作者:LucyCheng

This post is part of our special coverage Syria Protests 2011.

自比特币诞生以来,数字货币市场发展至今已达千亿美元的市值,同时领域内发行超过1700种数字货币。不过在价格随时都有可能剧烈波动,且各地政府监管态度不明朗的市场环境之下,部分地区投资者缺乏法币交易途径,投资者急需寻找替代稳定资产的解决方案来降低其持币风险。

Since the birth of Bitcoin, the digital currency market has developed to date at a value of hundreds of billions of dollars, with more than 1,700 digital currencies issued in the field. However, under a market environment where prices are likely to fluctuate sharply at any given time, and where governments are not well-regulated, investors in some parts lack the means to trade in French, and investors urgently need to find alternatives to stable assets in order to reduce their exposure to currency holdings.

而作为目前主流交易所的基础稳定数字货币,USDT已经成为投资者普遍的储值手段之一;其仅次于比特币的日均市场流通量及二十多亿美元的市值规模,让其他资产及从业者不禁觊觎,试图在这个供应量仅占全球市值1%份额的早期市场内抢占先机。

As a stable digital currency that is the basis of the current mainstream exchange, USDT has become one of the common storage instruments for investors; it is second only to the average daily market volume of Bitcoin and the size of the market value of over $2 billion, leaving other assets and practitioners in check and trying to take the lead in this early market, where supply represents only 1 per cent of the global market value.

在这种大背景下,稳定型加密货币开始增多,市场逐渐兴起。为了让大家更清晰的了解市场情况,哈希派(ID:hashpai)通过调查整理,梳理出现如今稳定币的币种及主要类型,并分析他们的特点。下面我们先从稳定币的概念开始,为大家详细道来。

In this broader context, stable encrypted currencies have begun to grow, and markets have gradually emerged. In order to provide a clearer picture of the market situation, ID: hashpai, through a survey, has sorted out the currency and the main types of currency that currently stabilizes the currency and analyses their characteristics.

稳定型加密货币(Stablecoins),实际上就是拥有相对稳定价值的数字货币;由于其底层技术基于区块链建立,让稳定币与其他加密货币一样具备不可篡改、可扩展及安全等等属性,能够在其他加密货币间充当交换媒介及记账单位。再加上其价格相对稳定的特点,投资者可以利用稳定币在投资过程中实现有效数字资产管理,从而减少资产大幅缩水的持币风险。

Stablecoins is actually digital currency with a relatively stable value; because its bottom-line technology is built on block chains that give stable currencies, like other encrypted currencies, irreproachable, scalable, and secure attributes, to act as a clearing medium and a unit of account among other encrypted currencies. Add to its relatively stable price characteristics, investors can use stable currencies to achieve effective digital asset management in the course of their investments, thereby reducing the risk of currency holding that assets are significantly shrunk.

另外除却金融属性,稳定币在区块链应用中也将起到重要作用。因为相较于比特币这类价格起伏不定且易被视为资产的加密货币,稳定币的市场流通性更高,有助于区块链应用内社区及通证经济模型的建立。

In addition to financial attributes, stabilizing the currency will also play an important role in the application of block chains. Because of the volatility of prices such as bitcoins and the ease with which they are treated as encoded currencies, stabilizing the currency’s market circulation is much more conducive to the application of intra-community and merciless economic models.

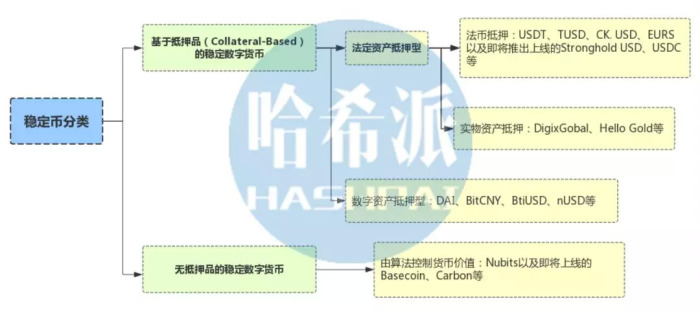

而为了实现币值水平的相对稳定,稳定币一般会与诸如黄金、法币等等具有稳定价值的资产直接挂钩;使其单位价格的货币代表着一定购买力。如果按照稳定币背后资产抵押类型来分类的话,我们可以将稳定币分为,与法定货币或数字资产等锚定的有资产抵押型,以及由算法控制的无资产抵押型两大类。

In order to achieve relative stability in the value of the currency, stable currencies are usually directly linked to assets of stable value, such as gold, French currency, etc. The currency of their unit price represents a certain purchasing power. If classified by the type of asset collateral behind a stable currency, we can divide stable currencies into two categories: asset-based mortgages, anchored with legal currency or digital assets, and asset-free collateral, controlled by algorithms.

原图来自:Cointelegraph

from: Cointelegraph

在基于资产或者说抵押品的稳定型数字货币中,与法定货币直接挂钩是最简单直接且较常出现的做法。这类稳定币背后有资产储备的支持,价值等比锚定货币,模式易懂流程直观,可确保用户所持币种能按比例兑换回法币。而这一类型中的代表,当属目前最为成功的USDT。

In stable digital currencies based on assets or collateral, a direct link to the legal currency is the simplest and more frequent practice. Behind such stable currencies is the support of asset reserves, such as the value of moored currencies, the mode of intuitiveness of the process ensures that the currency held by the user is proportionally re-convertible to the French currency.

①Tether公司发行的USDT

USDT issued by 1Tether

官网:https://tether.to/

Web site : https://other.to/

发行情况:2015年2月由注册地位于马恩岛及香港的Tether公司发行,是基于区块链及Omni Layer协议的加密货币

: was issued in February 2015 by Tether, both registered in the Isle of Man and Hong Kong, on the basis of the block chain and the encrypted currency of the Omni Layer Agreement

团队主要成员:首席执行官Jean-Louis van der Velde及首席战略官Philip Potter在交易平台Bitfinex上也担任相同职位

Key member of the

已上线平台:Bitfinex、Okex、Huobi、HitBTC、Bittrex、Kraken、Poloniex等四十多家交易所,其中近半数平台日交易量超过一亿美元

Online platform

流通情况:初始代币总量约为9万USDT,而后增发超八十次,截至目前为止共计发行约30亿枚,流通总量为24亿USDT;2018上半年日均交易量达22亿美元,环比增长300%

circulation : totals initial currencies of about 90,000 USDT and then more than 80 times more, with a total circulation of about 3 billion items and a total circulation of 2.4 billion USDT to date; the average volume of transactions amounted to $2.2 billion a day in the first half of 2018, with a ring increase of 300 per cent.

USDT即USD Tether,是领域内稳定币的先例,该数字货币与美元直接锚定,通过运营商Tether进行中心化1:1抵押发行。理论上来说,用户每购买一枚USDT代币,Tether公司的账户上将增加一美元的资金储备;相反用户需要兑换回美元时,相对应的代币会自动销毁,同时收取用户5%的手续费。

The USDT, USD Tether, is a precedent for currency stabilization in the field, which is directly anchored with the dollar, with a centralization of 1:1 mortgages through the operator Tether. Theoretically, Tether’s account will add a dollar to the fund reserve for each dollar purchased by the user; instead, when the user needs to convert back to the dollar, the corresponding coin will automatically be destroyed, with a charge of 5% of the user’s charge.

其最早是作为Bitfinex交易所的入金工具,随后迅速得到市场和各大交易所的接纳;如今已发展成为全球市值排名第九、日交易量第二的数字货币。不过顶着这些光环的同时,USDT还背负了不少骂名。首先是其高度中心化管理方式带来的暗箱操作、超发滥发、币价是否等值美元等等质疑,其次是部分银行账户被冻结所引起的市场信任危机,以及相关争议导致其价格波幅增大的现象等等。

This was first used as an entry tool for the Bitfinex exchange, which was quickly accepted by the market and major exchanges; it has now become the ninth and second-largest digital currency in the world’s market value. But, with these rings, the USDT carries a lot of curses.

不过在其他稳定币还未发展起来之前,USDT在该市场依旧会占据主导地位。另外值得一提的是,今年年初Tether还曾宣布,目前正在以太坊区块链上创建分别与欧元及日元挂钩的EURT和JPYT,并将与ERC20代币标准兼容。

However, USDT will continue to dominate the market until other stable currencies have developed. It is also worth mentioning that early this year Tether announced that EURT and JPYT, linked to the euro and yen, respectively, are being created on the Taiwan block chain and will be compatible with the ERC-20 standard.

②TrustToken平台创建的TrueUSD

TrueUSD created by 2TrustToken platform

官网:https://www.trusttoken.com/

Web site: https://www.trusttoken.com/

发行情况:2018年3月由位于加州斯坦福的初创公司TrustToken创建,是基于ERC20代币标准的数字货币。

Publication: was created in March 2018 by TrustToken, a start-up company based in Stanford, California, in digital currency based on the ERC-20 standard.

融资情况:2018年6月完成2000万美元的战略轮融资,投资方包括丹华资本、纪源资本、BlockTower以及硅谷知名风投Andreessen Horowitz、真格基金等

financing: 20 million US dollars in strategic rounds of financing completed in June 2018, with investments in Danhua Capital, Kiki Source Capital, BlockTower and Silicon Valley's famous Windshowresen Horowitz, Jinga Foundation, etc.

团队主要成员:Danny An,CEO,曾是人工智能公司Kernel的数据专家及在普华永道任职产品经理;Rafael Cosman,CTO,曾在谷歌及Kernel担任机器学习工程师

Key members of the

知名顾问:Ari Paul,对冲基金BlockTower的首席信息官;John Piotrowski,前高盛副主席;Bill Wolf,前高盛分析师常务董事

已上线平台:币安(占80%以上的交易量)、Bitso、Bittrex、CoinTiger、Cryptopia、HitBTC、IDEX、Koinex、Kuna、Kyber Network、Upbit以及ZebPay等印度交易所

Online platform: Currency Entries (over 80% of transactions), Bitso, Bittrex, CoinTiger, Cryptopia, HitBTC, IDEX, Koinex, Kuna, Kyber Network, Upbit and Zebpay Indian Exchanges

流通情况:2018年Q2日均交易量为814万美元,市值累积增长约783个百分点。

circulation: averaged $8.14 million per day for Q2 in 2018, with a cumulative increase of about 783 percentage points in market value.

TureUSD与USDT的发行模式相同,投资者可按照1:1的比例获取TUSD或赎回美元。但不同的是,TUSD的准备金情况更为透明,因为其引入了信托账户来管理美元资产,并承诺定期公布第三方会计事务所的审计报告及账户的美金存量;使TUSD具有法律保障,并保证完全美元储备和严格标准的KYC/AML验证。

TureUSD has the same distribution pattern as USDT, which allows investors to obtain TUSD or foreclosure at a ratio of 1:1. Unlikely, TUSD’s reserves are more transparent, as it introduces trust accounts to manage dollar assets and undertakes to publish periodically the audit reports of third-party accounting firms and the dollar stock of the accounts; and gives TUSD legal security and guarantees a full dollar reserve and a strict standard KYC/AML certification.

图片源自:blocktempo

Image by Blocktempo

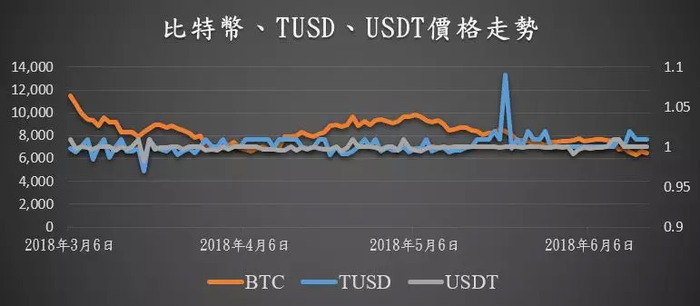

不过确保1:1的汇率及完全美元储备,不一定能完全保证TUSD价格的稳定性。今年3月正式交易以来,其价格波动率明显较USDT同期要高,而且TUSD曾在5月16日币安上线该币种交易那天,价格涨超1.3美元。虽然仅在半天时间TUSD这种与美元脱钩的现象就已缓解,而且之后其价格始终维持在一美元左右;但TUSD仍受到外界对其流动性的质疑。分析人士认为,由于TUSD追求独立托管,团队本身并没有充足资金储备和做市政策,在特殊情况时无法对市场情况作出及时反应及调节。

However, ensuring a 1:1 exchange rate and a full dollar reserve does not necessarily fully guarantee the stability of TUSD prices. Since the official transaction last March, its price volatility has been significantly higher than during the same period in the USDT, and TUSD increased its price by $1.3 on the day that the currency was put on line on 16 May.

另外值得注意的是,TUSD是基于以太坊智能合约的代币,除了与美元兑换时需要缴纳手续费之外,在以太坊钱包间互转时还需要收取ETH网络内的交易手续费。

It is also worth noting that TUSD is based on an ETH intelligent contract in which, in addition to a fee to be paid for the exchange with the United States dollar, transaction charges within the ETH network are charged for the exchange of ETH wallets.

③CK集团推出的CK.USD

CK.USD launched by the 3CK Group

相关网站:http://aboutck.com/ckfintech/ckusd.html

Web site: http://aboutck.com/ckfintech/ckusd.html

发行情况:2017年11月由加拿大上市公司Cascadia Blockchain Group的全资控股公司CKFintech Crop.推出,是基于金融公链CNET建立的数字货币

: Launched in November 2017 by CKFintech Crop. Canada's listed company, Cascadia Blockchai Group, and based on the digital currency created by the financial public chain CNET.

公司情况:CK Fintech Corp.于2016年4月在加拿大金融交易与报告分析中心注册,并获得金融服务上牌照

Company: CK Fintech Corp. Registered in April 2016 at the Canadian Financial Transactions and Reports Analysis Centre and obtained a licence plate for financial services

团队主要成员:Rachel Wang,CEO,拥有十年国际财富管理及商业战略经验,在加拿大温莎大学获国际会计及金融专业MBA学位;Robin Guo,COO,元宝币联合创始人;TilektesAdambekov,亚欧地区代表,曾在温德姆酒店集团、华为等工作

Key members of the

合作伙伴:Nebulas、Aelf、QTUM、红岩资本、天风证券、BITCapital、FIBIGCapital、钢牛集团、亚洲区块链基金等等

Partners: Nebulas, Aelf, QTUM, Red Rock Capital, Skywind Securities, BITCapital, FIBIGCapital, Steel Cow Group, Asian Block Chain Fund, etc.

已上线平台:同样隶属于Cascadia Blockchain Group的温哥华数字货币交易所Allcoin和BCEX,两者日均交易量位列全球前五十名内

Online platform: is also affiliated with the Vancouver Digital Currency Exchange, Allcoin and BCEX, both of which are among the top 50 daily traders in the world.

流通情况:2018年Q2日均交易量为1.26亿美元;但CK USD的流通货币量及市值方面的内容未详

circulation: had an average volume of transactions of $126 million per day in 2018; however, the amount of currency in circulation and the market value of CK USDD is not detailed

根据CK Fintech Crop.的说法,CK. USD是用于该公司体系内遵循KYC/AML交易所及金融机构间的资金清算工具,与美元锚定。小额兑换需求可从CK旗下交易所AllCoin及BCEX以市场价格购买使用,或者在场外交易平台OTC 789进行买卖;而CK Fintech Crop.只接受20万CK. USD的个人及机构购买申请。

According to CK Fintech Crop, CK. USD is a financial clearing tool used in the company’s system to follow the KYC/AML exchange and the financial institutions, and is anchored in the United States dollar. Small exchange requirements can be purchased from AllCoin and BCEX under the CK-based exchange for use at market prices, or from the off-site trading platform OTC 789; and CK Fintech Crop. accepts only 200,000 CK.USD’s individual and institutional purchase applications.

虽然官方表示会严格进行资金审计,并承诺及时公布销售和回购准备金的保有量;但截至目前为止,CK. USD的实际总流通量仍未知。另外就像其声明所说,公司不会在各个市场进行微观的买入卖出行为;为此CK USD价格波动较USDT和TUSD大,自上线以来一直在0.91到1.03美元间徘徊。

Although the official has indicated that financial audits will be strictly conducted and that the retention of sales and repurchase reserves will be announced in a timely manner, the actual total circulation of CK. USDD has not been known to date. Moreover, as stated in its statement, companies will not engage in micro-purchase sales in various markets; for this reason, the CK USD price volatility is larger than the USDT and TUSD, and has hovered between $0.91 and $1.03 since it came online.

④STASIS平台创建的EURS

EURS created by 4STASIS platform

相关网站:https://stasis.net/

发行情况:2018年7月由马耳他金融代币平台STASIS创建,是基于以太坊EIP-20标准且锚定欧元的数字代币

Publication: was created in July 2018 by STASIS, the Maltese financial token platform, on the basis of a digital token based on the EIP-20 standard and anchored in the euro

公司情况:STASIS母公司EXANTE于2012年发行全球首个比特币对冲基金,并积极与马耳他政府展开关于加密货币合规框架的工作。该公司去年获得超过5000万美元的融资;而STASIS则是去年成立的专注于金融产品代币化并进行交易流通的平台

STASIS's parent company, EXANTE, launched its first global bitcoin hedge fund in 2012 and actively worked with the Maltese government on an encrypt currency compliance framework. The company received more than $50 million in financing last year; STASIS was the platform established last year to focus on the monetization and circulation of financial products.

团队主要成员:Gregory Klumov,CEO,曾在美国对冲基金Kerrisdale Capital Management LLC、闪存存储领域先驱Violin Memory等多家公司担任投资者;Vyacheslav Kim,CFO,曾在俄罗斯投行RB Partners担任企业管理及并购主管

Principal member of the

已上线平台:伦敦交易所DSX以及欧洲比特币领先比特币交易平台HitBTC,其中88%以上的交易量集中在HitBTC平台

流通情况:自推出以来日均交易量为2.8万美元;资料显示,EURS当前总供给量为1229万枚,但实际流通量未详

circulation:

STASIS EURS(EURS)的发行及管理模式与TUSD相似,以欧元1:1抵押发行,储备金余额经四大会计事务所之一毕马威验证及公布;同时采取最为严格的三级资产验证流程、按周核实,为用户财产提供高规格及持续的透明度,而且能较好地符合欧洲例行的监管和风控要求。 STASIS EURS (EURS) is issued and managed in a manner similar to TUSD and issued on a Euro1:1 collateral basis, with reserve balances validated and published by KPMG, one of the four General Assembly accounting offices; it is accompanied by the strictest three-level asset validation process, weekly verification, high specifications and continuous transparency of user property, and is better aligned with European routine regulatory and wind control requirements. 按照STASIS声明的说法,该公司平台开始接受兑换后一周收到超一亿美元的申请,并获得首个机构用户。但目前EURS的市场流通量及交易对相对较少,仅有与比特币、以太坊、USDT及DAI四个币种的交易对;而且绝大部分的交易量集中在HitBTC平台内与USDT和DAI两种稳定币的交易对上。 According to the STASIS statement, the company’s platform began to receive more than $100 million in applications and first institutional users a week after the exchange. However, the current market volume and transactions in EURS are relatively small, with only four currencies: Bitcoin, Etheria, USDT, and DAI; and the vast majority of transactions are concentrated within the HitBT platform against two stable currencies: USDT and DAI. ⑤Stronghold公司计划推出的Stronghold USD Stronghold USD, planned for launch by Stronghold. 相关网站:https://stronghold.co/stronghold-usd/ 发行情况:2018年7月17日由美国金融服务初创公司Stronghold与科技巨头IBM合作推出,是建立在Stellar网络的数字代币。 : Launched on 17 July 2018 by Strongold, the United States financial services start-up company, in collaboration with the technology giant IBM, is a digital token based on the Stellar network. 融资情况:2018年7月12日完成330万美元的种子轮融资,投资方包括天使基金投资人Rick Marini、比特币基金会董事会成员Vinny Lingham、Hack VC等 Financing: US$ 3.3 million in seed rotations was completed on 12 July 2018 by investors such as Rick Marini, an angel fund investor, Vinny Lingham, Hack VC, etc., member of the Board of Directors of the Bitcoin Foundation 上线情况:Stronghold USD 8月10日下午已完成账户验证 Upline : Strongold USDD completed account validation on 10 August afternoon Stronghold USD将按照1:1比例与美元挂钩,储备金由总部位于拉斯维加斯的资产管理公司Prime Trust托管,同时拥有美国联邦存款保险公司的美元支持。 Strongold USDD will be pegged to the United States dollar on a scale of 1:1 and the reserve will be held by Prime Trust, an asset management company based in Las Vegas, with United States dollar support from the United States Federal Deposit Insurance Corporation. 其战略合作伙伴IBM表示,将利用Stronghold USD进行试验性实验,帮助银行以及其他金融机构更快、更安全的处理支付业务。为此目前来说,该稳定币主要面向金融机构、跨国及资产管理公司等企业级用户,个人投资者通道或许会在未来开放。 Its strategic partner, IBM, has indicated that it will use Strongold USD as a pilot to help banks and other financial institutions to process payments faster and more securely. To this end, the stable currency is currently primarily for business-level users, such as financial institutions, multinationals, and asset management companies, and individual investor access may open in the future. ⑥Circle公司计划发行的USD Coin USD Coin, planned for release by 6Circle 相关网站:https://blog.circle.com/2018/05/15/circle-announces-usd-coin-bitmain-partnership-and-new-strategic-financing/

发行情况:2018年5月16日总部位于波士顿的比特币初创公司Cricle宣布,将与比特大陆合作推出的基于CENTRE开发的数字货币

: On 16 May 2018, , Crickle, a Boston-based start-up company in Bitcoin, announced that the digital currency based on CENTRE would be launched in cooperation with Bitcontinent

公司情况:Circle Internet Financial ltd.于2013年建立,是一家数字货币产品开发公司;拥有700万用户,今年年初还完成对美国交易平台Poloniex的收购

case: Circle Internet Financial Ltd., established in 2013 as a digital money product development company; 7 million users and completed the acquisition of Polonix, the United States trading platform, early this year

融资情况:2018年5月完成由比特大陆领投的1.1亿美元E轮融资;另外前几轮则融得1.36亿美元,资方包括IDG Capital、高盛及Breyer Capital

团队主要成员:Naeem Ishaq,CFO,前移动支付公司Square高管 Main member of the 上线情况:考虑将USDC整合到其支付应用程序以及Circle Trade,但具体上线时间及对个人与机构用户的相关限制现在还未知 根据当前公布的资料显示,USDC强调交易合规性,并将与符合条件的机构展开合作;从而让USDC能够完全在美国法律法规体系之下,受CENTRE网络各项规定制约而运行。另外USDC采用Full Reserve模式,即托管储备金与美元金额相对应,保证不超发且美元提现。 According to the information currently published, the USDC emphasizes transaction compliance and will work with eligible institutions; thus enabling the USDC to operate exclusively under the United States legal and regulatory system and subject to the provisions of the CENTRE network. In addition, the USDC uses the Full Reserve model, in which the Trust Fund corresponds to the dollar amount, to ensure that it is not over-exceededed and to raise the dollar. 而除了锚定法币之外,法定资产抵押型稳定币中还有与黄金等保值资产挂钩的币种。其中最具代表性的是伦敦金银市场协会认证的以太坊资产平台DigixGobal以及黄金产品初创公司Hello Gold创建的代币。 In addition to moorings, the statutory asset-backed stable currency includes currencies linked to the value-added assets of gold. The most representative of these are the coins created by DigixGobal, an Etherms assets platform certified by the Gold and Gold Markets Association in London, and Hello Gold, a start-up company for gold products. 这些项目大多处于早期发展阶段,当前用户和市场关注度不高,链上交易流通性小;像DigixGobal创建的与1g黄金挂钩的DGX,市值及日交易量只达百万美元级别,而HelloGold的代币HGT的日均交易量则为一万美元以下 。不过相较于流通使用,这种锚定黄金等等保值大宗产品的稳定币种更倾向于作为资产对冲风险和保存储值。 Most of these projects are at an early stage of development, with low user and market attention and low turnover on the chain; DGX, created by DigixGobal and linked to 1g gold, has a market value and daily volume of transactions of millions of United States dollars, while HelloGold’s token HGT deals on average below $10,000 per day. But this anchored gold, among other things, is a stable currency that tends to be more asset hedge risk and storage value than is used in circulation. 另一种基于抵押品的稳定币,则是采用加密货币作为担保品的数字货币。这类币种不需要用户信任银行或者某家公司,因为作为担保品的加密货币储备金可在链上查看及验证。从某种意义上来说,其背后的逻辑与房产贷款抵押相似,用户将房产(加密货币)抵押从而获得现金(稳定币)。当房产升值的时候,用户可以申请更多的贷款;当房产贬值时,银行会催促用户还贷。如果无法偿还,房产将被收走以降低银行的损失。 Another stable currency based on collateral is the use of encrypted currency as a digital currency for collateral. Such currency does not require a user to trust a bank or a company, because an encrypted currency reserve as collateral can be viewed and validated on the chain. In a sense, the logic behind it is similar to that of a mortgage on a real estate, whereby the user mortgages the property (encrypted currency) to obtain cash (stable currency). When the property is appreciated, the user can apply for more loans; when the property devalues, the bank urges the user to repay the loan. If it cannot be repaid, the property will be taken away to reduce the bank’s losses. 原图来自:Cointelegraph from: Cointelegraph 本质来说,就是在币值波动性较高的加密货币基础上,通过超额抵押等模式试图构建价格相对稳定的数字货币,从而促进交易。而基于数字资产稳定币种中,最典型的例子就是MakerDAO在以太坊上发行的DAI。 Essentially, it is an attempt to build digital currencies with relatively stable prices, such as over-collateralization, based on encrypted currencies with high currency volatility. The typical example of digital asset-based currency stabilization is the DAI issued by MakerDAO in Ether. ①MakerDAO创建的DAI DAI created by 1makerDAO 官网:https://makerdao.com/ 发行情况:2017年12月由北欧公司MakerDAO发行,是价格对标美元的ERC-20标准数字货币 : issued in December 2017 by the Nordic company MakerDAO, the standard ERC-20 digital currency price against the United States dollar 融资情况:MakerDAO去年12月获得由安德森 霍洛维茨基金领投,Wyre Capital、Walden Bridge Capital等跟投的1200万美元融资 Finance: MakerDAO received $12 million in financing last December from the Anderson Holowitz Foundation, with Wyre Capital, Walden Bridge Capital and others 已上线平台:HitBTC、Gate.io、YoBit、OasisDEX等十多个交易平台上线,不过一半以上的交易量集中在MakerDAO旗下去中心化交易平台OasisDEX内 Online platform: HitBTC, Gate.io, Yobit, OasisDEX, etc. online, but more than half of the volume of transactions is concentrated in the MakerDAO centralized trading platform OasisDEX 流通情况:当前流通量为4693万DAI,较年初增长12倍;而2018年Q2日均交易量为3880万美元,环比增长1.78倍 circulation: currently has 4.6993 million DAIs, a 12-fold increase from the beginning of the year; the average Q2-day turnover was $38.8 million in 2018, a 1.78-fold increase in the ring. DAI的目标是成为与美元保持稳定1:1兑换关系的数字货币,用户可通过MakerDAO在以太坊上创建的智能合约平台,抵押其他加密货币来换取相应数量的DAI。不过为了保持DAI价格水平的相对稳定,系统采用超额抵押机制,即以N倍的抵押物换取DAI,从而吸收抵押数字资产本身价格波动带来的风险。 The DAI’s goal is to be a digital currency with a stable 1:1-exchange relationship with the United States dollar, and users can use the smart contract platform created by MakerDAO in the Taiku to encumber other encrypted currencies in exchange for the corresponding amount of DAI. However, in order to maintain relative stability in the DAI’s price levels, the system uses over-collateral mechanisms, i.e. to exchange N-fold collateral for DAI, thereby absorbing the risks associated with price fluctuations in the mortgaged digital assets themselves. 除了超额抵押机制之外,Maker平台还采用包含抵押物变现、套利机制、目标价格变化反馈机制、应急全局清算在内的多层机制来保持DAI价格与美元的相对稳定。简单来说,当抵押的数字货币价格上涨时,Maker平台的看护机 (Keeper)通过对DAI的买卖获得利润,并借此保持DAI价格的稳定。而当抵押品价格波动超过一定幅度时,系统其它机制无法稳定DAI价格时,应急全局清算模式会启动,将DAI回收并向用户返还抵押数字货币,从而在最大程度上暴涨持币者利益。 In addition to the over-collateralization mechanism, the Maker platform uses multiple layers of mechanisms, including collateral realization, arbitrage, target price change feedback mechanisms, and emergency global liquidation, to maintain relative stability between DAI prices and the dollar. In short, when mortgage digital currency prices rise, the Keeper of the Maker platform earns profits from trading in DAI, thereby maintaining stability in DAI prices. 现阶段DAI仅接受ETH作为抵押资产,接下来6个月或以上时间里,团队将考虑接受更多的数字资产作为抵押品。所以说,目前DAI的稳定性很大程度上取决于ETH币值。而鉴于其超过300%的超额抵押率,DAI在保持价格稳定方面相对成功;但在如此高的抵押率之下,愿意为获得价格稳定的DAI而付出三倍抵押资金的用户不多;从长远来看,这无疑会对DAI的市场流通带来一定限制。 At this stage, DAI only accepts ETH as collateral, and over the next six months or more, the team will consider accepting more digital assets as collateral. So, the stability of DAI now depends largely on the value of ETH. ②以BTS为抵押品的BitCNY以及BitUSD 2 BitCNY and BitUSD with BTS as collateral 官网:http://cryptofresh.com/a/CNY; https://openledger.io/?r=by24seven#/market/USD_BTS 发行情况:2014年由BitShares团队发行,通过BTS抵押发行的数字货币 Publication: Digital Currency Issued via BTS Mortgage, by BitShares Team, 2014 已上线平台:BitShares Asset Exchange、OpenLedger DEX都已上线BitCNY以及BitUSD,而CoinTiger则添加了对BitCNY的支持;BitCNY、BitUSD两者超60%的交易量集中在BitShares Asset Exchange 流通情况:BitCNY当前流通量为1.36亿BitCNY,2018上半年日均交易量为2687万美元,环比增长351%;BitUSD当前流通量为1064万BitUSD,2018上半年日均交易量为251万美元,环比增长130% : bitCNY currently has a circulation of 136 million BitCNY, with an average daily turnover of $26.87 million in the first half of 2018, an increase of 351 per cent in the ring; BitUSD currently has a circulation of 10.64 million BitUSD, an average of $2.51 million in the first half of 2018, an increase of 130 per cent in the ring. BitCNY以及BitUSD的原理与DAI类似,每枚BitCNY、BItUSD背后均有用户以至少两倍价值抵押的BTS,而为了让两者与人民币及美元锚定,BTS系统通过智能合约设定的强制平仓及强制清算机制来维持其价格稳定。 BitCNY and BitUSD principles are similar to those of the DAI, each of which has a BTS with a user mortgage of at least twice the value, while the BTS system maintains its price stability by means of a mandatory silo and a mandatory liquidation mechanism under a smart contract to anchor both with the renminbi and the United States dollar. 不过受到比特股价格剧烈波动的影响,BitCNY、BitUSD上线早期曾出现持续清算而爆仓的现象;直到后来BTS价格波动性下降,其价格才相对稳定,交易量逐渐提高。另外如上所说,想要降低BitCNY、BitUSD的持币风险需要设置更高的抵押倍数,而愿意以高倍数抵押获取稳定币的投资者不多,导致网络内供应量难以提高,无法应对大规模的应用。 However, as a result of sharp price fluctuations in bit shares, BitCNY and BitUSD were exposed in the early days to continued liquidation; their prices were relatively stable until then when BTS prices became less volatile, and the volume of transactions gradually increased. And, as noted above, trying to reduce the currency risk of BitCNY and BitUSD requires higher collateral multiples, while few investors are willing to obtain a stable currency with a high multiple mortgage, making it difficult to increase supply in the network to cope with large-scale applications. ③Havven创建的nUSD 3Havven created nUSD 官网:https://havven.io/ Web site: https://havven.io/ 发行情况:2018年7月由位于澳大利亚的区块链初创公司Havven推出,通过其旗下加密货币Havven抵押发行的数字货币 Publication: Launched in July 2018 by Havven, Australia-based block chain starter, with digital currency issued through its encrypted currency Havven mortgage 公司情况:Havven于2017年建立,已于去年末及今年五月先后完成共3030万美元的融资,投资方包括Block Tower、GBIC、Youbi等 Status of 知名顾问:以太坊基金的安全工程师Matthew di Ferrante;doc.ai创始人兼前剑桥大学驻场企业家Walter de Brouwer 流通情况:目前仅在KuCoin平台上线,流通量为115万美元,日均交易量为10万美元以下 circulation: currently online only on KuCoin platform, with circulation of $1.15 million and average daily transactions of less than $100,000 nUSD是去中心化支付网络Havven推出的首Nomins(Havven系统内的稳定数字货币),价格对标美元,基于以太坊区块链而建立;今年年底也将在EOS网络上发布。此外根据Havven的规划,年底该平台还将发布多种与全球货币挂钩的Nomins,比如nEUR、nAUD、nYEN、nKRW。 NUSD is the first Nomins (the stable digital currency in the Havven system) launched by the decentralised payment network Havven, which is price-to-dollar based on the Taiwan block chain; it will also be posted on the EOS network by the end of this year. In addition, the platform is expected to publish, by the end of the year, a number of Nomins linked to global currencies, such as neur, nAUD, nYEN, nKRW. Havven利用双代币机制来打造稳定币种,其Nomins采用Havven作为担保,冻结后者可作为Nomins发行的抵押。Nomins稳定性由Havven团队对市场供应量直接干预以及固定价格赎回抵押品机制来维持。不过就目前来看,其发行一个月以来出现五次左右较大幅度的价格波动;另外有半数交易量集中在与USDT的交易对上。 Havven uses a two-generation currency mechanism to create a stable currency, and its Nomins uses the Havven as collateral to freeze the latter as collateral issued by Nomins. Nomins stability is maintained by the Havven team’s direct intervention in market supply and a fixed price foreclosure mechanism. ④准备上线的以Alchemint Standards为抵押品的稳定币 A steady currency with Alchemint Standards as collateral. 官网:http://alchemint.io/#/home 发行情况:将基于Alchemint Standards(SDS)发行且价格对标法定货币的NEO系数字货币 Release: The NEO is a digital currency issued on the basis of Alchemint Standards (SDS) and priced against the legal tender 融资情况:Alchemint团队今年六月通过ICO募得1600万美元,此外还获得NEO Gobal Capital、科银资本、分布式资本、BK Fund、千方基金等的投资 financing: 16 million dollars raised by the Alchemint team through ICO in June of this year, in addition to investments in NEO Global Capital, Treasury Capital, Distributed Capital, BK Fund, thousands of funds, etc. 形象来说,Alchemint即将推出的稳定币就是Havven与MakerDAO两个项目的融合,使用双代币机制,让用户超额抵押其发行的数字资产来换取稳定币;设定强制平仓与清算等机制,并通过调整目标价格变化率来维持价格的相对稳定。 In an image, Alchemint is about to launch a stable currency that integrates the two projects Havven and MakerDAO, using a two-generational mechanism whereby users over-collateralize their issued digital assets in exchange for a stable currency; establishing mechanisms such as mandatory siloing and liquidation; and maintaining relative price stability by adjusting the target price rate of change. 无抵押型数字货币,顾名思义就是无须任何抵押的稳定币;其智能合约被编程为类储备银行,由算法来控制流通权利,决定发行和销毁货币的数量及时间,使其价值尽可能地贴近挂钩资产的价值。 A non-collateral digital currency is, by definition, a stable currency without any collateral; its smart contract is programmed as a reserve bank, with algorithms controlling the right to circulation, deciding on the amount and time of the currency to be issued and destroyed, and bringing its value as close as possible to the value of the linked asset. 原图来自:Cointelegraph from: Cointelegraph 2014年由PeerCoin社区开发、领域内首个实现价格稳定的数字货币——Nubits就属于这一类型;不过2018年3月开始Nubits与美元严重脱锚,目前价格已跌至0.4美元以下。而随后出现的Basis、Carbon目前还未发行。 The first digital currency developed by the PeerCoin community in 2014 to achieve price stability & mdash; — Nubits are in this category; however, Nubits, which began in March 2018, has been severely disconnected from the United States dollar and now prices have fallen below US$ 0.4. The ensuing Basis, Carbon, has not yet been issued. ①最终将与CPI挂钩的Basis(上线时间未定) 1 Basis, which will eventually be linked to the CPI (upline time not fixed) 官网:https://www.basis.io/ Web site: https://www.basis.io/ 融资情况:2018年4月参与Basis开发的区块链创业公司Intangible Labs通过期货通证简明协议(SAFT)从225位投资手中筹得1.25亿美元;另外去年10月Basis还获得来自BainCapital、Stanley Drunckenmiller、DCG、真格基金等的投资 Financing: Intangile Labs, a block chain business company involved in the development of Basics in April 2018, raised $125 million from 225 investments through the Concise Futures Pass (SAFT) agreement; Basis also received investments from BainCapital, Stanley Drunckenmiller, DCG, Jinga Foundation, etc. in October of last year 团队主要成员:首席执行官Nader Al-Naji、联合创始人Lawrence Diao以及Josh Chen曾在谷歌、全球投资和技术发展企业D. E. Shaw任职软件工程师 Key members of the 知名顾问:胡佛研究所高级研究院兼前美国财政部国际事务副部长John B. Taylor;AngelList和CoinList创始人Naval Ravikant 最早的算法银行构思来自于RobertSams于2014年提出的Seignorage Shares,其基本设计思路是通过对代币供应量的弹性控制来保证法币价值。简单来说,系统将设计稳定币及股份两种代币。当稳定币价格高于锚定价格时,系统自动增发以降低价格;反之则将股份拍卖,并将所融资金回购稳定币,从而抬高币价。 The earliest algorithms were conceived from Seignorage Shares, introduced by Robert Sams in 2014, whose basic idea was to guarantee French currency value through flexible control over the supply of tokens. In simple terms, the system would be designed to stabilize both the currency and the shares. When the price of the currency is stabilized above the price of anchor, the system automatically increases to lower the price; on the contrary, the shares are auctioned and the money financed is bought back to stabilize the currency, thus raising the price of the currency. 而Basis则在Seignorage Shares基础上进行改进,在回购及增发环节引入债券;将增发过程产生的代币优先分配给债券持有者,同时支付利益。另外为了避免系统因通货紧缩而陷入死亡螺旋,Basis还设计了偿还期限;即设定时间过后,项目将不履行偿还责任。根据项目白皮书的描述,Basis短期内将锚定美元价格,不过最终价值会与持有者使用数字货币购买商品或服务的消费价格指数(CPI)挂钩。 Basis, on the other hand, has improved on the basis of Seignorage Shares by introducing bonds into the buy-back and upscaling chain; giving priority to bondholders, along with paying benefits, to the currency generated by the surge process. In addition, in order to avoid the death spiral of the system as a result of deflation, Basis has designed a repayment period; that is, the project will not be liable for repayment after the time has been set. According to the project's White Paper, Basis will, in the short term, set a fixed dollar price, although the final value will be linked to the consumer price index (CPI) used by the holder to purchase goods or services in digital currency. ②最终将与CPI挂钩的Carbon(上线时间未定) 2 Carbon, which will eventually be linked to the CPI. 官网:https://www.carbon.money/ Web site: https://www.carbon.money/ 融资情况:2018年4月完成200万美元的种子轮融资,投资方包括General Catalyst、Digital Currency Group、FirstMark Capital、Plug and Play Ventures等 Financing: $2 million in seed rotation financing completed in April 2018 by investors such as General Catalist, Digital Crime Group, First Mark Capital, Plug and PlayVentures 团队主要成员:联合创始人Connor Lin曾在ConsenSys任职;首席营销官David Segura曾投资稳定币项目Basis Key member of the Carbon创始人表示,该项目是从美联储目前采用的机制启发而来的,不过这种机制将通过去中心化的方式实现。在Carbon系统中,将产生Carbon stablecoin和Carbon Credits两种代币;前者的价格将始终维持在一美元,并在流通过程中根据其波动状况来调整需求。 The founder of Carbon said that the project had been inspired by the current mechanism used by the Fed, but that it would be achieved through decentralisation. In the Carbon system, two indents would be generated, Carbon Standardcoin and Carbon Credit; the former would remain at a price of one dollar and adjust demand in the course of circulation to its fluctuations. 具体来说,在算法控制下,当Carbon stablecoin价格低于1美元时,系统会举行排名,而愿意放弃稳定币的用户将能兑换Carbon Credits;而价格上涨需要增发时,新创造出的稳定币将提供给Carbon Credits持有者。 Specifically, under algorithmic control, when the price of Carbon Stablecoin is less than $1, users of the system who are willing to give up the stable currency will be able to convert into Carbon Credits; and when price increases require an increase, the newly created stable currency will be provided to the holder of Carbon Credits. 稳定币不止USDT,但目前USDT市值约等于整个市场 stabilizes more than USDT, but the market value of USDT is now roughly equal to the market as a whole 步入2018年以来,在熊市及市场监管未定的阴霾之下,稳定币越来越受市场关注,推出的相关新项目及大型机构入场者也开始增多。不过在无资产抵押型稳定币还未证明其可行性之前,加密货币抵押型稳定币使用范围仍难以扩大的当下;直接与法货挂钩的数字货币仍旧是市场较常选择的稳定币解决方案。 Since 2018, under the shadow of uncertain regulation of the bear market and the market, stabilizing currencies has become increasingly market-oriented, and new projects and large-scale institutions have begun to grow. But the use of encoded currency-stabilized currencies remains difficult to expand until the viability of asset-free stabilizers has been demonstrated; digital currencies directly linked to French are still the more commonly chosen stable currency solution in the market. 而在TUSD、EURS等法定资产抵押型稳定币才刚上线不久的大背景下,即使黑料被连连爆出,USDT在市场上依旧会占据主导地位;毕竟现阶段USDT的支持场景最多、流通量最大,当然价格波动率也是最小的。 In the larger context of legal asset-backed stabilizers such as TUSD, EURS and others, even if black material were to explode, the USDT would still dominate the market; after all, at this stage, the USDT has the most supporting scene, the largest circulation and, of course, the smallest price volatility.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论