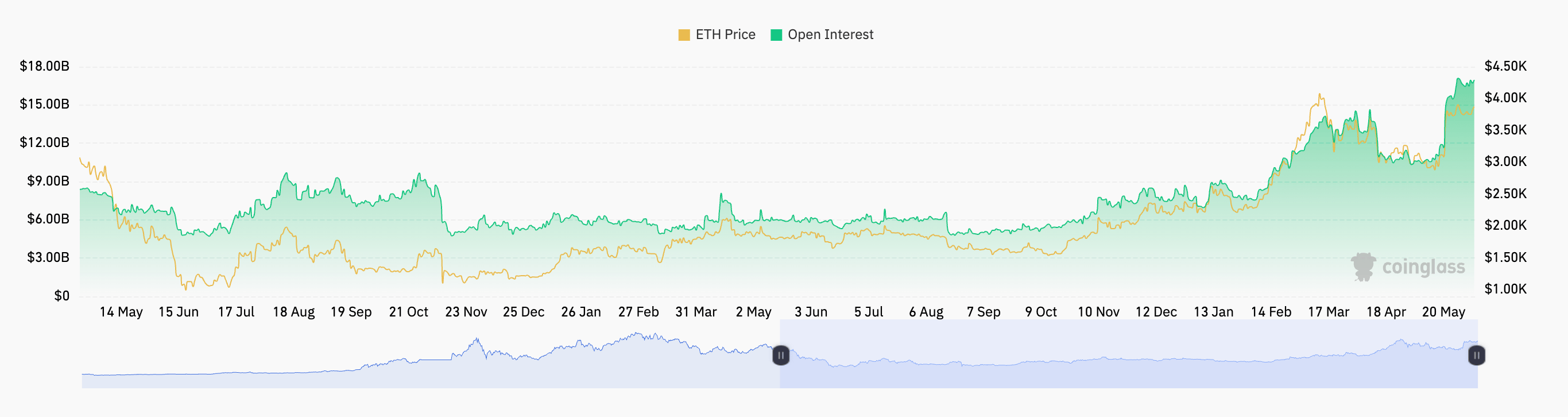

以太坊3 月 23 日,以太坊价格跌至 4,000 美元,一度突破 3,890 美元,随后因 4,658 万美元的杠杆多头清算而出现回调。 此后,以太坊期货未平仓合约于 5 月 28 日创下 170.9 亿美元的历史新高。

Etheria March 23, when the price fell to US$4,000, a one-time breakthrough of US$ 3,890, followed by a rewinding of US$ 4658 million in leveraged multiple liquidations.

同样,根据 Coinglass 的数据,随着以太坊期货未平仓合约持续在 3,700 美元以上盘整,其未平仓合约仍保持在 161 亿美元的高位。

Similarly, according to Coinglass, the unscathed contracts remained at a high of $16.1 billion as the Etheraya futures contracts continued to run above $3,700.

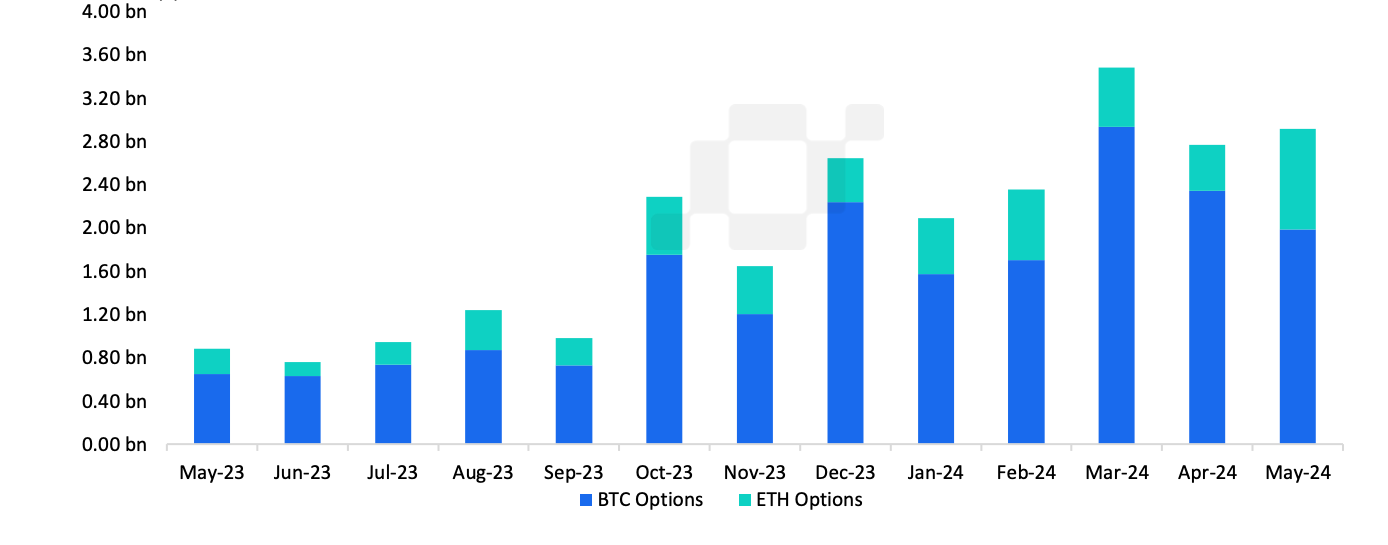

与此同时,芝加哥商品交易所 (CME) 以太币期货期权的月交易量在 5 月份达到了历史最高水平。据CCData 6月5日发布的报告显示,CME ETH期权交易量上涨115%,至9.31亿美元,较4月份的6.1575亿美元大幅增加,创下月度交易量新高。

At the same time, the Chicago Commodity Exchange (CME) reached an all-time high in May in terms of its monthly trading volume for futures. According to a report released on 5 June by CCData, CME ETH.

ETH 工具交易活动的增加凸显了美国证券交易委员会突然改变对美国现货以太坊 ETF 申请的规定后,机构对该资产的兴趣日益浓厚。一些分析师认为,以太币衍生品市场交易活动的增加表明,在 5 月 23 日现货以太坊 ETF 获得批准后,机构对 ETH 的兴趣增加。

The increase in ETH tool trading activity highlights the growing interest of the agency in the asset following the sudden change in the requirements of the US Securities and Exchange Commission for ETF applications. According to some analysts, the increase in ETH trading in the derivatives market in TT$ suggests that the agency’s interest in ETH increased after ETF was approved on May 23.

算法交易公司 Wintermute 的分析师表示:“以太币的 CME 未平仓合约正在接近历史最高水平,表明在 S-1 申请和最终推出之前,机构对 ETH/BTC 交易表现出浓厚兴趣。”

The analyst for the algorithm trading firm Wintermute stated: “The CME unsalary contract in Temas is approaching the highest level in history, indicating a strong institutional interest in the ETH/BTC before the S-1 application and final launch.”

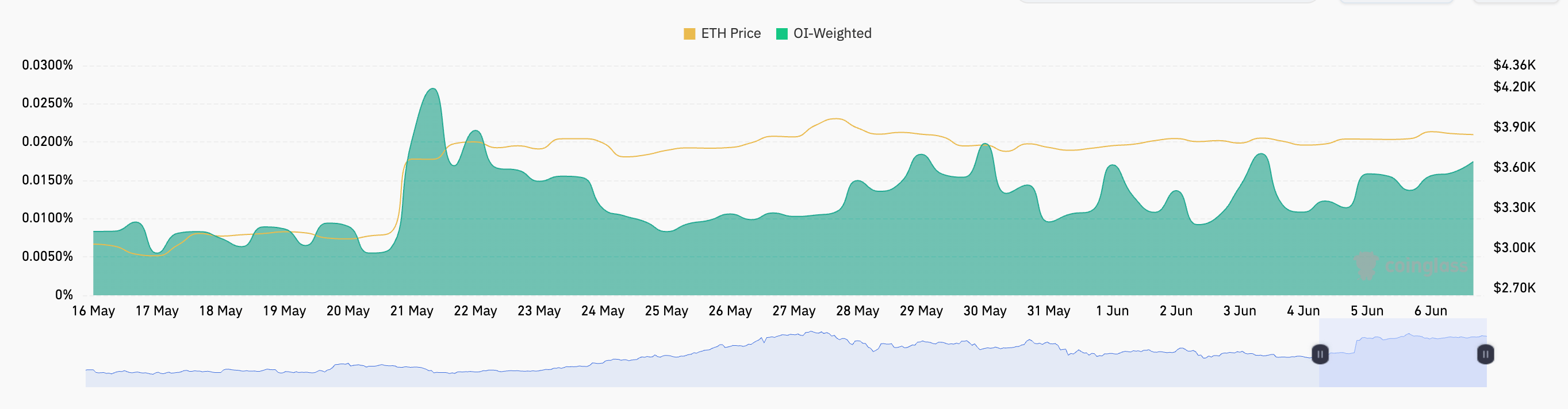

该交易公司在 5 月 27 日发布的一份报告中表示,以太币期权的增加表明,由于对价格大幅波动的预期增强,隐含波动率上升。隐含波动率是根据期权价格衡量市场对特定时间段内未来波动性的预期。

In a report issued on 27 May, the trading firm stated that the increase in the right to the Teen currency indicates an increase in the rate of volatility implied by the expected increase in large price fluctuations. The implied rate of volatility measures the market’s expectations of future fluctuations over a given period of time based on option prices.

市场参与者预计,随着现货以太坊 ETF 推出的临近,以太币的价格将变得更加波动。

Market participants expect to become more volatile at the price of the talisman as the spot moves closer to ETF.

市场对美国证券交易委员会突然逆转的反应表明,投资者措手不及。过去一个月内不断增加的以太币负面情绪已经消失。尽管价格走势仍可能受到整体市场形势的影响,但未来上涨的可能性有所提高。

The market’s response to the sudden reversal of the US Securities and Exchange Commission has shown that investors are caught up. The growing negative sentiment in the past month has disappeared.

同样,永续合约(反向掉期)等其他指标也反映了同样的看涨倾向。这些衍生品也称为反向掉期,其内含利率通常每八小时重新计算一次,这表明对杠杆多头头寸的需求过大。

Similarly, other indicators, such as permanent contracts (reverse swaps), reflect the same upward trend. These derivatives are also referred to as reverse swaps, with interest rates usually recalculated every eight hours, indicating an excessive demand for leveraged multiple positions.

Coinglass 数据显示,ETH 融资利率在过去几天内大幅上升至 0.0175,相当于每周 0.367%。通常,在乐观情绪不断增加的情况下,利率仍为正值。因此,使用永续合约的交易者表现出与期货市场相同的看涨情绪。

Coinglass data show that ETH financing rates have risen significantly over the past few days to 0.0175, equivalent to 0.367 per cent per week. Usually, with optimism rising, interest rates remain positive.

根据 CoinGecko 的数据,截至本文发布时,以太坊价格为 3,843 美元,在过去 24 小时内上涨了 1.2%。

According to CoinGecko, at the time of the publication of this paper, the price of the Tatiya was US$ 3,843, an increase of 1.2 per cent over the last 24 hours.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论