldy, then the “pig-killing” exchange, which is based solely on harvest investors, is the true dark side of the contract market.

刘凡向界面新闻透露,此类交易所的对手盘即为交易所本身,为了招徕用户,往往以高返佣招募带单老师,或者拉人进带单群,利用投资小白亟需一套简单投资方式和方法论的心理,引君入瓮。

Liu Van revealed to the interface news that the rivals of such an exchange are the exchanges themselves, often recruiting single teachers or bringing people into the group with a view to recruiting users, and that a simple investment approach and methodology is urgently needed to draw the attention of the users.

这类交易所的盈利方式在行话中被称作“吃客损”,也叫“吃头寸“,意为吃掉客户的损失,把客户在这里亏掉的钱,当成是利润大家一起分。

The profit-making modalities of such exchanges are referred to in the verbs as “food for customers” and as “eat for positions”, meaning to eat the loss of customers and to share the money lost here as profits.

周珂是一家中型合约交易所的运营人员,她对这种模式更为熟悉。其所在的交易所曾就合约市场做过竞品调研,也为此接触过不少有过带单经历的KOL。

Chok, who operates a medium-sized contract exchange, is more familiar with this model.

她告诉界面新闻记者,这些交易所的目标用户十分明确,收割对象往往都是对行业了解不深的小白,并非币圈资深用户,这类用户或是被来自交易所的一通电话邀请进入免费带单群,或是加入了某财经KOL的行情分析群。

She told the interface journalists that the target users of these exchanges were clear and that the target recipients were often small whites with little knowledge of the industry and were not senior customers of currency circles, either invited to a free-of-charge list by a telephone call from the exchange or joined a KOL business group.

在前者场景下,这些山寨交易所通过灰产数据交易精准获取炒币人群,谎称三大交易所客服以增加用户信任,将用户拉入免费带单群,实则在群里发布十分诱人的高昂收益率晒单,吸引用户去其山寨交易所。

In the former context, these barangay exchanges, which accurately capture the people who pay the price through the grey trade, falsely claim that the customer service of the three exchanges increases the trust of the users, pulls them into a free-of-charge pack, and publishes highly attractive high rates of return in the group and attracts users to their barley exchanges.

后者则是通过丰厚返佣待遇,招徕区块链或者炒股社区的财经大V,将用户引流至其平台。周珂告诉界面新闻,她见过的最高返佣比例高达85%,而即使给予KOL超过一半的返佣激励,交易所仍然赚得盆满钵满。

The latter, in turn, attracts users to their platforms through a generous home-to-home treatment, a block chain or a stock-breeding community’s financials. Zhouqiang informs the interface that the highest rate of return-to-work she has seen is 85%, and even if KOL is given more than half of the incentive to return home, the exchange still earns a full fortune.

据她透露,这类交易所的逻辑是,为了吸引用户,带单老师会先给到点位让用户小赚几笔,后面等用户赌性上来,交易资金越来越大,杠杆越开越高,最后后台操纵上下插针定点爆仓;更有交易所仅仅设置50倍以上的高倍杠杆,直接省略低倍杠杆的过程。

According to her, the logic of such an exchange is that, in order to attract users, the teacher of the tape will give the user a few small amounts of money at the point, while the later user will gamble, the more the money is going to be traded, the more the leverage is going up and down, and then the backstage will be manipulated to set the pointer; and even more so, the exchange will only set up a 50-fold or more high leverage and directly omit the low-leveraging process.

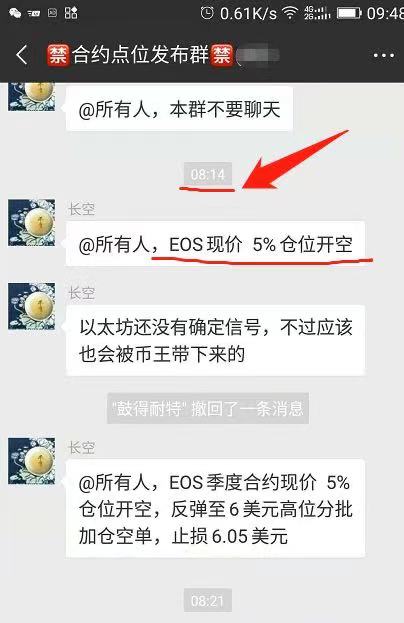

一个典型的带单群通常是这样的:新的一天,带单老师往往会发布“今日操作建议:***附近多单上车,止损**,收益**个点出。”类似的实操点位信息,同时一些跟单者就会排队发出“已买进”的信号。

A typical pack is usually like this: on a new day, teachers tend to publish “Today's Operational Recommendations: *** more cars, stop losses, ** returns, ** points.” Similar real point messages, while some billboarders line up to send a “buy-in” signal.

“那些KOL都有后台,可以看见他邀请链接下每个用户的开单点位。他们可以计算这个点位,和平台合伙定点爆破这些单子。”周珂直言。与此同时,这些交易所也会有自己的交易团队,在知道用户所有下单数据的前提下,反向开仓,赚爆仓的钱。

"Those KOLs have backstages, and they can see him inviting each user to a single point. They can calculate this point, and they can partner with the platform to blow up the lists.

“吃客损的收益比赚交易手续费挣钱多了”。她表示。

“The gains from the loss of customers are greater than the transaction fees.” She said.

这类山寨交易所为何还能生存至今?周珂解释称,这些交易所之前或多或少都有“杀猪盘”背景,本来就是刀口舔血的人。“只要没被查,去玩的韭菜真是源源不断,因为合约太赚钱了”。

Why do these boar exchanges survive so far? Chok explained that they used to have more or less a “pig-killer” background, and that they were people who licked blood with a knife. “As long as they weren't checked, there's a lot of cabbage to play, because the contract is too profitable.

58Coin是周珂口中不幸被查的交易所代表。今年2月,据蓝鲸财经报道,58Coin交易所办公室以及关联公司办公室均被查,“近10辆警车带走数百人”,已有投资人以被诈骗为由向当地警方报案。

58 Coin is the representative of the exchange that was unfortunately investigated at Zhou's Coco. In February this year, according to the Blue Whale Bank, the office of the 58 Coin Exchange and the office of the affiliated company were investigated, “nearly 10 police cars took hundreds of people away,” and investors reported to the local police for fraud.

事实上,在被查之前,围绕在58Coin上的争议就一直不断,有多位投资者在公开平台上反映,该交易所修改后台数据人工插针、以及止盈止损功能失灵,导致用户资产爆仓。

In fact, the controversy surrounding 58 Coin continued until it was investigated, with multiple investors reflecting on the open platform that the exchange modified the backstage data manual needles and failed to stop the inefficiency and loss of functionality, leading to the bursting of user assets.

当然,也有幸运者获得高额收益,但提现困难则是压倒不少投资者的最后一根稻草。

There are also, of course, high returns for the fortunate, but the difficulty of recovering is the last straw to prevail over many investors.

在58Coin出事之前,其官方微博显示,从2018年至2021年2月,一直仍有大部分人留言提币不到账,但即便如此,58Coin在此期间一直正常运营,甚至在2020年8月仍在发布招聘信息。

Prior to the incident in 58 Coin, official tweets showed that, from 2018 to February 2021, a large number of people had left unrecorded comments, but even so, 58 Coin had been operating normally during the period and had even been issuing recruitment information in August 2020.

今年1月才进入合约市场的新手投资者小东也遇到过这样的情况。他通过某排名网站推荐的一家名为coinfit的交易所做合约交易,在平台盈利的2万美元,以被平台以交易流水未达标为由拒绝提币。他曾向微博大V求助是否要继续交易下去,该大V回复称,“Bitgit是杀猪盘交易所,不要进,已经有3个受害者了。”

This was also the case for a new investor who had just entered the contract market in January. He made a contract deal through a company named Coinfit, a top-ranked website, and made a profit of $20,000 on the platform, refusing to raise money on the grounds that it had failed to meet the criteria for trading. He asked Big V for help to keep trading. The Big V replied that “Bitgit is a pig-killing exchange, don't come in, there are three victims.”

“回滚”魔术手,投资者吃到嘴里的肥肉被吐出来了

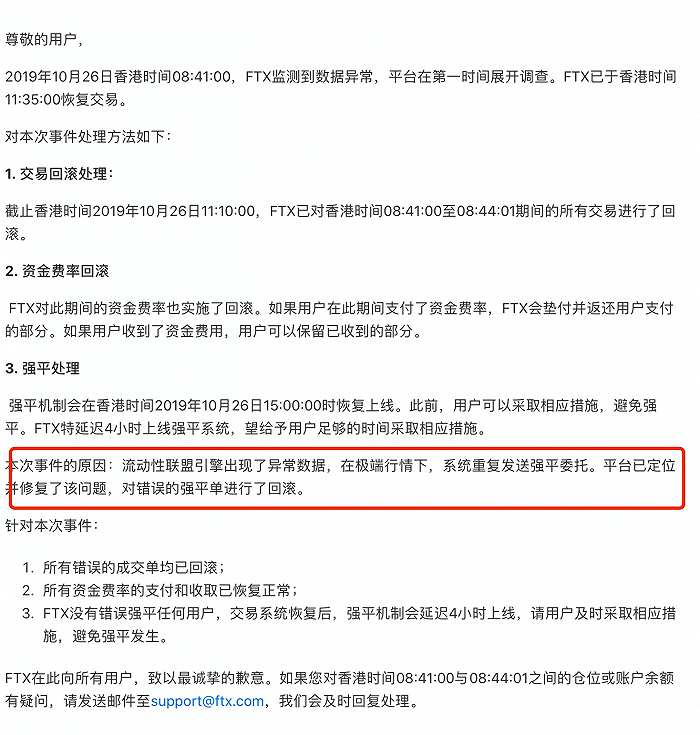

搜索加密货币交易所相关信息,“回滚交易”也是与不少交易所绑定紧密的一大关键词。

Searching for information on encrypted currency exchanges, “roll-back transactions”, is also a key word tied closely to a number of exchanges.

在百度百科释疑中,回滚为通信软件工程术语,指的是程序或数据处理错误,将程序或数据恢复到上一次正确状态的行为,回滚对程序员意味着非常严重的失误。回滚次数往往与程序员的薪金直接联系。主流互联网公司通常都将回滚定位为最严重的事故。

In encyclopaedia, rollback is a communication software engineering term that refers to a program or data processing error that restores the program or data to the last correct state, and rollback is a very serious error for programmers. The number of rollbacks is often directly linked to the programmer’s salary.

但据界面新闻了解,回滚对于不少加密货币投资者而言也并不陌生,近几年来,包括一线交易所在内的大部分平台在发生期货合约价格异常事件时,几乎无一例外都采用回滚方式挽回损失。

However, according to the interface news, rollbacks are not new to many encrypted currency investors, and in recent years most platforms, including first-line exchanges, have, almost without exception, used rollbacks to recover losses in the event of futures contracts price anomalies.

一些交易所也会将回滚写进用户协议中:在发生有人为恶意操控市场情况下,平台有权利通过交易回滚的方式消除不良交易产生的影响,遂作出合约交易数据回滚的决定。在合约市场中,通常表现为:平台将把所有币种的当周、次周、季度合约数据回滚至改天某一时段,也就是异常交易发生时,此后所有的交易操作将不作数。

A number of exchanges will also write back into user agreements: in the case of maliciously manipulated markets, the platform has the right to address the impact of bad transactions by rolling back. In the contract markets, it is often shown that the platform rolls back all currency data from week to week, week to quarter to another time, that is, when an unusual transaction occurs, and then all transactions do not count.

事实上,传统金融世界中也存在回滚现象。

In fact, there has also been a rebound in the traditional financial world.

2011年8月,美国骑士资本的交易程序出现问题,当日上午的相关交易均被纽交所和纳斯达克取消;而在被载入中国证券史上的327国债事件中,上交所回滚了收盘前8分钟的交易。

In August 2011, there were problems with the transaction procedures for the capital of the United States Knights, and the transactions were cancelled in the morning by the New Dealers and NASDAQ; in the case of the 327-state debt, which was recorded in the history of Chinese securities, the transaction was returned eight minutes before the closure.

但在加密货币合约市场中,这一权利似乎被滥用了。

However, this right appears to have been abused in the market for encrypted currency contracts.

在定义有关回滚必要性的问题上,监管机构与第三方评估单位缺位了,而当权利被交易所掌握在手中,其决定的合理性往往备受质疑,尤其在合约市场这类多空博弈市场中,数据回滚相当于要求盈利的做空投资者将“吃到嘴里的肥肉吐出来”,不免引发诸多争议。

In defining the need for rollbacks, regulators and third-party assessment units are absent, and the legitimacy of their decisions is often questioned when rights are in the hands of the exchange, especially in a multi-air market such as the contract market, where data rolls are tantamount to requiring profit-making empty investors to “eat the fat out of their mouths” — a source of controversy.

滥用回滚就不怕用户流失吗?对于记者的疑惑,周珂无奈表示,用户流失和真金白银流失,一些交易所是宁愿选择前者的。

Do you fear loss of users if you abuse the rollback? With the doubt of journalists, Cho has no choice but to say that the loss of users and the loss of real silver is the preferred option for some exchanges.

防踩坑指南:不要开高倍杠杆、选择头部交易所

加密货币合约交易江湖险恶,投资者要如何避免踩坑?

How do investors avoid stepping on pits when encrypted currency contracts are traded in dangerous ways?

对于一些“杀猪盘”、“吃客损”的交易所来说,周珂给出的建议是,对于一些“老能看到收益率特别离谱的交易所,尤其是那种老有人想方设法给你点位的,包括跟单产品,带单团队,分析社区,千万别进,搞不好499把镰刀,就1个韭菜”。

For some of the “pork-killing” and “guest-eat” exchanges, Chok made the suggestion that for some of the “old-seeing exchanges with particularly disproportionate rates of return, especially those who try to locate you, including documentary products, single-lined teams, community analysis, never enter, maybe 499 sickle blades, just a pickle”.

她还透露,想要分辨是不是“吃客损”有一个简单的方法,就是加交易所客服,问能不能带单合作,要一份KOL合作方案。

She also revealed that there was a simple way to determine whether or not it was “grave-and-lost”, namely, to add exchange services, and asked if it would be possible to bring a single cooperation and to have a KOL cooperation programme.

对于宕机、拔网线、回滚交易这类往往成为“罗生门”的情况,在刘凡给出“不要开高倍杠杆”的实在建议。

In the case of engines, wires, rollbacks, etc., which often become the “Rosing Gate”, there is a concrete suggestion in Liufan that “don't use high leverage”.

他认为,“最讨厌拔网线的人应该是那些做了高倍杠杆的人,和想要抄底的人”,一些现货持有者以及低倍杠杆持有者并不反感,相反,对于后者来说,不失为一种稳住市场态势的行为。

In his view, “the people who hate to remove the net should be those who do, and those who want to copy it”, some spot holders, as well as low leverage holders, are not repulsive; rather, for the latter, it is a form of market-stabilizing behaviour.

他以去年3月12日比特币暴跌为例。彼时,比特币价格暴跌引起连环爆仓,进一步加速价格瀑布式下滑。而对于其在第二天反弹,刘凡归因于以Bitmex为代表的一众交易所集体“拔网线”。他认为:“这是由于市场上的最大卖盘瞬间停止,场外流动性开始跟上,且Bitmex用自己的保险金吃爆仓单,一下子稳住了市场,比特币价格才开始反弹。”

He took the example of Bitcoin, which fell sharply on March 12, last year. At the same time, Bitcoin’s price collapse caused a series of booms, further accelerating the price falls. For its rebound the following day, Liu Van was attributed to a group of exchanges, represented by Bitmex, “drawing out of the net.” He argued: “This was because the biggest sale in the market came to an abrupt halt, out-of-the-street liquidity started to keep up, and Bitmex ate the warehouse slips with his own insurance money, so that the market was stabilized and Bitcoin prices began to rebound.”

他指出,现货投资者没有爆仓的风险或者爆仓风险小,对于他们而言,最担心的风险就是系统性风险,以及市场缩水风险。

He pointed out that spot investors had no or low risk of explosion and that for them the most feared risk was systemic risk, as well as the risk of shrinking the market.

而针对回滚交易,周珂也认为,要把头部交易所与小交易所分别看待。她说:“头部交易所有时候回滚交易对大家都好,比如因为黑客攻击,大部分人都亏了,只有黑客赚了,这种情况大家都愿意回滚交易。有一些小交易所回滚交易纯粹是玩不起就掀牌桌。”她建议,在这种情况下,最好选择有一线二线、拥有一定用户口碑的交易所。

In the case of rollback transactions, Chokko also argued that it would be better for everyone to look at head exchanges separately from small exchanges. She said, “The head exchange sometimes loses, for example, because of hacker attacks, most people lose, only hackers earn money, a situation in which people are willing to roll back. Some small exchanges roll back deals are simply unwieldy to turn tables.” She suggested, in this case, that it would be better to choose a two-line exchange with a certain user profile.

“如今币圈已经涌现出不少合约交易所,可替代性太强了,用户用钱投票,不合格的交易所很快会被淘汰。”对于币圈乱象会否继续蔓延,刘凡还是持乐观态度。

“Now that the currency circle has emerged in a number of contract exchanges, there are too many alternatives, and users vote with money, and an unqualified exchange will soon be eliminated.” Liufan remains optimistic about whether currency turmoil will continue to spread.

(应受访者要求,文中吴海、刘凡、周珂、小东均作化名处理)

(According to the request of the interviewer, Wen Wu Hai, Liu Van, Chok, Xiaodong are treated under an alias.)

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论