图1,BTC月线走势图-ATFX

Figure 1, BTC's map - ATFX

ATFX汇评:2017年9月比特币在国内禁止交易,当时的价格为4367美元。三年半的时间过去,比特币经历了三次大涨,第一次高点在2017年12月形成(19891美元),第二次的高点在2019年6月形成(13764美元),第三次的高点在2021年1月形成(35081美元)。如果把比特币看做是一支股票,那么其每股价格高于A股市场所有品种(贵州茅台最高2000+人民币),即便和美股市场比较,比特币几个也仅仅排在巴菲特的伯克希尔哈撒韦股价(34.18万美元/股)之下,名列第二。

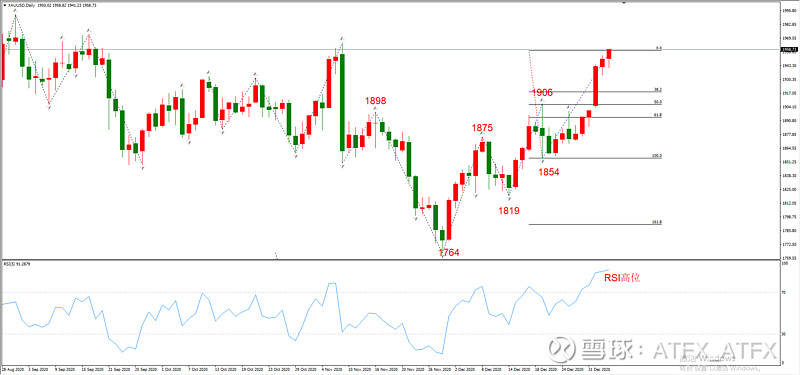

ATFX assessment: Bitcoin was banned in the country in September 2017 at a price of $4367. Three and a half years passed, Bitcoin experienced three major increases, the first was formed in December 2017 (US$ 19891), the second was formed in June 2019 (US$ 13764) and the third was formed in January 2021 (US$ 35081). If Bitcoin was treated as a stock, the price was higher than the price of all varieties in the A market ( 虽然比特币股价一飞冲天,但其基本面依据非常不清晰,目前能够依据的只有“避险属性”这一条。笔者更倾向于把比特币的暴涨看作是“互联网时代的郁金香”,支撑其价格暴涨核心因素就是“赚钱效应”,只要行情不断上涨,就能够吸引更多的资金入场;只要涨势暂停,资金也会作鸟兽散。支持这一观点的例证就是比特币上涨的时候凌厉,下跌的时候也很疯狂。2017年的上涨以暴跌至3219美元结束,跌幅83.81%,2019年的上涨以暴跌至4001美元结束,跌幅70.93%;那么,2020年的上涨又会以何种价格收场?我想不难预测。 Although Bitcoin’s share price is soaring, its basics are very unclear, and the only one that can be relied on is the “risk-free attribute.” I prefer to view the surge in Bitcoin as “the tulips of the Internet era.” The central factor underlying the surge in prices is the “profit effect”, which attracts more money as long as it rises; as long as it stops. 前面我们提到避险属性,这种避险是指在宏观经济衰退时,投资品价格逆势上涨,且涨幅较大。从这点来看,比特币表现不俗,因为在2020年新冠肺炎疫情肆虐的情况下,比特币从4001美元的价格冲高至35081美元,翻了将近10倍。反观同样具有避险属性的黄金,其疫情之前的报价为1463美元,2020年达到的最高价为2074美元,总涨幅41.76%,远低于比特币的表现。 In this sense, Bitcoin behaved well, as it jumped from US$ 401 to US$ 35081 in 2020, almost ten times more than in the case of the new coronary pneumonia epidemic. In contrast, gold, which is equally safe, was offered at US$ 14,63 before the outbreak, reaching its highest price of US$ 2074 in 2020, a total increase of 41.76 per cent, well below its performance. 必须承认,黄金的赚钱效应不及比特币,但比特币毕竟在国内禁止交易,并且投机氛围浓厚,缺乏基本面支撑导致其每次的下跌幅度都极大。综合考虑,交易者如果想要在经济衰退时选择避险品种,黄金依旧处于首选地位。 It must be acknowledged that gold does not have the same earning effect as Bitcoin, but Bitcoin, after all, is prohibited from trading in the country and has a strong climate of speculation, with the lack of basic support leading to a significant decline in each case. Taken together, gold remains the preferred option if traders want to choose the type of risk-free species in times of recession. 图2,黄金日线走势图-ATFX Figure 2, gold line trends - ATFX 黄金日线级别也开始启动上涨行情,前期勾形结构1906~1854~市价在不断扩大,预计多头还将持续下去。黄金的走势与两个因素有关,一个是美元指数,另外一个是美股表现。当美元指数大幅下跌时,代表外汇市场出现较高风险,黄金受避险情绪推动,顺势开启上涨。由于美联储执行极端的货币宽松政策,且美国国内疫情没有好转的迹象,美元指数近期一直在持续下跌,这对黄金多头的推动作用非常明显。当美国股票指数大跌时,代表美国国内经济出现较大风险,作为国际黄金购买的主力军,美国经济下行势必推动美国金融机构买入黄金对冲风险。自2021年1月4日起,美国三大股票指数均大幅下跌,以纳斯达克100指数为例,其1月最高点为12973点,当前市价为12578,点,已经395点 。虽然相比美国股票历史上的下跌本次回调幅度并不大,但在美元指数和美股的双重刺激之下,黄金的多头走势幅度将超乎大部分人的预期。 As a result of the Fed’s extreme monetary easing and the lack of signs of improvement in the US domestic epidemic, the dollar index has been declining in the recent past, and this has contributed significantly to the expansion of the gold stock index. When the United States stock index has fallen, there are two factors associated with the movement of gold, the dollar index, and the dollar’s performance. As the dollar index has fallen sharply, the US economy is likely to be driven by higher risks in the foreign exchange market and the risk of gold being hedged. Since 4 January 2021, the three major United States stock indices have fallen sharply to 比特币的行情时镜中花,虽然妖艳异常但很难获得;黄金的行情才是“真金白银”,其市场接受度和趋势稳定性远远高于比特币。做投资就是要心态稳,不能因为一时的剧烈行情表现就迷失方向,笔者建议交易者看淡比特币的惊人表现,回归到传统黄金的分析上来。这一建议当下看起来不合时宜,但相信未来他将会展现出有价值的前瞻性。 Bitcoin's time-frame is a flower that is difficult to get, although it is an anomalous one; gold's behavior is “real silver,” and its market acceptance and trend stability is much higher than Bitcoin. Investment is a matter of a stable mind, not a lost way because of a moment's intense behavior, and I suggest that traders look at the amazing performance of Faybitco and return to the analysis of traditional gold. This proposal does not seem appropriate at the moment, but it is confident that he will show valuable forward-looking behaviour in the future. ATFX免责声明: ATFX disclaimer: 1、以上分析仅代表分析师观点,汇市有风险,投资需谨慎。 1. The above analysis represents only the point of view of analysts, the market is risky and investments need to be prudent. 2、ATFX不会为直接或间接使用或依赖此资料而可能引致的任何盈亏负责。 ATFX is not liable for any gain or loss that may result from the direct or indirect use of or reliance on this information.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论