原创 本星君 读懂本星球

Original, Star King. Read the planet.

作者▏未 定

Author's undecided

出品▏本星君

He's a star.

近日,哈萨克斯坦的骚乱在出人意料的领域引发了连锁反应。

In recent days, riots in Kazakhstan have triggered a chain reaction in unexpected areas.

当哈萨克斯坦政府中断全国互联网的时候,直接引发了全球比特币矿池的动荡。

When the Government of Kazakhstan shut down the national Internet, it directly caused instability in the global pit of Bitcoin.

根据加密货币咨询与研究网站的表示,哈萨克斯坦的“断开连接”导致比特币的全球算力下降了12%。

According to the encrypted currency advice and research website, Kazakhstan's “disconnection” resulted in a 12 per cent reduction in Bitcoin's global arithmetic.

▲哈萨克斯坦的暴乱现场

The riot scene in Kazakhstan.

所谓的算力,也被称为哈希率,是指比特币网络处理能力。

The so-called arithmetic, also known as the Hashi rate, refers to the Bitcoin network processing capacity.

由于哈萨克斯坦突然断网,导致多家挖矿企业在哈萨克斯坦的业务规模呈现断崖式下跌。

The sudden closure of the network in Kazakhstan has led to a steep decline in the scale of the operations of several mining enterprises in Kazakhstan.

算力的下降导致比特币交易价格大跌,下跌至41008美元,到达了九月以来最低点。不过,即使价格下跌,一枚比特币的价值仍然高达26万人民币。

The fall in numeracy led to a sharp fall in Bitcoin transaction prices to $4108, the lowest since September. However, even when prices fell, the value of a bitcoin remained as high as 260,000 yuan.

小小的比特币,究竟是什么来头,十年间,价值竟上涨了四万倍?哈萨克斯坦又如何能以一己之力导致比特币的大幅波动呢?

And how can Kazakhstan, by its own means, cause significant bitcoin fluctuations?

1.神秘的比特币创始人

1. Mysterious Founder of Bitcoin

2008年,一场席卷了全世界的金融危机令一批密码学家对现行的货币体系感到了深深的不安。他们对目前所使用的这套中心式和通胀式的货币体系产生了深深的不信任之感。

In 2008, a financial crisis that engulfed the world deeply troubled a group of cryptographers about the current monetary system. They had a deep sense of mistrust about the central and inflationary monetary system currently in use.

于是,一位叫做中本聪的密码学家开始了思考,他试图创造一种既没有中心银行,也没有通货膨胀的稳定的货币体系。

As a result, a cryptographer called Nakamoto began to think, trying to create a stable monetary system that had neither a central bank nor inflation.

这就是比特币。

That's Bitcoin.

中本聪迈出了比特币的关键一步,但并非第一步。

China has taken a crucial step in Bitcoin, but it is not the first step.

曾在1974年获得了诺贝尔经济学奖的哈耶克在《货币的非国家化》一书中曾经希望能废除中央银行制度,转而允许私人发行货币,通过自由竞争和优胜劣汰产生最好的货币。

Hayek, who had won the 1974 Nobel Prize for Economics, in his book Non-Stateization of Currency, had hoped to abolish the central bank system and instead allow private money issuance to produce the best currency through free competition and better or worse.

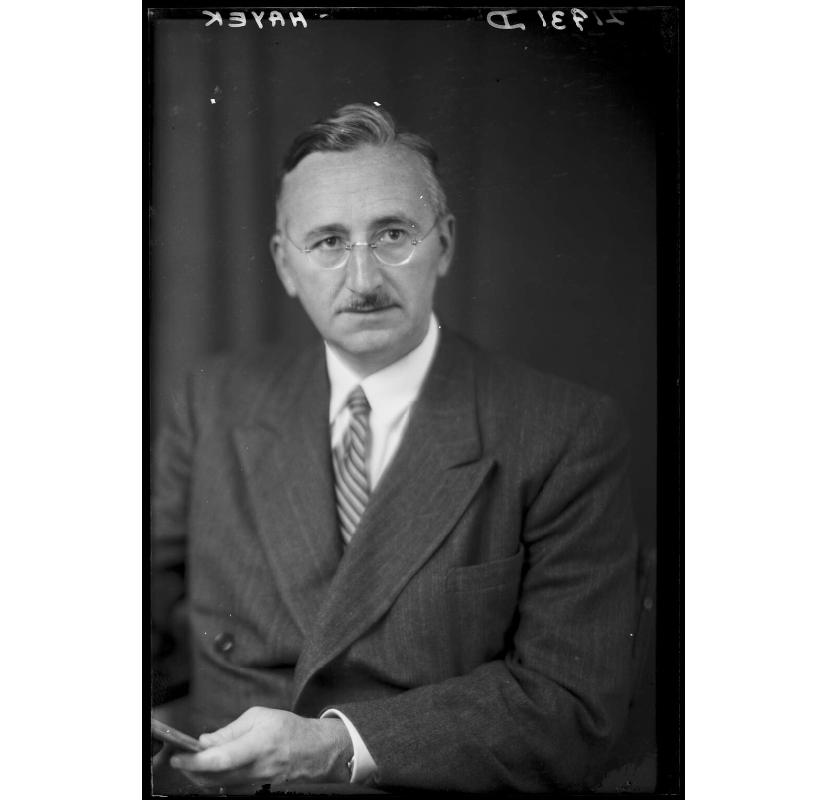

▲经济学家哈耶克,是比特币开创的先驱

The economist Hayek was the pioneer of Bitcoin.

您或许对哈耶克这个名字感到陌生,但您一定听过他另外一本大名鼎鼎的著作——《通往奴役之路》。

You may be unfamiliar with the name Hayek, but you must have heard his other famous book, The Way to Slavery.

受到哈耶克这位老前辈的影响,众多经济学家开始探索如何建立一个比国家信用更可靠的货币体系。

Under the influence of Hajek, an old generation, many economists have begun to explore how to build a monetary system that is more reliable than national credit.

譬如说米尔顿·弗里德曼,这位经济学家提出了一个大胆的想法——用计算机按照程序来发行货币,如此一来即可避免各国央行无限制地超发货币。

For example, Milton Friedman, an economist, has come up with a bold idea of using computers to issue the money in accordance with the program, so that central banks can avoid excessive currency transfers without any restrictions.

显然,这就是比特币的理论基础。

Obviously, that's the rationale for Bitcoin.

在理论基础创立之后,有一些人开始试图将理论化为现实。

After the creation of the theoretical foundation, some began to try to translate the theory into reality.

美国密码学家大卫·乔姆创造了一种叫eCash的加密货币。他给出了一个创造性的方案——盲签(blindsignature)。但乔姆的加密货币仍然需要一个令众人信服的中心化服务器。

The American cryptographer David Jom created an encrypted currency called eCash. He offered a creative solution -- blind signage. But Chom's encrypted money still needs a centralized server to convince people.

在大卫·乔姆之后,计算机科学家尼克·萨博做出了突破。他在1998年设计了一套去中心化货币体系——比特黄金(bitgold),提出了“智能合约”这一概念。

After David Jom, computer scientist Nick Sabo made a breakthrough. In 1998, he designed a decentralized monetary system — bitgold — which introduced the concept of “smart contracts”.

尼克·萨博也因此被认为是中本聪本人——没错,目前为止,中本聪仍然是一个正体不明的神秘人。

Nick Sabo is thus also considered to be the neutron himself — yes, so far, he is still an undisclosed mystery.

▲尼克·萨博经常被猜测是中本聪本人,但其多次否认

He's often suspected of being Nakamoto himself, but he has denied it many times.

总之,站在这些人的肩头,中本聪在2008年开创了比特币。

All in all, while standing on the shoulders of these people, Central Benz created Bitcoin in 2008.

2.暴涨2512万倍的比特币

2. A dramatic 25.12 million-fold increase in bitcoin

2008年11月1日,中本聪在一个密码学邮件组中发表了论文《比特币:一种点对点的现金支付系统》。

On 1 November 2008, Nakamoto published a paper in a cryptography mail group, Bitcoin: a point-to-point cash payment system.

在这篇论文中,中本聪给出了对电子货币的新构想:去中心化、不可增发、无限分割。

In this paper, China has given a new vision of e-money: decentralisation, immeasurability and infinity.

两个月后,中本聪在芬兰赫尔辛基的一个小型服务器上,创建了第一个区块——“创世区块”,挖出了世界上第一批比特币。

Two months later, Nakamoto created the first block on a small server in Helsinki, Finland - the Genesis Block - and dug up the first bitcoin in the world.

兴奋的中本聪随即将十个比特币转给了自己的密码学老友——为比特币创立提供了不少帮助的哈尔·芬尼。这也是比特币的第一次转移。

Then the excited Bint was able to transfer ten bitcoins to their own cryptographic friends -- Hal Finny, who helped to create bitcoin. It was also the first time that Bitcoin had been transferred.

比特币的第一次估值是1309枚比特币=1美元。这个算法是用计算机挖矿所需的电费来计算的,也就是说当时用一美元的电费可以挖出1309枚比特币。

The first valuation of Bitcoins was 1309 bitcoins = US$ 1. This calculation is based on the cost of electricity needed for a computer to dig, i.e. 1309 bitcoins at the time.

2010年5月22日,这一天对比特币的发展有着极为重要的意义。为了证实比特币能否在现实用于交易,美国程序员拉斯路·汉耶茨用10000枚比特币购买了价值40美元的披萨,也开启了比特币的货币职能。

On May 22, 2010, the development of Bitcoin was extremely important. To confirm whether Bitcoin was actually being traded, US programmer Laszlo Hanytz purchased 40-dollar pizzas with 10,000 bitcoins, which also opened up Bitcoin’s currency function.

得益于各位程序员的宣传,比特币开始得到一批人的追捧。

Thanks to the publicity of the programmers, Bitcoin began to receive a crowd of people.

譬如说无政府主义,他们非常欣赏比特币排斥政府和中央银行这一点,另外一部分自由市场的支持者也对比特币表示欢迎。

For example, anarchism, they greatly appreciated the exclusion of the Government and the Central Bank by Bitcoin, which was also welcomed by supporters of a part of the free market.

由于这些人的追捧,比特币的价值开始了缓缓的上升,等到2011年2月9日,比特币的价格首次突破1美元。

As a result of their acclaim, the value of Bitcoin began to rise slowly, and by 9 February 2011, the price of Bitcoin had exceeded $1 for the first time.

当天,美国媒体陷入了疯狂,虚拟货币第一次等价于现实货币,众多看到商机或渴求暴富的人们访问比特币的官网,这直接导致了官网的瘫痪。

That same day, the American media went into madness, virtual currency was first equal to real currency, and a large number of people who saw business opportunities or were eager to be rich visited the official network in Bitcoin, which directly led to the paralysis of the network.

▲比特币,如今被视作数字黄金

bitcoin is now considered digital gold.

彼时的人们还不会想到,数年后一枚比特币即可兑换数万美元,被视作数字黄金。

People in each other would not have thought that a bitcoin could be exchanged for tens of thousands of dollars a few years later and would be considered digital gold.

当时比特币已经开始用于交易,虽然这不太光彩——此时的比特币通常用于在暗网购买违禁品等交易。

At that time, Bitcoin had begun to be used for transactions, although it was not a good thing — at that time, bitcoin was usually used for transactions such as the purchase of contraband on the dark web.

总之,受到关注的比特币渐渐开始步入正轨。资本也开始涌入,越来越多的人意识到投资比特币或者“挖掘”比特币有利可图。

In short, the concerned bitcoin is starting to get on the right track. Capital is also coming in, and more and more people are realizing that investment in bitcoin or “digging” bitcoin is profitable.

成为投资界新宠的比特币,开始了急速膨胀的过程,身价也随之暴涨,其价格逐年暴涨。

Bitcoin, a new fan of the investment world, has begun a process of rapid expansion, with a sudden rise in prices and year-on-year spikes in prices.

2011年,巴比特(中国比特币资讯网)创始人长铗在知乎上回答了这么一个问题“大三学生手头有6000元,有什么好的理财投资建议?”。

In 2011, the founder of Babbitt (China's Bitcoin Information Network) answered this question with the knowledge that “Journal students have $6,000 at their disposal. What are the good proposals for financial investment?”

长铗简短的写道:“买比特币,保存好钱包文件,然后忘掉你有过6000元这回事,五年后再看看。”

"Buy the bitcoin, save the wallet, then forget you had $6,000 and look at it in five years."

这个帖子由此被视作“知乎神帖”。

This post is therefore considered as a "know-it-it-it-all" post.

如果那个题主按照长铗的建议买了六千元比特币的话,能赚到多少钱呢?

How much would that be if the subject had bought $6,000 in bitcoins on a long-term proposal?

2011年比特币的价格是三美元/枚,数年后的2017年,比特币的价格来到巅峰——高达1.9万美元/枚。

In 2011, the price of Bitcoin was US$ 3 per item, and a few years later, in 2017, the price of Bitcoin peaked - up to US$ 19,000 per item.

如果他将六千元全部购买比特币,那么他2017年时将持有两千枚比特币,每一枚1.9万美元,也就是3800万美元,折合人民币2.3亿元。

If he buys all of the $6,000 in bitcoin, he will hold 2,000 bitcoins in 2017, $19,000 each, or $38 million, equivalent to 230 million yuan.

十年间翻了三万八千倍。

It's 38,000 times higher in 10 years.

在当时,深圳的一套三居室,还抵不上100个比特币;一辆奔驰S500顶配,都抵不上10个比特币。

At that time, Shenzhen had a three-bedroom set that did not match 100 bitcoins and a Mercedes S500 pair that did not match 10 bitcoins.

如果将时间拉长,从2009年1美元兑换1309.03个比特币算起,8年后,1比特币兑换19891.99美元,比特币价格翻了2512万倍

If the length of time is extended, starting from US$ 1 to 1309.03 in 2009, eight years later, one bitcoin to US$ 19891.99 and the price of bitcoin has increased by 2,512 million times.

这就是为什么难以计数的资本会疯狂涌入比特币市场的原因。天下熙熙,皆为利来,天下攘攘,自然也都是为了利往。

That's why the incalculable capital rushes into the Bitcoin market. It's all for the good, it's for the good, it's for the good, it's for the good.

3.哈萨克斯坦断网,为何比特币暴跌?

3. Why did Bitcoin crash when Kazakhstan broke off the net?

那么,比特币与哈萨克斯坦是怎么回事呢?

So, what's going on with Bitcoin and Kazakhstan?

这还得先从中国讲起,比特币有利可图,中国自然不会缺席。

It has to start with China, which is profitable and naturally not absent.

2011年,中国的第一个比特币交易平台“比特币中国”成立。

In 2011, China's first Bitcoin trading platform, “bitcoinChina”, was established.

次年,李笑来在深圳、广州、上海等地路演,募集了国内首个比特币基金Bitfund.PE。

The following year, Li laughter came on the way to Shenzhen, Guangzhou and Shanghai to collect the country's first bitcoin fund, Bitfund.PE.

随后,数字货币交易平台火币网也宣告成立,比特币由此在中国渐渐走红。

This was followed by the launch of the Digital Currency Exchange Platform (DTT) gunnet, which led to the gradual growth of Bitcoin in China.

但央行对比特币持有相对保守的看法,发布了《关于防范比特币风险的通知》,指出比特币不具有合法货币的地位。

The central bank, however, took a relatively conservative view of Bitcoin and issued a Notice on Risk Protection against Bitcoin, stating that Bitcoin did not have the status of a legitimate currency.

只不过,央行的通知没能让中国的资本冷静下来,越来越多的资本冲入比特币行业。

Only the central bank's circular failed to calm China's capital, which is increasingly rushing into the Bitcoin industry.

当年9月,中国监管当局决定关闭中国境内虚拟货币的法币交易所。不久之后,云币网、比特币中国等平台相继宣布关闭所有虚拟货币交易业务。

In September of that year, China’s regulatory authorities decided to close the French currency exchange for virtual currency in China. Shortly thereafter, platforms such as the Yunnnet and Bitcoin China announced the closure of all virtual currency transactions.

比特币在中国的交易停止后,它会转移去哪里呢?

Where will Bitcoin be transferred when the deal in China stops?

其实,赚取比特币的过程虽然名为“挖矿”,但实际上并非是真的用矿镐去挖掘某些矿物,而是一个比喻。

In fact, the process of earning Bitcoin, while known as “mining”, is not really a metaphor for excavating certain minerals with a miner.

比特币的发行方式是这样的,现在假定我是比特币系统,我要将我手中的比特币发放出去。但我并不是一个随意的散财童子,要想拿到我的比特币需要满足两个要求。

Here's how Bitcoin is distributed, assuming I'm the bitcoin system, and I'm going to release the bitcoin in my hand. But I'm not a random child who needs to meet two requirements to get my bitcoin.

第一、你是我的朋友(在系统中)。

First, you're my friend.

第二、你要能猜到我手上比特币的编号。

Secondly, you have to guess the number of bitcoin in my hand.

猜编号的这个过程,就被比喻为“挖矿”,一次猜测就是一次“下镐”,组织众人同时挖矿,就叫做矿场主。

This process of numbering is referred to as “mining”, and one guess is “blowing”, and organizing the simultaneous mining of people is known as the mine owner.

对于矿场主而言,他们唯一需要付出的成本就是大规模开动计算机的电费。

For mine owners, the only cost they have to pay is the cost of electricity for large-scale start-up computers.

因此,当矿场主们无家可归不得不离开中国的时候,他们会自然会倾向于转移至电费更低的地方。

As a result, when mine owners are homeless and have to leave China, they will naturally tend to move to places where electricity costs are lower.

这就是中国比特币“矿工”的新大陆——哈萨克斯坦。

This is the new continent of “miners” in Bitcoin, China — Kazakhstan.

由于资本的疯狂涌入,比特币在中国的发展势头堪称疯狂,最高峰时的中国贡献了全世界七成算力。

As a result of the sudden inflow of capital, Bitcoin has gained a crazy momentum in China, with China at its peak contributing 70 per cent of the world's economy.

这些矿头纷纷涌入哈萨克斯坦的后果,就使哈萨克斯坦由币圈小国一跃成为“世界第二”。

The consequences of the influx of these mines into Kazakhstan have made Kazakhstan “second in the world” from a small currency ring.

哈萨克斯坦政府对此感到乐观,并出台了配套政策,扶持比特币产业的发展。这令其他迷茫的中国矿头更是下定决心,转移至哈萨克斯坦。

The Government of Kazakhstan is optimistic about this and has put in place an accompanying policy to support the development of the Bitcoin industry. This has led other lost Chinese miners to move with determination to Kazakhstan.

所以,哈萨克斯坦今天的断网才会导致全球算力突然消失百分之十二,并引发比特币价格的暴跌。

That is why today's blackout in Kazakhstan led to the sudden disappearance of 12 per cent of global computing power and triggered a sharp fall in bitcoin prices.

不过,读者们可能会问:挖矿的人少了,比特币的产出随之减少,根据供需定理,比特币的价格应当暴涨才对,怎么反而会下跌呢?

However, readers may ask: How can the price of Bitcoin fall when there are fewer diggers, the output of Bitcoin decreases, and the price of Bitcoin should soar according to supply and demand rules?

按照比特币的设计规则,比特币的总量是固定的只有2100万枚。出币的频次也是固定的,平均10分钟出一次币。

According to the bitcoin design rules, the amount of bitcoins is fixed at only 21 million.

在一开始,一次能出50个比特币。中本聪的“创始区块”就挖出了五十个比特币,之后每4年会减半一次。

In the beginning, 50 bits of bitcoin were available at a time. In the middle, the founding block dug up 50 bitcoins, and then halved every four years.

现在平均10分钟能产生6.25个比特币,出币频率仍然是平均10分钟出一次币。

An average of 6.25 bits of currency are now generated in 10 minutes, and the currency frequency is still an average of 10 minutes.

由于出币速度与算力无关。因此,一万台机器挖矿,和一百台机器挖矿,挖出的结果是一样的。

Because the speed of the currency is not related to arithmetic. As a result, 10,000 machines dig, and 100 machines dig, and the result is the same.

或许您还是没听懂,那就给您举个例子。

Maybe you still don't understand. Let me give you an example.

假设哈萨克斯坦有十台机器,在哈萨克斯坦之外有九十台机器。一百台机器同时挖矿,每10分钟能产生6.25个比特币。

Assuming that there are 10 machines in Kazakhstan and 90 machines outside Kazakhstan, 100 machines dig at the same time and produce 6.25 bitcoins every 10 minutes.

但是,在哈萨克斯坦突然断网后,全球只剩下了九十台机器在挖矿,但是出产的比特币仍然是6.25。

However, after the sudden closure of the network in Kazakhstan, there were only 90 machines digging in the world, but the production of bitcoin was still 6.25.

换句话说——挖矿的难度突然下降了,这才是比特币的价格下降的原因。

In other words, the difficulty of mining has suddenly declined, which is why the price of bitcoin has fallen.

▲位于哈萨克斯坦的一家比特币挖矿场,其能耗相当于一个发电站

A bitcoin mining site in Kazakhstan with the same energy consumption as a power station

但这对比特币而言还真不算什么大事,价格崩盘这种事,比特币早已习惯。不如说,比特币的价格不崩盘,币圈反而会啧啧称奇。

But it's really not a big deal for a bitcoin, and bitcoin is used to that. Let's just say, bitcoin's price doesn't crash, and the ring is gonna be amazing.

未来的比特币将会如何发展,我们现在不得而知。

We do not now know how the future bitcoin will develop.

反对者视之为诈骗,嗤之以鼻;拥护者视之为未来,狂热追捧。或许,多年之后我们才会得到新的答案。

Those who oppose see it as fraud and scorn, and those who embrace it as the future are eagerly pursued. Perhaps many years from now we will have a new answer.

原标题:《哈萨克斯坦断网,比特币躺枪?》

Original title: Kazakhstan Net Breaking, Bitcoin Lies Gun?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论