比特币挖矿 | 挖一个比特币到底要投入多少成本? 当你听到“比特币”这个词的时候,首先可能就会想到它的价格。近来,比特币价格正在稳步上涨。比特币的价格,偶尔会急剧下降,偶...

资讯 2024-07-01 阅读:120 评论:0当你听到“比特币”这个词的时候,首先可能就会想到它的价格。近来,比特币价格正在稳步上涨。比特币的价格,偶尔会急剧下降,偶尔也横盘,对于想要投资比特币,预测接下来比特币的价格是下跌还是会上涨就不得不关注一个重要的因素——比特币的挖矿成本。

When you hear the word "bitcoin," you may think of its price first. Recently, the price of bitcoin has been rising steadily. Bitcoin prices, which occasionally drop sharply, and occasionally spread across the board. For those who want to invest in bitcoin, it is expected that the next price of bitcoin will fall or rise, and it will have to focus on an important factor — bitcoin's mining costs.

那么,这次就来聊聊比特币的挖矿成本受到哪些因素的影响,具体是怎么计算的。

So, this time, let's talk about the factors that affect the mining costs of Bitcoin and how they are calculated.

我们一边了解基础概念,同时计算一下挖矿的成本。

While we understand the basic concepts, we also calculate the cost of mining.

一、算力

I. CAPACITY

定义:比特币挖矿的能力,也就是矿机每秒能做多少次hash碰撞,算力越高,挖得比特币越多。单位是hashes/second(h/s) 。

Definition: Bitcoin's ability to dig, that is, how many whash collisions a mine machine can do per second, the higher the arithmetic, the more bitcoin is dug. The units are hashes/second(h/s)

算力常见单位:

Frequent unit of measure:

1EH/s=1000PH/s=10^18H/s

1PH/s=1000TH/s=10^15H/s

1TH/s=1000GH/s=10^12H/s

1GH/s=1000MH/s=10^9H/s

1MH/s=1000KH/s=10^6H/s

1KH/s=1000H/s=10^3H/s

注意:以上^表示次方

N.B. The above indicates a sub-section

目前全网算力91.97EH/s,参考地址BTC.com。

At present, full Web capacity is 91.97EH/s, reference address BTC.com.

比较热门的蚂蚁S17矿机额定算力为53TH/s,即5.3×10^13(10的13次方)H/s。

The more popular ant S17 machine has a rated capacity of 53TH/s, i.e. 5.3 x 1013 (13 times 10) H/s.

二、难度

Difficulties

定义:为了使得区块产生的速度维持在大约每十分钟一个,产生新区块的难度会定期调整。

Definition: The difficulty of generating new blocks will be adjusted periodically in order to maintain the rate of creation of blocks at approximately every 10 minutes.

为了使得区块产生的速度维持在大约每十分钟一个,产生新区块的难度会定期调整。

The difficulty of generating new blocks will be adjusted periodically in order to maintain the rate at which they are generated at approximately every 10 minutes.

如果区块产生的速度加快了,那么就提高挖矿难度;如果区块产生速度变慢了,那么就降低难度。比特币系统在每隔2016个区块被产出后(约两周的时间),会以最近这段时间的区块产生速度,自动重新计算接下来的2016个区块之挖矿难度。

If blocks are generated faster, they increase the difficulty of mining; if blocks are created slower, they reduce the difficulty. After every 2016 blocks are produced (about two weeks), the Bitcoin system automatically recalculates the difficulty of digging the next 2016 blocks at the rate of the most recent ones.

目前全网难度13.69T,参考地址BTC.com。

At present it is 13.69T, reference address BTC.com.

图:2019年11月27日全网难度与算力

Figure: Web-wide difficulty and arithmetic on 27 November 2019

三、挖币相关计算

III. Currency-digging-related calculations

1.挖币数量

1. Number of coins excavated

一台矿机每天可挖得比特币的数量=一台矿机算力÷全网算力×每天比特币产出总量

The number of bitcoins per day can be dug by a mine machine = total daily Bitcoin output per day

以蚂蚁矿机S17为例:

In the case of ant mine machine S17:

①矿机算力53TH/s;

1 miner arithmetic 53TH/s;

②全网算力92.67EH/s,即92670000TH/s;

2 Web full capacity 92.67 EH/s, i.e. 92.67000 TH/s;

③根据比特币产生的时间表计算(数据参考bitcoinblockhalf.com),到下次比特币产量减半前共可以产出305,688个比特币,所用时间为169天。那么每天可产出比特币总量为305688/169=1808.805个/天。

3 Based on the timetable generated by Bitcoin (data reference bitcoinblockhalf.com), a total of 305,688 bitcoins could be produced for 169 days by the next halving of Bitcoin production. The total amount of bitcoin produced per day would then be 305688/169 = 1808.805.

比特币产生的时间表(数据来源:bitcoinblockhalf.com)

Timelines generated by Bitcoin (data source: bitcoinblockhalf.com)

带入上述公式,可以算出蚂蚁S17矿机每天挖得的比特币数量为:

With the formula described above, it can be calculated that the number of bitcoins that the ant S17 miner digs every day is as follows:

53÷92670000×1808.805=0.00103449514个

53 9267000 x 1808.805 = 0.00103449514

由此可以推算出每T算力每天可以挖的比特币为:

This makes it possible to extrapolate the bitcoin that can be dug every day for every T-calculus:

0.00103449514÷53=0.0000195188个

0.00103449514 = 53 = 0.0005188

由于每天产出比特币总量有略微浮动,所以我们只要知道这是如何计算的即可,实时数据可以参考地址BTC.com。

Since the amount of bitcoin produced per day fluctuates slightly, we simply need to know how this is calculated, and real-time data can be consulted at BTC.com.

图:2019年11月6日每T每日产出比特币的数量

Figure: Number of bitcoins per day per T as at 6 November 2019

上文的计算数据中1T*24小时可挖数量,与BTC.com的数据有所不同,是因为我们在计算每天产币的总数量的时候是根据产币天数推算,得到每天产出1808.805个比特币,而根据BTC.com的数据反推,目前的每天产币为1690.50个。

The figure of 1 T* in the above calculation is 24 hours excavable, which is different from that of BTC.com, because we calculated the total amount of money produced per day on the basis of the number of days in which it was produced, resulting in 1808.805 bitcoins per day, whereas according to BTC.com, the current figure is 1690.50.

2.挖币耗电(电费)

2. Digging for electricity (electricity)

一个比特币的耗电=挖一个比特币所用的算力T×每T的耗电

A bitcoin consumption = digging a bitcoin's arithmetic Tx per T consumption

1T每小时可以获得BTC数量为:

The number of BTCs available per hour for 1T is as follows:

0.0000195188÷24=0.00000081328

假设一小时内挖出一个比特币,则需要

If you dig up a bitcoin in an hour, you need it.

1÷0.00000081328=1229588.825497T

蚂蚁S17矿机功耗算力53T,2385W,即每T,45W,即每T一小时耗电0.045kW。

Ant S17 mine powered 53T, 2385W, i.e. 0.045kW per T, 45W, i.e., 0.045kW per T-hour.

耗电为

Electricity consumption is...

1229588.825497TX0.045=55331.497148kW

假设电费为0.4/kw.h元,则挖一个比特币的耗电成本为54973.9179297×0.4=22132.6元

Assuming the cost of electricity is 0.4/kw.h, the cost of digging a bitcoin would be 54973,97997 x 0.4 = $22132.6

注:此处未计算矿机成本以及其他相关成本。

Note: Miner costs and other related costs are not calculated here.

3.矿机折旧

3. Depreciation of miners

矿机的折旧由于一直是动态的,不好按照准确的数据来计算,但是可以按照每两周(难度调整周期)来估算。

Depreciation of mine machines, which has been dynamic and is difficult to calculate on the basis of accurate data, can be estimated on a biweekly basis (difficult adjustment cycle).

两周的矿机剩余成本=矿机成本÷(1+难度百分比)

Two-week residual cost of mine = miner cost (1+ per cent difficulty)

两周的矿机折旧=矿机成本-矿机剩余成本

Depreciation of miner for two weeks = miner cost - miner surplus cost

因为难度是两周左右调整一次,所以我们说的矿机剩余成本也是以两周为节点。

Because the difficulty is to adjust around two weeks, what we are talking about is that the residual cost of the miner is also a two-week node.

下一个两周的矿机折旧=上两周矿机剩余成本-上两周矿机剩余成本÷(1+难度百分比)

Depreciation of mine machines for the next two weeks = residual cost of miners for the last two weeks — residual cost of miners for the last two weeks (1+ per cent difficulty)

依此类推。以蚂蚁S17为例,机器成本按照18000元计算,假设2019年9月27日投入使用,那么此后两周内:

In the case of ant S17, the cost of the machine is calculated at $18,000, assuming that it will be operational on 27 September 2019, then within two weeks:

两周的矿机剩余成本:

The remaining cost of the mine for two weeks:

18000÷(1+1.95%)=17655.71元

$18,000 (1+1.95%) = $17,655.71

两周的矿机折旧:

Depreciation of miner for two weeks:

18000-18000÷(1+1.95%)=344.29元

18,000-18000 (1+1.95%) = $344.29

下一个两周的:

Next two weeks:

矿机剩余成本

Surplus cost of miners

17655.71÷(1+5.25%)=16775.02元

17655.71 (1+5.25%) = 16775.02

矿机折旧=17655.71-16775.02=880.69元

Miner depreciation = 17655.71-16775.02 = $880.69

4.挖币的矿机成本

4. Cost of a miner to dig coins

假设两周内(一个难度周期)正好挖一个比特币,由于功率固定,算力固定,所以耗电是固定的,那么就是计算,最少用多少台矿机可以挖到。

Assuming that within two weeks (a difficult cycle) a bitcoin is being dug, the electricity consumption is fixed because the power is fixed and the arithmetic is fixed, then it is calculated that the minimum number of mine machines can be dug.

以蚂蚁S17为例,当前为2019年11月27日,全网算力92.67EH,难度调整+5.25%。

In the case of ant S17, which is currently 27 November 2019, the full net capacity is 92.67 EH, with difficulty adjustment + 5.25%.

每台矿机每天的产币数量

Number of coins per miner per day

53T÷(92.67×1000000T)×1808.805(每天比特币总量)=0.0010345个

53 T (92.67 x 10,000,000 T) x 1808.805 (total Bitcoins per day) = 0.00010345

每台矿机两周产币数量

Biweekly production of coins per miner

0.0010345×14=0.014483个

0.0010345 x 14 = 0.014483

两周挖的一个比特币需要的矿机数量

The number of machines that a bitcoin needs for two weeks.

1÷0.014483=69台

1 x 0.014483 = 69

这两周的矿机折旧成本:

Depreciation cost of mine machines for the last two weeks:

[18000-18000÷(1+5.25%)]×69=61952.494元

[18000-18000 (1+5.25%)] x 69 = $61952.494

那么据此可以推算假如目前算力条件下,

So it can be deduced that under the current conditions of computing,

以18000的价格购买53T的矿机,

A mining machine for 53 T was purchased at a price of 18,000.

挖一个比特币需要的电力及矿机成本约为:

The cost of electricity and mine machines required to dig a bitcoin is approximately:

22132.6+61952.494=84085.094元。

22132.6 + 61952.494 = $84085.094.

上述只是针对新矿工而言,成本显得很高,是因为我们在设置矿机折旧成本的时候按照当前难度调整的百分比计算的,并且购入机器的成本和电费成本还有这两周的难度涨幅都比较高。

The above is only for new miners, whose costs appear to be high because of the percentage adjusted for the current difficulty when we set the depreciation cost of the miner and the higher cost of purchasing the machine and the higher cost of electricity, as well as the increase in the difficulty of the two weeks.

5.全网总矿机数

5. Total net miner

按照目前全网算力92.67EH/s计算

Based on the current network full capacity of 92.67 EH/s

假设全部是蚂蚁S17矿机,那么大约有:

If it's all ant S17 machines, then it's about:

92.67×1000×1000T÷53T=1748490台

92.67 x 1000x1000T53T = 1748490

一天的全球耗电为:

The global electricity consumption of the day is:

1748490×2.385×24=100 083 567.6KW

6.推算未来算力

6. extrapolation for the future

根据BTC.com显示的算力增长数据,推算未来每两周左右,算力的增长百分比。由于算力会根据挖矿难度,矿机数量等因素变化,所以选取一个长时间段,比如比特币的减半周期四年来计算。

Arithmetic growth data from BTC.com calculates the percentage increase in power in the next two weeks or so. Since it changes according to factors such as the difficulty of mining, the number of machines, etc., a long period is chosen, such as four years of the four-year period of halving Bitcoin.

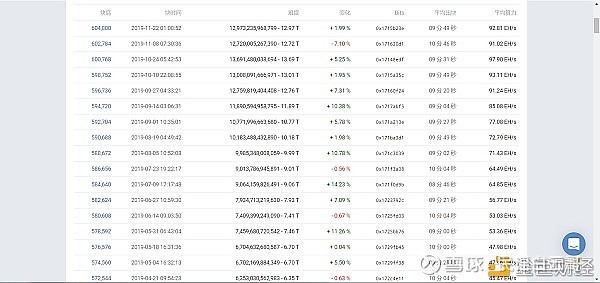

在BTC.com节选近四年算力增长数据

Selection of almost four years of arithmetic growth data in BTC.com

求平均值计算出近四年每次调整算力平均值为4.72%。

The average is calculated at 4.72 per cent for each adjustment during the last four years.

假设从2019年11月22日算起(上次难度调整日)推算未来一年蚂蚁S17总的产币量。由于全网算力上涨,单台矿机挖的币越来越少,那么必然伴随着矿机的贬值,贬值的幅度暂以每两周降低4.72%计算。

Assuming that the total yield of ant S17 for the coming year is calculated from November 22, 2019 (the last difficult adjustment date). With the increase in net capacity and the smaller and smaller amount of currency that one miner digs, the depreciation will inevitably be accompanied by the depreciation of the mine, which will be reduced by 4.72% every two weeks.

综上可得下图:

In summary, the following graph is available:

综上计算,可得理想状况下,距离减半前190天,此时购入一台蚂蚁S17一共可以挖到0.15298472个比特币,消耗电费4350.24元,机器残值9147.3855元。

On the basis of this calculation, it is possible to obtain an ant S17 at a distance of 190 days before being halved, so that a total of 0.15298472 bitcoins can be acquired, with a consumption charge of $4350.24 and a mechanical residual value of $9147,3855.

以上即关于比特币挖矿成本的计算,数据主要参考主流网站可找到的相关数据,因为主要为理论上的数据计算,故所有计算结果仅供参考,不作为投资依据。

For the above-mentioned calculation of the costs of mining bitcoin, the data refer mainly to relevant data that can be found on the mainstream website, since the calculations are mainly theoretical, and therefore all the calculations are for reference purposes only and are not used as a basis for investment.

用户可以通过挖矿平台购买算力合约,从而赚取相应算力所挖到的比特币。对于购买云算力合约的用户来说,此举不仅免除了自己挖矿所带来的矿机设置、挖矿噪音等烦恼,而且还能省去交电费、维护费支出等繁琐步骤。只需动动手指,就可灵活购买算力合约,每天得到净收益,合约到期后,轻松积累上涨行情带来的巨大红利。

Users can buy computing contracts through mining platforms, thereby earning the bitcoin that they can dig. For users who buy cloud computing contracts, this not only relieves themselves of the troubles of mining machines, mining noise, etc., but also saves them from such cumbersome steps as electricity and maintenance costs.

举个例子,比如用户在HASHBOX云算力平台上以266元人民币买下1T的比特币特价算力合约,就相当于买下了在1T算力的比特币三年的收益。换言之,用户花费266元买了一份指数基金,而“指数”就是比特币的价格,比特币价格上涨,用户收益则变大。

& nbsp; & nbsp; for example, the Bitcoin Special Price Contract, where users buy 1T in RMB 266 on the HASHBOX cloud computing platform, is equivalent to the three-year profit of buying a bitcoin at 1T. In other words, the user spends $266 on an index fund, whereas the index is the price of Bitcoin, the price of bitcoin is higher, and the user gain is greater.

若不考虑挖矿难度等因素,在当前1枚56800元人民币的币价下,用户以266元买入1T的比特币合约,就可以在365天后赚取409元,刨除本金后也就是143元的收益。年化收益率达到35.5%。当然,这是在不包含电费的前提下得到的结果。而如果入BTC价格继续上涨,那么这份合约的升值空间也就会更大。

& nbsp; & nbsp; if the difficulty of mining is not taken into account, at the current RMB 56,800, the user will earn $409 after 365 days to buy a bitcoin contract for 1T. The annualized rate of return is 35.5%. This, of course, is the result of a price that does not include electricity. And if BTC prices continue to rise, there will be greater scope for the contract to appreciate.

实际情况呢?当全网挖矿难度不断增加,挖矿收益也会急速下跌。在刚刚过去的丰水期,全网算力就曾急剧增加,使得挖矿难度相应地增加了50%,这意味着,用户可能将付出更大的代价,却只能得到更小的收益。

& nbsp; & nbsp; The reality is that, when the whole net is becoming more difficult to dig, the profits will fall fast. During the recent water boom, the net capacity increased dramatically, increasing the difficulty of digging by a corresponding 50%, meaning that users may pay a greater price but only a smaller gain.

不过,正如前面所说,云算力仍然为市场提供了不一样的产品选择,尤其是当币价处于上行通道的时候,这种吸引力更是明显。HASHBOX作为挖矿行业的一匹黑马,围绕传统挖矿行业痛点,面对挖矿的普通用户和小白用户,推出了云算力购买、矿机租赁和预付电费的活动,致力于让人人都可以享受到挖矿带给大家的红利。HASHBOX从矿机选购、矿场建设、手续办理、运营维护等实业环节到平台建设、云算力销售、数字资产存储、核对发放收益等数字环节,每个环节都严格审核,切实保障用户的利益。

& nbsp; & nbsp; however, as stated earlier, cloud computing still offers different product options for the market, especially when currency prices are on the upper route. HasHBOX, as a black horse in the mining industry, has introduced cloud power purchases, mine rentals, and prepaid electricity payments, in the face of ordinary and small white users in the traditional mining industry, to ensure that everyone can enjoy dividends from mining. HasHBOX buys from mining machines, mines, processing, operating maintenance, etc. business links to platform construction, cloud computing sales, digital asset storage, and checking the proceeds of distribution, each of which is strictly scrutinized to ensure that users'interests are effectively safeguarded.

为此,专业人士表示,数字资产发展是大势所趋,同时,在数字资产中,POW的矿业生态得到越来越多人的认同。云算力的形式对于供应商、平台、用户来说,是三方共赢。未来将会有越来越多的矿池更深入地发展云算力,也必然会吸引更多优秀的供应商的加入。

& nbsp; & nbsp; to this end, professionals say that digital asset development is on the move, while, among digital assets, the mining ecology of Pow is increasingly recognized. The form of cloud computing is a three-way win for suppliers, platforms, and users.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论