比特币2030年一百万美元一个 本人介绍:2017年开始持有比特币。随后在一家去中心化交易所工作了1年多。先贴一个本人持仓4年多的总市值的变化,图片来自...

资讯 2024-06-22 阅读:114 评论:0本人介绍:2017年开始持有比特币。随后在一家去中心化交易所工作了1年多。

In 2017, I started holding bitcoin. I then worked at a decentralised exchange for more than a year.

先贴一个本人持仓4年多的总市值的变化,图片来自Coinbase。可以看到18年的peak,然后沉寂了3年,然后2020年底又爆发了,之前18年的peak显得就是一个小波浪。

You can see 18 years of peak, then three years of silence, and then at the end of 2020, 18 years of peak appears to be a small wave.

本文的结构:先说说比特币可以长期持有的逻辑,总结一下就是趋利避害。然后谈谈监管的影响,以及引用木头姐的研究。

The structure of this paper: first, the logic that bitcoins can hold over a long time, and then, to sum up, is a profit-absorbent. Then we talk about the impact of regulation, and we quote from the wood sister's study.

1.先说避害

First of all, avoid harm.

比特币是有无法取代的刚需的,它的价值不可能跌为零,下面有几个刚需的例子:

Bitcoin has an irreplaceable need, and its value cannot be reduced to zero, and there are a few examples of this need:

洗钱,它可以突破外汇管制,没有兑换限额像黑市交易比如军火、毒品,或者是黑客勒索,因为比特币钱包是匿名的动荡国家的法币风险非常大,比如我去过伊朗,货币面值都很大,因为货币贬值太厉害。下面是一个伊朗钞票。津巴布韦等国家自己的法币几乎就不值钱。我原来做一个外企全球的财务分析,发现很多大国比如俄罗斯 土耳其 阿根廷的货币也是经常顿时跌20% 30%。持有这些国家的货币,不如持有比特币的。

Money-laundering allows it to break foreign exchange controls without exchange limits, such as black market transactions such as arms, drugs, or hacking, because bitcoin wallets are a very high risk of currency in an anonymously volatile country, for example, when I went to Iran, and the currency is too much in nominal terms because it is too much. Here is an Iranian banknote. Zimbabwe’s own French currency is almost worthless.

比特币就是数字黄金,有一个储值避险的功能。用这个逻辑去分析其他货币,其实很容易发现其他货币没有这个逻辑。没有黑客勒索狗狗币或者以太坊的。其他货币更多大家看重的是使用价值,比如以太坊是用来做Defi生态的,狗狗币因为金额小可以做打赏小费。所以这些币是需要不停技术升级的。有时候稳定的东西反而很好,比如茅台,不需要技术投入,就是默默酿一样的酒就好了。比特币是一样的道理,技术不好就不好,网络堵塞就堵塞,手续费高就高,大家看重的不是你的使用价值,而是储值避险的价值。

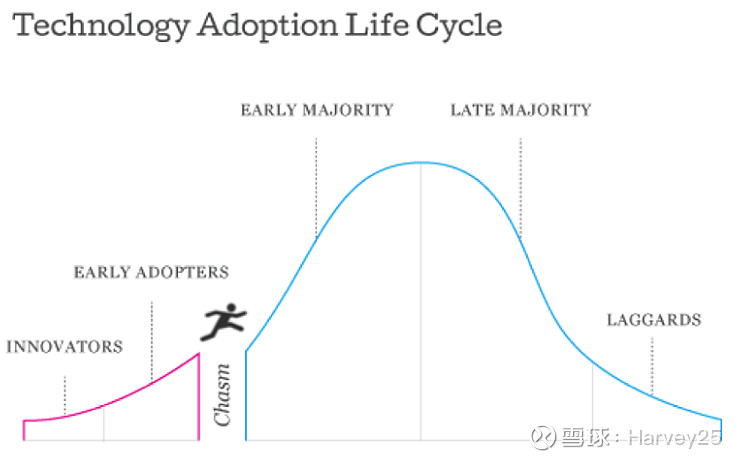

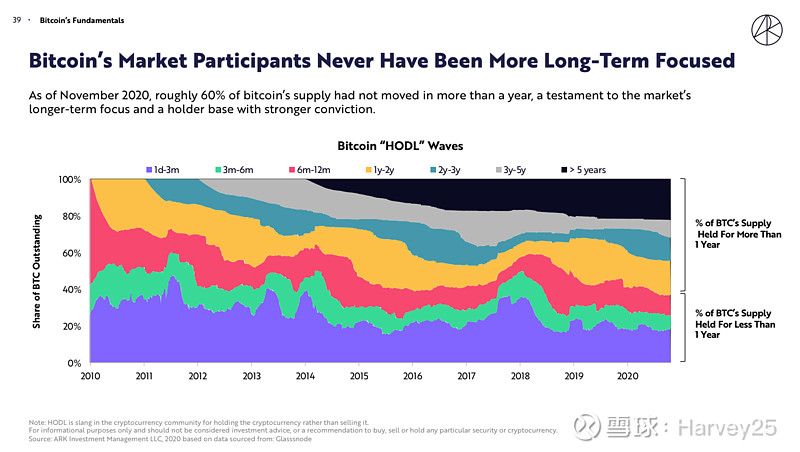

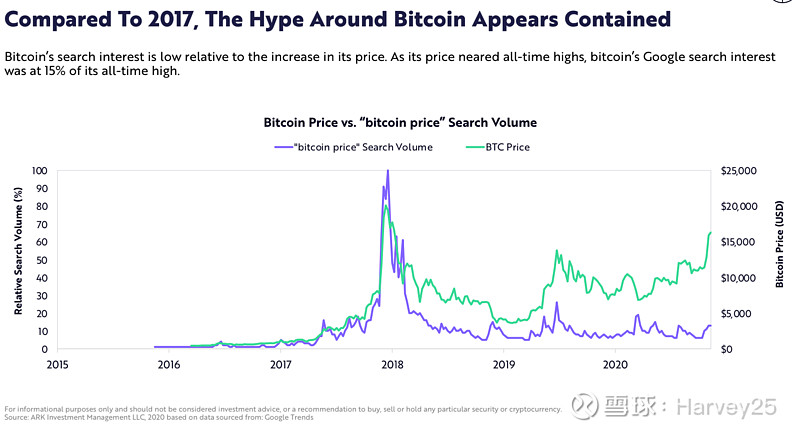

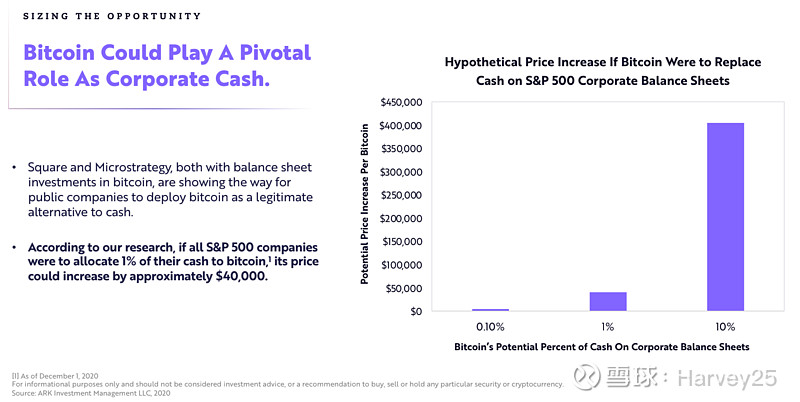

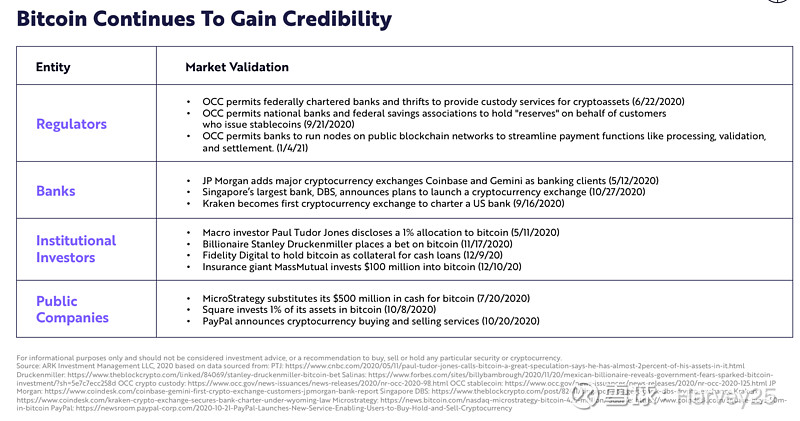

Bitcoin is digital gold, and there is a storage-risk function. It is easy to find that other currencies are not. There are no hackers blackmailing dog coins or Etheria. Other currencies are more valued at the value of use, such as Ether for Defi ecology, which can be rewarded with tips because of small amounts. So these currencies need constant technological upgrading. Sometimes things that are stable are good, such as 很多人会质疑比特币的技术性能,说新一代的加密货币技术上更好,比特币连智能合约都没有,交易也慢,手续费也很高。但是,如果能够认同比特币就是数字黄金,就可以想到黄金是性能最好的吗?不是。它重量也不轻,也不方便携带,硬度也不是最大,其实就是一块石头。但是为什么它被当初储值必备,因为社会共识就认为他有价值。同样比特币是第一个加密货币,安全性能已经得到了验证(没有人突破过这个算法),这个被共识的地位是无法修改的。 Many would question the technical skills of bitcoin, saying that the new generation of encrypted money is technically better, that bitcoin does not even have smart contracts, that transactions are slow, and that fees are high. But, if you can agree that bitcoin is digital gold, can you think of gold as the best performance? No. It's not too heavy, it's not easy to carry, it's not the most hard, it's a rock. 2.再说趋利: 2. Again, profiting: 如果一旦公众看到比特币上涨,都会想配置。比如散户想配置比特币ETF,机构也不得不推出相关产品,不然就流失客户。大家的需求就不只是避害了,而是转为了趋利,也就是贪婪需求。 If the public sees an increase in bitcoin, they want to configure it. For example, the diaspora wants to configure bitcoinETF, the agency has to launch the product or lose the customer. People’s needs are not just avoiding, but turning to profit, that is, greed. 目前的趋势是越来越多的机构开始配置比特币,比如特斯拉,推特,Square,MicroStrategy等等公司。还有很多投资机构推出比特币相关投资产品。 The current trend is that an increasing number of institutions are beginning to configure bitcoin, such as , 有一个理论叫做跨越裂谷,就是当一个新东西从早期使用者,跨越到了主流社会都接受之后,就会加速被接受。比如当年微信和米聊在打,然后张小龙推出一个摇一摇和身边的人,顿时跨越了裂谷,微信就被完全普及了。 One theory, called crossing the Rift Valley, is that when a new thing is accepted from an early user and from the mainstream society, it accelerates acceptance. For example, when micro-letters and rice are playing, Zhang Xiaolong rolls out a man who shakes and walks around, and then crosses the Rift Valley, the micro-letter is completely universal. 什么时候比特币到顶了呢?就是社会80%的人都接受的时候,剩余20%的人反正也不会买,他们是Laggards,就是完全不接受新东西的人。所以当身边的人都还在质疑比特币是泡沫的时候,说明还是可以买入的。但当大家都认同它的价值的时候,也就是该买的都买了,也就没有人接盘了,这时候价格就不会大幅上涨了。上涨都在多空对峙的时期,准确的说,是慢慢大家转变观念开始接受这个新东西的时期。 When the bitcoin comes to the top, when 80% of the population accepts it, the remaining 20% will not buy it anyway, they're Lagards, or people who do not accept new things at all. So when everyone around us questions that bitcoin is a bubble, it suggests that it can be bought. But when everyone agrees on its value, that is, when it's bought, no one will take it, and prices will not rise significantly. 3.再说说监管对比特币的影响: 3. Again, the impact of the regulation of bitcoin: 很多人觉得政府禁止挖矿,或者禁止交易所在本国设立,或者禁止用本国的银行/支付系统交易比特币,这样会打击到比特币的基本面。但是其实2008年以来,比特币已经收到了无数次监管,各部委不知道发了多少文,提示了多少风险。完全不影响其价格长期上涨。 Many feel that the government’s ban on mining, or the establishment of an exchange in the country, or on trading in bitcoin in its own banking/payment system would hit the basics of Bitcoin. But, since 2008, Bitcoin has received numerous regulations, and the ministries do not know how many letters have been sent, suggesting how much risk. 比特币天然有一个抗监管的属性,这也是去中心化的意义。 Bitcoin has a natural anti-regime attribute, which is also the point of decentralizing. 4.最后引用一下ARK基金的木头姐发布的Big Idea 2021中对比特币研究的数据,来佐证一下我的观点: 4. Finally, I quote from the data from the Big Idea 2021 study published by the ARK Foundation's wood sister, to support my point of view: 上图说明,长期持有者是越来越多的,黑色部分是持有五年以上的人。 As shown in the figure above, the number of long-term holders is increasing and the black part is held by persons older than five years. 上图说明,机构持仓越来越多,2020年底的行情主要来自机构。紫色是比特币价格这个关键词的搜索量,可以看到2020年价格上涨,但是搜索量没有大幅增加。因为1个机构投入1000万,搜索一次,但是散户要投入1000万,可能得1000个散户每个人投入1万,搜索1000次。所以搜索量低,一定程度反应散户参与度。 The figure above shows that there is a growing number of institutions, and that at the end of 2020, it is mainly from institutions. Purple is the key word for bitcoin prices, which shows a price increase in 2020, but the number of searches has not increased significantly. Because one agency invests 10 million, one search, but the bulk house invests 10 million, possibly 1,000 for each of them, searching 1,000 times. 假如S&P500的公司,将1%的现金转化成比特币,那么1个比特币的价格会上涨4万美元。如果10%呢,那就是40万美元。除了S&P500公司,还没考虑有很多银行 机构投资者 养老金基金等也想要配置比特币的。 If S&P500 converts 1 per cent of its cash into bitcoin, then the price of a bitcoin would increase by $40,000. If 10 per cent, it would be $400,000. Apart from S&P500, there are not many banks & nbsp; institutional investors & nbsp; pension funds, etc. that want to configure bitcoin. 原来越多的投资机构和银行还有公司开始接受比特币了支付了,虽然本人不认同比特币的价值在于流通支付。但本人18年用比特币买过披萨。最近的消息是小米在葡萄牙开始接受比特币支付。 The more investment agencies and banks and companies began to accept the payment of bitcoin, although I did not agree that bitcoin was worth it in circulation. But I bought pizza in bitcoin for 18 years. The most recent news is that began to accept the payment of bitcoin in Portugal. 总结:比特币可以持有,持有5-10年必有惊喜。 Summing up: Bitcoin can be held with surprises for 5-10 years.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论