比特币什么价格购入合适?很多投资者在比特币BTC价格低于7万美元的时候买入,这是为什么呢?目前比特币是加密货币市场上知名度最高的一款,并且在未来发展趋势中有望长期突破7万美元,接下来小编就带来详细的比特币BTC买入时机的介绍以及投资者为什么喜欢宅低于7万美元的时候买入介绍。

Why is it that many investors buy at BTC prices below $70,000? The bitcoin is now the most well-known item in the crypto-currency market and is expected to make a long-term breakthrough of $70,000 in the future, followed by a detailed introduction by the editor-in-chief to the timing of BTC purchases and why investors prefer houses below $70,000.

BTC价格低于7万美元买入的4个原因:

4 reasons BTC prices are below $70,000:

根据TradingView 的数据,5 月 20 日,比特币升至 71,401 美元的六周高点,这是自 4 月 9 日以来的最高水平。

According to TradingView, on May 20, Bitcoin rose to a six-week high of $71,401, the highest level since April 9.

随着比特币恢复到 70,000 美元的心理关口之上,资金费率也开始上升。Coinglass的数据显示,比特币BTC的资金费率升至 0.0187%,为 4 月 9 日以来的最高水平,这表明大多数交易者都在做多 BTC。

As Bitcoin recovered above the $70,000 psychological threshold, the funding rate started to rise. Coinglass data show that the BTC funding rate rose to 0.0187 per cent, the highest level since April 9, indicating that most traders are doing more BTC.

本质上,正的资金费率表明持有比特币BTC多头头寸的交易者(买家)倾向于使用杠杆。

In essence, positive funding rates indicate a preference for leverage by traders (buyers) holding multi-position positions in Bitcoin BTC.

在比特币BTC涨至 70,000 美元之前,过去一个月的融资利率一直保持在 0.01% 以下,这表明比特币BTC买家变得更加自信。

Until the BTC in Bitcoin rose to $70,000, the financing interest rate for the past month had remained below 0.01 per cent, indicating that the BTC buyers in Bitcoin had become more confident.

四小时比特币BTC图表最近出现了反向头肩形态,这增强了投资者的信心,交易者利用该形态来识别从看跌到看涨的趋势反转。

The four-hour Bitcoin BTC chart has recently seen an inverse shoulder-to-back pattern, which enhances investor confidence and is used by traders to recognize the reversal of the downward trend from the point of view to the point of view.

受欢迎的加密货币分析师 Moustache在 5 月 21 日的一篇文章中写道,比特币BTC的反向头肩形态可能预示着更多的上涨动力:“我昨天告诉过你,我们看到了 $BTC 的一根大绿蜡烛。我希望你在听?倒头肩形态永远不会消失。山寨币将紧随其后。”

The popular encrypt currency analyst Moustache wrote in an article on May 21 that the reverse shoulder shape of Bitcoin's BTC might be a portent for more upwards: “ I told you yesterday that we saw a big green candle of $BTC. I hope you're listening. The upside shoulder form will never disappear.

分形是指在多个时间范围和图表上重复出现的技术图表模式,无论交易者将标的资产的价格走势缩小到什么程度。

The fractal refers to a pattern of technical charts that is repeated on multiple time frames and charts, regardless of the extent to which the dealer has reduced the price trend of the targeted asset.

从分形分析的角度来看,比特币BTC当前在周线图上的反弹看起来与 2021 年 11 月的反弹相似,当时 BTC 从 7 月份的 31,000 美元上涨至 11 月份的 69,000 美元。

From the point of view of fractal analysis, the current rebound of Bitcoin BTC on the bilineal map appears to be similar to that of November 2021, when BTC rose from $31,000 in July to $69,000 in November.

如果图表模式重复出现,比特币BTC在未来几周可能会有更大的上涨势头。

If chart patterns are repeated, Bitcoin BTC may have a greater upward trend in the coming weeks.

此外,根据受欢迎的加密货币分析师 Jelle 的说法,比特币BTC的价格轨迹也与 2017 年牛市相似,他在 5 月 21 日的帖子中写给他的 81,000 多名粉丝:“比特币BTC继续遵循与 2017 年牛市相同的路线。前一个周期高点周围空气动荡 – 但一旦我们清除这个障碍,一切就会顺利。”

In addition, according to the popular encrypted currency analyst Jelle, the price trajectory of Bitcoin BTC is similar to that of the 2017 cow market, with more than 81,000 fans written to him in his post on May 21: “ Bitcoin BTC continuing to follow the same route as the 2017 cow market. Air turmoil around the previous cycle heights & ndash; but once we clear this barrier, everything will go well.

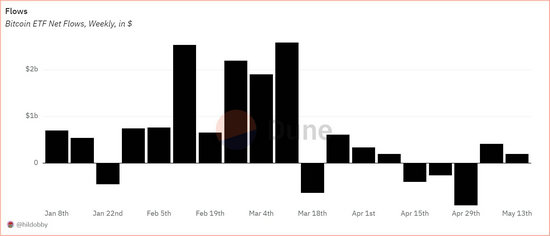

此外,美国现货比特币BTC交易所交易基金(ETF)的机构资金在经历三周净负流出后,连续两周出现正流入。

In addition, the United States spot currency BTC Exchange Trading Fund (ETF) recorded a positive inflow for two consecutive weeks after a three-week net negative outflow.

根据 Dune 的数据,美国比特币BTC ETF在上周积累了价值超过 2 亿美元的比特币BTC,在 5 月 6 日当周积累了价值超过 4.13 亿美元的比特币BTC。

According to Dune, BTC ETF in Bitcoin accumulated over $200 billion in BTC in the last week and over $413 million in BTC in the week of May 6.

根据 Farside Investors 的数据,5 月 20 日,比特币BTC ETF 出现价值超过 2.35 亿美元的正流入,超过前一周的净流入。

According to Farside Investments, on May 20, Bitcoin BTC ETF recorded a positive inflow of more than $235 million, exceeding the net inflow of the previous week.

机构投资者从 ETF 流入是比特币BTC当前涨至历史新高的重要原因。截至 2 月 15 日,比特币BTC ETF 占全球最大加密货币新投资的 75% 左右,比特币BTC价格突破 50,000 美元大关。

The influx of institutional investors from ETFs is an important reason for the current increase in BTC in Bitcoin to historical heights. As of February 15, BitcoinBTC ETF accounted for about 75% of the world’s largest new investments in cryptographic currencies, and Bitcoin BTC went over the $50,000 mark.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论