以太坊(ETH)复苏之路或将在未来几个交易日下滑3200位置的风险,目前行情走势来看以太坊(ETH)复苏之路遇到了一个强劲的阻力区间。本月开市以来,随着整个市场范围内的价格上涨,ETH的价格在本月初上涨了近22%。在长假归来的第一天10月8号,这一市值第二大的加密货币从3000美元以下涨至3650美元以上,快速的拉伸增加了市场信心,同时也加大了市场看涨情绪。

Since the opening of the market this month, the prices of ETH have risen by almost 22% since the beginning of the month, as prices have risen across the market. On October 8, the second largest encoded currency in the market rose from $3,000 to over $3650 on the first day of the long term.

技术图表专家推测:6000美元很快就会到来,1万美元在准备中了。分布式数据网络PACProtocol的首席执行官DavidGokhshtein也预测ETH的上行目标为1万美元。但ETH的价格有可能进入三个明显的看跌指标的汇合点,这可能限制其上行走势,并削减其近期的部分涨幅。其根本依据来自技术面上给出的重要迹象,就让我们一起来看看。

Technical chart experts speculate that $6,000 will come soon, and $10,000 is in preparation. David Gokhshtein, CEO of the distributed data network PACProtocol, also predicts an upward target of $10,000.

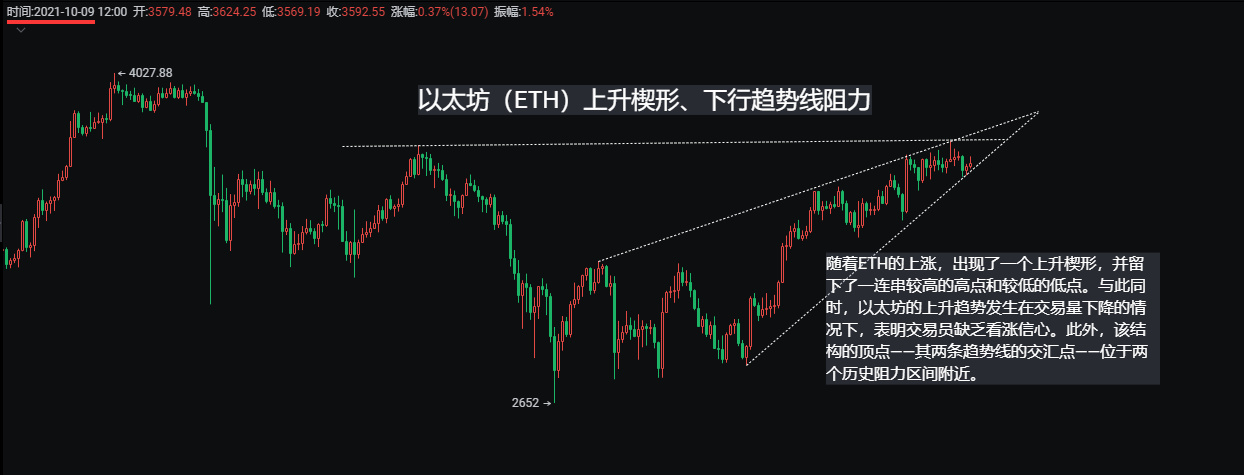

技术面上的两个阻力区间和一个上升楔形,三个看跌指标可能促使ETH经历看跌逆转,即上升楔形、下行趋势线阻力和中期阻力带,如下图所示。

Two resistance zones on the technical side and an upscaling chasm, with three visual drops likely to cause ETH to experience a reversal of decline, i.e., rising silt, downward trend line resistance and medium-term resistance, as shown in the figure below.

随着ETH的上涨,出现了一个上升楔形,并留下了一连串较高的高点和较低的低点。与此同时,以太坊的上升趋势发生在交易量下降的情况下,表明交易员缺乏看涨信心。此外,该结构的顶点——其两条趋势线的交汇点——位于两个历史阻力区间附近。第一个是中期阻力带,如上图所示,之前它显示的ETH顶部在3650美元上方。与此同时,第二个阻力位是下行趋势线,在下面的日线图上可以更清楚地看到,在3800美元左右。

As the ETH rises, an upswing has emerged, leaving a series of higher and lower lows. At the same time, the upward trend in the Taikus has taken place in the context of declining trade volumes, indicating a lack of confidence on the part of traders. Moreover, the top point of the structure — the intersection of its two trend lines — is close to the two historical resistance zones. The first is the medium-term drag belt, which, as shown in the figure above, was shown at the top of the ETH at $3650. At the same time, the second resistance is the lower trend line, which can be seen more clearly in the Japanese line below, around $3,800.

因此,上升楔形的顶点和两条阻力趋势线对以太坊构成了看跌反转的风险。如果发生这种情况,ETH将暴跌,跌幅将达到楔形的上下趋势线之间的最大高度。这使得它将跌破3200美元,这是2021年9月上半月以太坊交易员的一个积累区间。

As a result, the peak of the scaffolding and the two resistance trend lines pose a risk to the Ether. If this happens, the ETH will drop sharply, reaching the maximum height between the scaffolding top and bottom trend lines. This will bring it down by $3,200, a build-up zone for the first half of September 2021 for the trader.

激活反转头肩形态,中继反转或将迎来以太坊(ETH)复苏之路,重回历史新高4300,如下图所示。

Activate inverted shoulder shapes, which will either lead to an Ethio-Team recovery path, returning to an all-time high of 4300, as shown in the figure below.

跌至或跌破3200美元并不一定会将ETH推入一个全面的看跌周期。相反,它可能触发一个看涨的反转头肩形态。如果该形态按照预期进行,交易员对ETH代币的积累将在3200美元附近增加,导致向上图中的颈线区域反弹。在这样做的时候,ETH价格将把它的反转头肩目标放在与该模式的颈线和底部之间的最大距离相等的长度。这将使ETH价格达到约4500美元的历史新高。

Falling to or falling into $3,200 does not necessarily push the ETH into an overall downward spiral. On the contrary, it may trigger an upswinging inverted shoulder shape. If that pattern is carried out as expected, the trader’s accumulation of ETH tokens will increase near $3,200, leading to a rebound in the neck line area of the top map. In doing so, ETH prices will target its head back at the maximum distance from the neck line and the bottom of the model.

认真看完前面的分析,不管是现货还是合约交易的思路,想必都是很清晰的;现货方面目前重点关注楔形整理破位后方向的选择,如果楔形整理结束后行情突破压力线,价格冲击3800-4300-4500三个位置的概率是极大的。如果行情承压回踩3200位置将会成为重点关注和上车的机会。永续合约方面目前建议围绕楔形区间3500-3620区间操作,风险一定控制好,因为不论破位突破还是承压必定伴随着一波暴动的行情。

A careful look at the preceding analysis, both on the spot and on the way to the contract deal, must be clear; the spot is now focused on the choice of the direction of the scaffolding post, and if the scaffolding breaks the pressure line, the probability of a price impact of 3800-4300-4500 positions is very high. If you press back 3,200 positions, it will be an opportunity to focus on and get in the car. With the ongoing proposal for a permanent contract to operate around 3,500-3620 blocks between the scaffolds, the risk must be kept under control, since both the breakout and the pressure must be accompanied by a wave of violence.

目前,年内牛市行情可能会迎来一个转折点,通俗点说,加密货币在经历过监管风波之后,正在走向常规化表现。投资者对于市场的理解和面对暴动行情的处理方式正在逐步成熟,市场信心和热度正在恢复,这也将会以太坊(ETH)复苏之路提供助力,最后让我们一起期待本轮牛市的到来。

Currently, cattle markets are likely to reach a turning point in the year, and it is commonplace to say that encoded currencies are moving towards regularization after they have experienced a regulatory wave. Investors’ understanding of the market and their handling of riots are maturing, market confidence and heat are regaining, and this will help with the recovery path of the Tahrir and, finally, let us look forward to the arrival of the city.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论