一图看懂USDT本位与币本位永续合约的区别与优势 USDT本位永续合约是一种数字资产衍生产品,用户可以通过判断涨跌,选择买入做多或卖出做空合约来获取数字资产价格上涨/下降...

资讯 2024-06-25 阅读:124 评论:0USDT本位永续合约是一种数字资产衍生产品,用户可以通过判断涨跌,选择买入做多或卖出做空合约来获取数字资产价格上涨/下降的收益。类似于一个担保资产现货市场,它是以USDT计价,且价格接近于标的参考指数价格,锚定现货价格的主要机制是资金费用。USDT本位永续合约没有交割日,用户可以一直持有,每8小时结算一次,每次结算后会将已实现盈亏、未实现盈亏转到用户账户余额中。

USDT is a derivative of digital assets, and users can choose to buy into more or sell for empty contracts in order to reap the benefits of higher or lower digital asset prices. is similar to a spot market for encumbered assets, which is denominated in USDT and is close to the price of a reference index, and the main mechanism for anchoring spot prices is the cost of funds. The unsatisfied date for USDT allows users to hold every eight hours to settle , and each settlement will result in the transfer of realized and unrealized gains to the user account balance.

USDT本位永续合约市场的机制

担保资产率与强制平仓:担保资产率=账户权益/占用担保资产*100%-调整系数,当担保资产率小于等于0时,仓位会触发强平。资金费用:买方和卖方之间每隔8小时定期支付费用。如果资金费率为正,多仓将支付而空仓将获得资金费;如果资金费率为负,则空仓将支付而多仓将获得资金费。(只有用户在结算资金费用时的净持仓不为0时,才需要支付或收取资金费用)。结算资金费用时间(GMT+8):00:00、8:00、16:00。

The rate of encumbered assets and mandatory silos: the rate of encumbered assets = interest in the account/occupancy of the encumbered assets* * 100 per cent - an adjustment factor that triggers a stronger position when the rate of encumbered assets is less than equal to zero. Financial costs: regular payments are made every eight hours between the buyer and the seller. If the fund rate is positive, the money will be paid and the money will be left empty; if the fund rate is negative, the money will be paid and the money will be paid (only when the net holding of the asset is not zero for the user).

USDT本位永续合约与币本位永续合约的不同点

计价单位不同。USDT本位永续合约是以USDT为计价单位;币本位永续合约是以美元为计价单位。因此两者之间的指数价格也会有所不同,比如BTC/USDT的指数价格是取各交易所BTC现货兑USDT的价格;而BTC/USD币本位永续合约的指数价格是取各交易所BTC现货兑美元的价格。

Different units of . USDT is a unit of value in USDT, and currency is a unit of value in United States dollars. Thus, the price of the index is different in the case of BTC/USDT, for example, BTC/USDT, for BTC, for BTC, for each exchange, for USDT, and BTC/USD, for BTC, for each exchange, for BTC, for the United States dollar.

合约价值不同。USDT本位永续合约每张合约的价值为对应的标的币种,比如BTC/USDT的面值为0.001BTC;币本位永续合约每张合约的价值为USD,比如BTC/USD的合约面值为100美元。

The contract value is different. USDT-based contracts have a corresponding value in currencies such as BTC/USDT, with a face value of 0.001 BTC, and currency-based contracts such as BTC/USD, with a face value of $100.

充当担保资产币种不同。USDT本位永续合约所有品种合约都使用计价币种USDT作为担保资产,用户只需要持有USDT即可参与各个品种合约的交易;币本位永续合约是以标的币种作为担保资产,用户需要持有对应标的币种方可参与该品种合约的交易,比如BTC/USD币本位永续合约,用户需要转入BTC充当担保资产。

由于充当担保资产币种的不同,在价格下跌时,两种合约的担保资产贬值的风险也有所不同。假设当BTC/USD币本位永续价格下跌时,对用户仓位所需的担保资产要求越高,持仓担保资产所需的BTC越多;但USDT本位永续合约因为所需的担保资产是USDT,BTC币价下跌不会影响USDT担保资产的价值。

serves as an encumbered asset in different currencies. USDT is used as an encumbered asset for all types of contracts for permanent use. USDT is used as an encumbered asset for all types of contracts for which the user needs only to be in possession of the USDT; the higher the requirement for the asset for the location of the user, the greater the requirement for the BTC to be in possession of the encumbered asset, is required for the user to be in the same type of contract, such as BTC/USD for permanent use, and the user needs to transfer to BTC as an encumbered asset.

As a result of the different types of contracts for permanent use of the encumbered asset, there is a different risk that the encumbered asset will depreciate when the price falls.

计算盈亏币种不同。USDT本位永续合约所有品种合约都使用计价币种USDT计算盈亏;币本位永续合约是以标的币种计算盈亏,比如用户交易BTC/USD币本位永续合约,盈亏的币种是BTC。

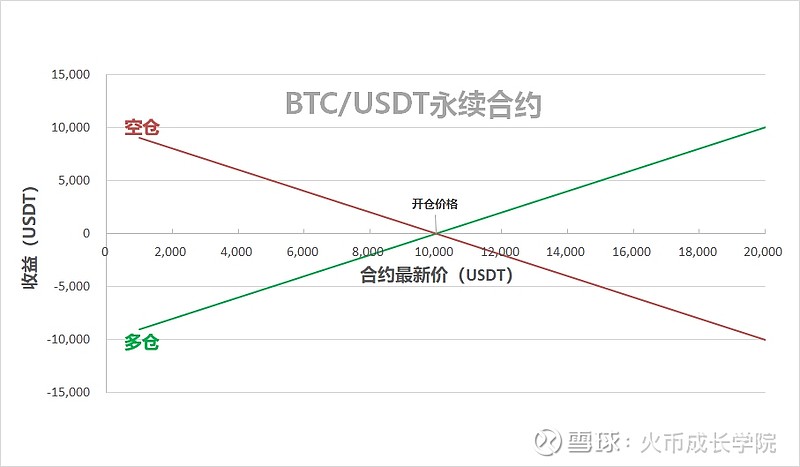

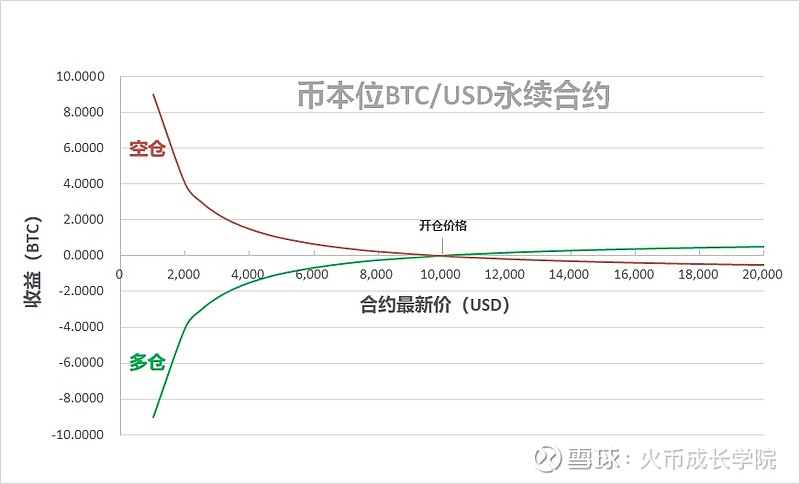

由于盈亏币种的不同导致盈亏模型也有所不同。假设使用相同有价格分别在USDT本位永续和币本位永续合约进行BTC的品种开仓100张合约,盈亏模型如下:

calculates the profit and loss in different currencies . USDT calculates the gain and loss by using the currency of the United States of America (USDT) for all type contracts; the currency is the currency of the currency of the currency of the currency of the currency of the currency of the currency of exchange, such as the transaction of the BTC/USD for the currency of the currency of the user, and the currency of the BTC for the currency of the currency of the United States of America (BTC).

differ from the model of the gain and loss due to differences in the currency of the profit and loss. Assuming that the same price is used for 100 contracts of the BTC for the species of the currency of the currency of the United States of America (USDT) and the currency of the currency of the currency of the currency of the currency of the currency of the currency of the currency of the currency of the year, respectively, the model of the gain and loss is as follows:

【漫画USDT本位永续合约01期】

and nbsp;

一图看懂USDT本位与币本位永续合约的区别与优势

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论