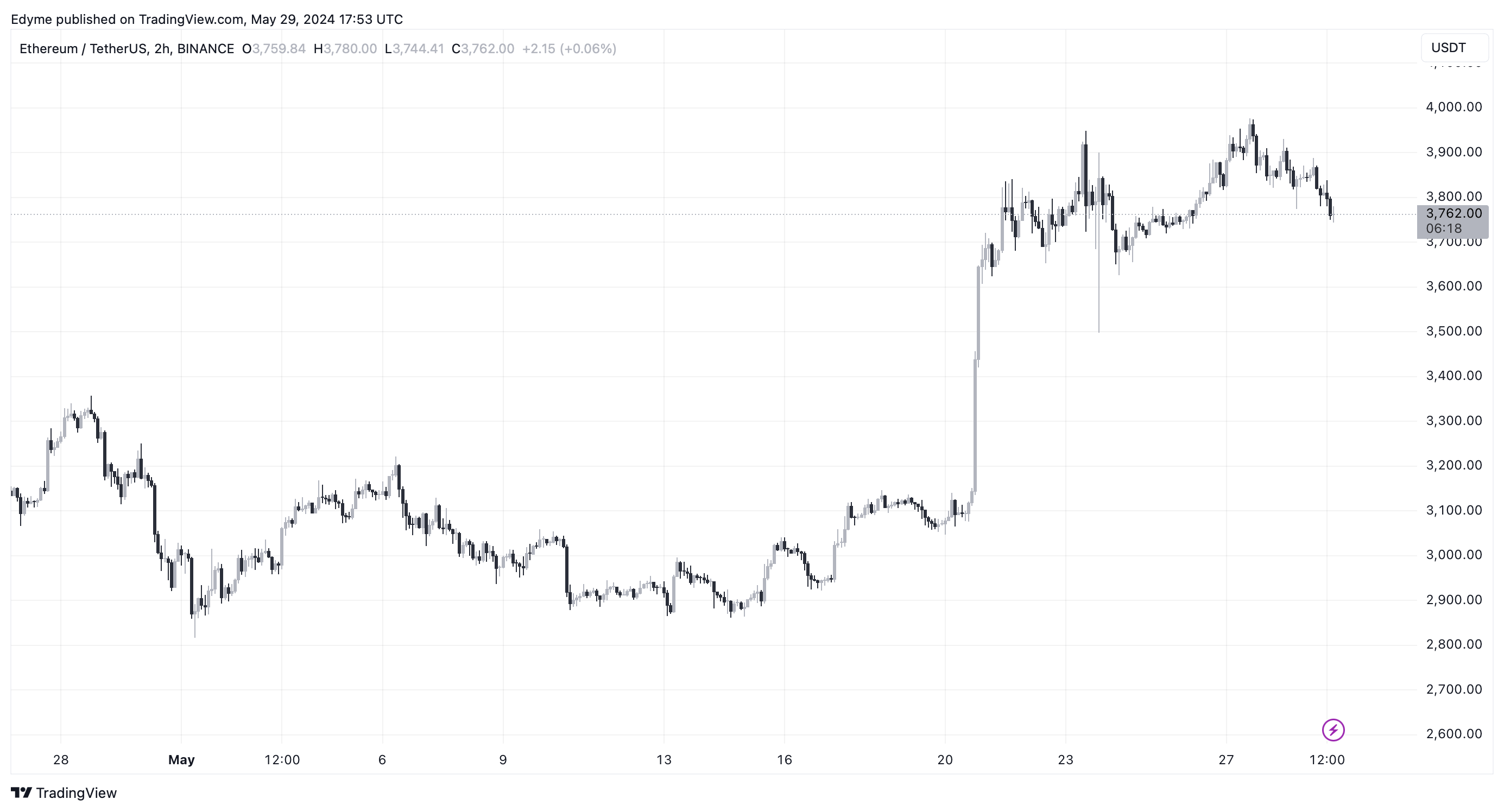

随着以太坊 ETF 近期获批,加密货币市场一片沸腾,引发了投资者和分析师的讨论和猜测。自上周现货以太坊 ETF 获得批准以来,以太坊迄今为止仅飙升至 3,959 美元的高位,随后回落至当前交易价格 3,757 美元。

With the recent approval of

虽然达到 3,900 美元的大关代表着显著的上涨,但仍未达到美国证券交易委员会批准现货ETF后许多人预期的大幅上涨。

While the threshold of $3,900 represents a significant increase, it still falls short of the large increase expected by many following the approval of spot ETFs by the United States Securities and Exchange Commission.

现货以太坊 ETF 批准是否已计入价格?根据最近的一份报告,专家们对于这些批准的影响是否已在市场上充分反映存在分歧。

Is the ETF's approval on the spot included in the price? According to a recent report, there is disagreement among experts as to whether the impact of these approvals has been adequately reflected in the market.

DeFiance Capital 的 Arthur Cheong 对此进行了讨论,他指出市场尚未适应这一重大转变,并且市场动态的如此重大变化无法立即反映在价格上。

Arthur Cheong of Defense Capital discussed the issue, noting that markets had not yet adapted to this major shift and that such major changes in market dynamics could not immediately be reflected in prices.

GSR 的 Brian Rudick 对此表示赞同,他指出现货比特币 ETF观察到的模式可能会在 ETH 上重演,其中显着的价格波动伴随着对现货 ETF 的预期和实际推出。

Brian Rudick of the GSR agreed with this by pointing out that the pattern observed by the ETF at may be repeated at , where price fluctuations are evident and are accompanied by expectations and actual roll-out of current ETFs.

尽管以太坊近期有所上涨,但这些市场专家的共识是,ETF 批准的全部潜力可能尚未被反映在价格中。

Despite the recent rise in Etheria, there is a consensus among these market experts that the full potential of ETF approval may not yet be reflected in prices.

Rudick 进一步透露,ETH 的未来价格可能取决于新推出的现货以太坊 ETF 的资金流入情况,类似于比特币的趋势。他预测,在这些 ETF 的强劲流入推动下,以太坊的价格可能比本月初上涨“50-*”。

Rudick further revealed that the future prices of ETH may depend on the newly introduced spot ETF inflows, similar to the trend in Bitcoin. He predicted that the prices of ETFs, driven by their strong inflow, could be “50-*” higher than at the beginning of this month.

与此同时,Tranchess 的 Danny Chong 认为,该批准只是部分反映在价格中。他预计,随着市场适应波动的需求和供应动态,短期内将出现相当大的波动和潜在的横盘交易。

At the same time, Tanchess’ Danny Chong argued that the approval was only partially reflected in prices. He predicted that there would be considerable volatility and potential cross-cutting transactions in the short term as markets adapted to volatile demand and supply dynamics.

Chong 强调,现货 ETH ETF 可能会促进机构采用并稳定以太坊的长期价格。

Chong stressed that spot ETH ETF may promote institutional adoption and stabilize the long-term prices of the ETA.

与此同时,DeFi Report 创始人 Michael Nadeau 最近分析了以太坊现货 ETF 获批对其市场走势的潜在影响。

Meanwhile, the founder of DeFi Report, Michael Nadeau, recently analysed the potential impact of Ether's spot ETF approval on market trends.

Nadeau 提出了一个估值框架,表明整个加密货币市场可能达到 10 万亿美元的市值。他认为,ETH 有望超过彭博社估计的比特币净流入量的 10-20%。

Nadeau proposes a valuation framework that suggests that the entire market for encrypted currencies could reach a market value of $10 trillion. In his view, the ETH is expected to exceed the 10-20% of Bloomberg’s estimated net inflow of bitcoins.

根据他的预测,ETH 在本周期的高峰期可以达到 1.8 万亿美元的市值,假设供应量保持不变,这可能会将 ETH 的价格推高至约 14,984 美元。

According to his projections, ETH could reach a market value of $1.8 trillion during the peak period of the cycle, which, assuming that supply remains constant, could push prices of ETH up to approximately $14,984.

相比之下,他指出,如果比特币的市值达到 4 万亿美元,其价格可能会飙升至 202,000 美元。

In contrast, he noted that, if the market value of Bitcoin reached $4 trillion, its price could surge to $202,000.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论