现货比特币ETF上市第二日,虚拟货币市场迎来抛售潮。

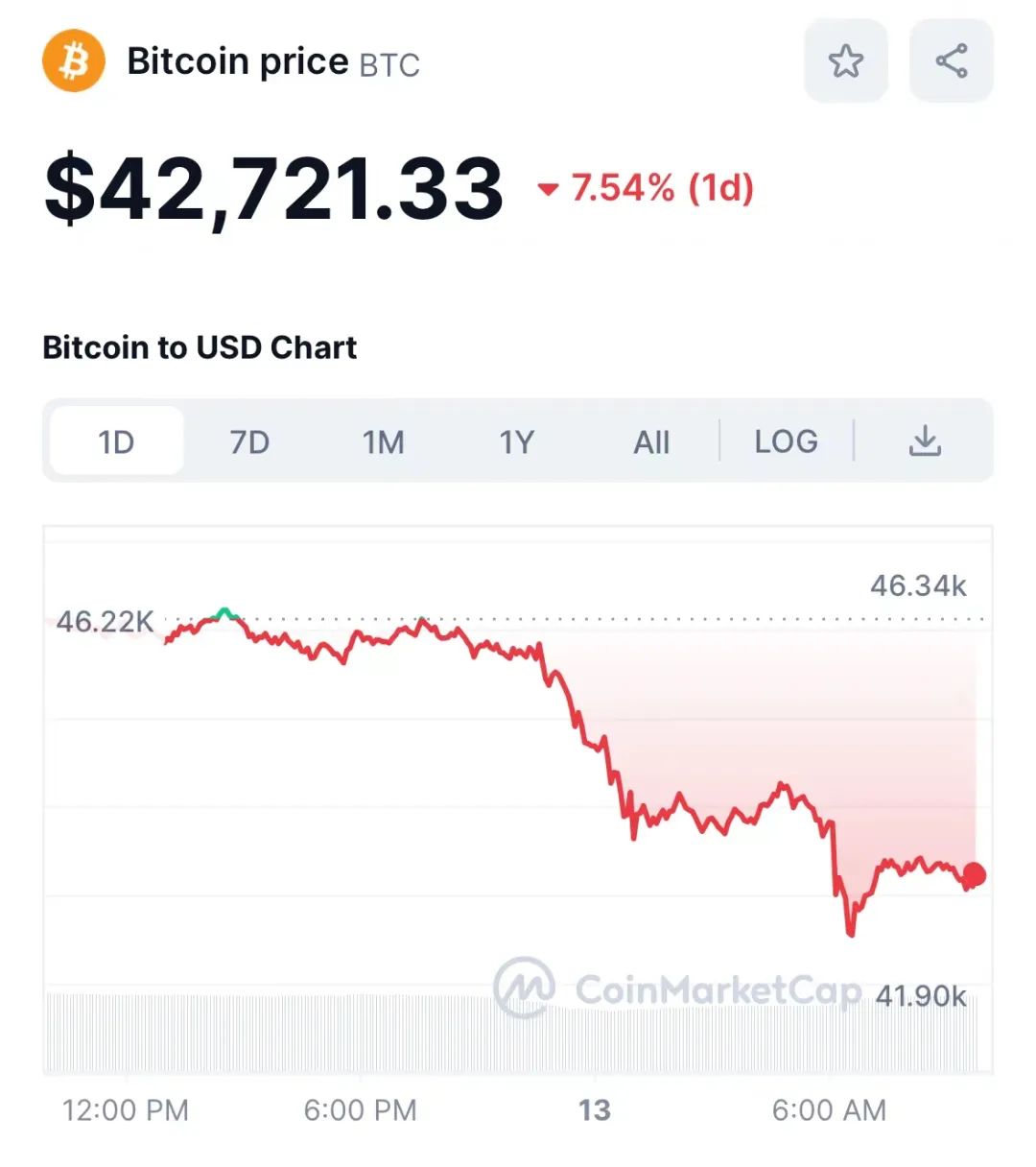

受比特币现货ETF获批的消息提振,比特币价格1月11日一度突破48000美元/枚,但随后陷入持续下跌。北京时间1月13日凌晨,比特币加速下跌,一度跌破42000美元关口。截至目前,日内跌幅超7%,暂报42721.6美元/枚。

Upon the approval of the Bitcoin spot ETF, the price of Bitcoin passed $48,000 on 11 January, but then fell steadily. In the early morning hours of 13 January Beijing time, bitcoin fell at an accelerated rate of $42,000. To date, it has dropped by more than 7%, provisionally by $42721.66.

图片来源:CMC

图片来源:CMC

比特币深夜闪崩

{\bord0\shad0\alphaH3D}Bitcoin {\bord0\shad0\alphaH3D}Strange

因比特币一度失守42000美元关键点位,CoinGlass数据显示,最近24小时,比特币市场共有超10万人爆仓,爆仓总额为3.5亿美元(约合人民币25亿元)。

In the case of Bitcoin, which once lost its key position of $42,000, CoinGlass data show that in the last 24 hours, the Bitcoin market has had over 100,000 blasts, with a total of $350 million (approximately RMB 2.5 billion).

图片来源:CoinGlass

图片来源:CoinGlass

美股市场上,虚拟货币概念股也随之下跌,Marathon Digital跌超15%,Riot Platforms跌超10%,Micro Strategy跌超9%,嘉楠科技跌近9%,Coinbase跌超7%。

In the US stock market, the virtual currency concept share also fell, with Marathon Digital falling by more than 15 per cent, Riot Platforms by more than 10 per cent, Micro Strategy by more than 9 per cent, KAST by almost 9 per cent, and Coinbase by more than 7 per cent.

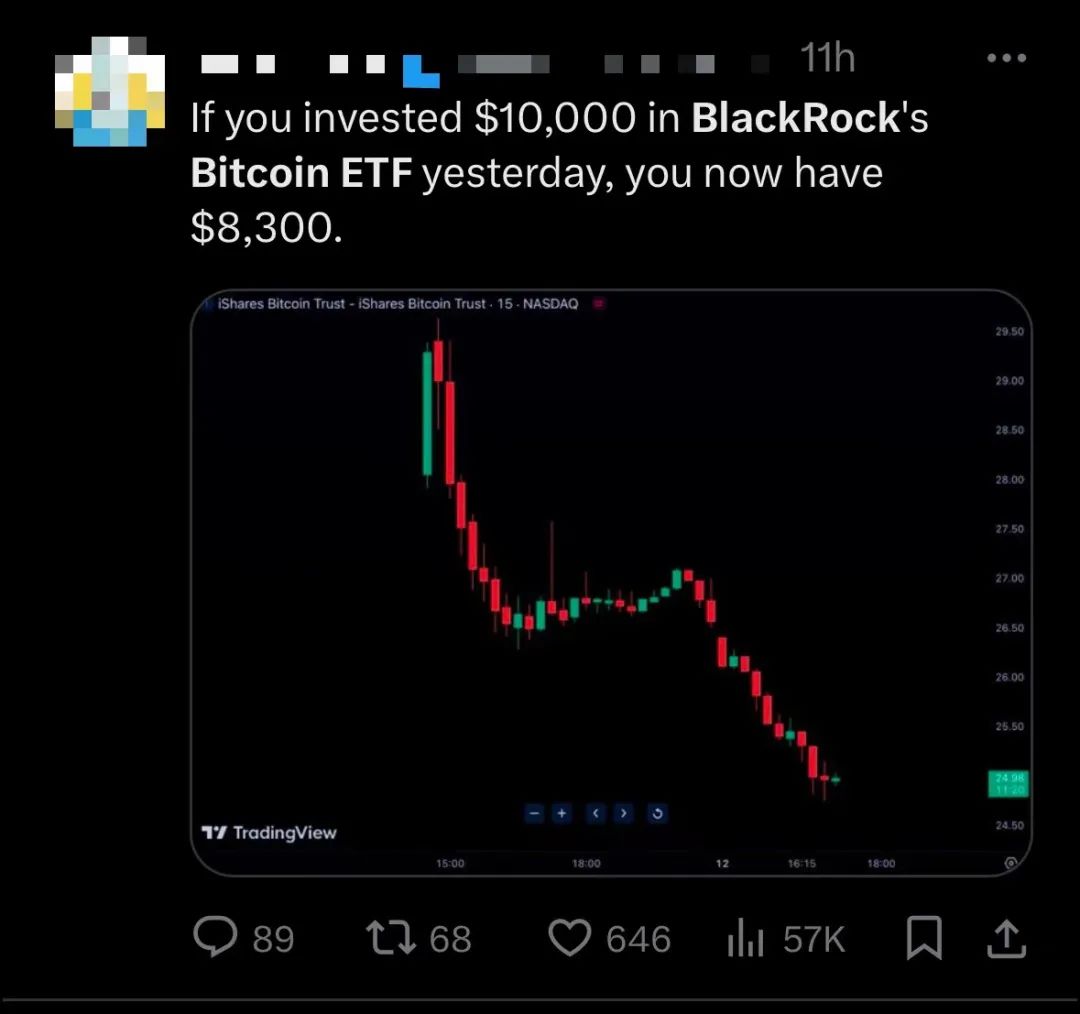

比特币现货ETF亦遭受重挫。其中,贝莱德(Blackrock)旗下iShares Bitcoin Trust(IBIT)暴跌6.2%,Grayscale(灰度)旗下转为ETF的Grayscale Bitcoin Trust BTC Fund(GBTC)下跌超5%。

The Bitcoin spot ETF also suffered a severe setback. Among them, the iShales Bitcoin Trust (IBIT) under Blackrock fell by 6.2%, and the Grayscale (Greyscale) under the ETF for conversion to the ETF fell by more than 5%.

连续两日的表现不佳,令比特币现货ETF上市首日就冲进去的投资者,损失不小。有投资者表示:“以贝莱德的ETF计算,周四投进去1万美元,周五只剩下8300美元,亏损近2000美元(约合人民币14500元)。”

The poor performance of two days in a row resulted in significant losses to investors who entered the spot ETF in Bitcoin on the first day of the market. Some investors said: “In the calculations of the ETF in Belede, $10,000 was invested on Thursday, leaving only $8,300 on Friday, at a loss of nearly $2,000 (approximately 14,500 yuan).

图片来源:社交平台

图片来源:社交平台

业内人士表示,今日比特币大跌,主要因为比特币现货ETF获得批准的利好消息落地后,多数投资者乐观情绪消退,倾向于获利了结。

According to industry sources,

SkyBridge Capital创始人Anthony Scaramucci表示,自比特币现货 ETF开始交易以来,比特币下跌是由于投资者抛售。目前比特币的抛售量很大,预计供应过剩的情况将在未来6到8个交易日内消化。

The founder of SkyBridge Capital, Anthony Scaramucci, said that the drop in bitcoin had been due to investors selling it since the start of the Bitcoin spot ETF. Bitcoin was currently sold in large quantities, and oversupply was expected to be absorbed in the next six to eight trading days.

加密数据服务商CryptoQuant预测,现货ETF获得批准后,比特币预计将回调至32000美元。

CryptoQuant, the encryption data provider, predicted that, with the approval of the spot ETF, Bitcoin was expected to revert to $32,000.

上市交易首秀

当地时间1月11日,11只比特币现货ETF在纽交所、芝加哥期权交易所、纳斯达克三个交易所上市交易。

On 11 January local time, 11 Bitcoin spot ETFs were placed on the market at the New Exchange, the Chicago Futures Exchange and NASDAQ exchanges.

雅虎财经数据显示,交易首日开盘半小时,贝莱德、富达(Fidelity)和灰度产品的总交易量就突破10亿美元。

According to Yahoo financial data, the first half-hour of the transaction opened and the total volume of trade in the products of Beled, Fidelity and Greyscale was over $1 billion.

从首日交易数据来看,比特币现货ETF总成交量达46亿美元。其中,资管机构灰度的比特币现货ETF(GBTC)交易量最大,成交量为23.26亿美元。

The first-day transaction data show that Bitcoin's spot ETFs totaled $4.6 billion. Of this, the largest amount of Bitcoins' spot ETF (GBTC) transactions, with $2.326 billion, is accounted for by the agency's grey size.

另外两家成交量靠前的机构分别是贝莱德和富达。其中,贝莱德旗下的比特币现货ETF(IBIT)成交量超过10亿美元,排名第二。富达旗下比特币现货ETF(FBTC)成交量为7.12亿美元,排名第三。

The other two pre-dealing institutions are Belede and Fuda, respectively. Among them, the Bitcoin spot ETF (IBIT) under the Beled flag is second in number, and the Bitcoin spot ETF (FBTC) under the Fuda flag is third in number, at $712 million.

现货比特币ETF在上市的第二天(当地时间1月12日)继续保持热度。

The spot Bitcoin ETF remained hot on the second day of the market (12 January local time).

在新推出的现货比特币基金发行方中,贝莱德以5.64亿美元的交易额领先,而Fidelity的成交量为4.31亿美元。当天比特币现货ETF总成交量达到31亿美元,连续两日累计成交量接近77亿美元。

Of the newly launched spot bitcoin issuers, Belede led by $564 million in transactions, while Fidelity made a transaction of $431 million. On that day, Bitcoin made a total of $3.1 billion in active ETF transactions, with cumulative transactions amounting to nearly $7.7 billion for two days in a row.

OKX研究院高级研究员赵伟对中国证券报记者表示,短期来看,比特币现货ETF的获批,会刺激虚拟货币市场的发展。长期来讲,或推动比特币等加密资产触达更大的资金面。

According to Zhao Wei, a senior researcher at the OkX Institute, China Securities Journal, in the short term, the approval of the spot ETF in Bitcoin will stimulate the development of virtual money markets. In the long run, it will help to raise the financial profile of encrypted assets such as Bitcoin.

为拿到比特币现货ETF的发行资格,上述金融机构已经等待了将近一年时间。

The above-mentioned financial institutions have been waiting for almost a year to qualify for distribution of the spot ETF in Bitcoin.

近日,在审核决定下发之前,贝莱德宣布为其比特币现货ETF注入1000万美元种子基金;VanEck则表示将为待批准的比特币现货ETF提供7250万美元种子资金。

Recently, prior to the issuance of the audit decision, Beled announced the injection of $10 million in seed funds for its spot ETF in Bitcoin, and VanEck indicated that $72.5 million in seed funding would be provided for the pending ETF in Bitcoin.

彭博社智库的ETF分析师费罗发吉说,目前比特币现货ETF市场的需求可能来自基金发行人早前安排的“种子资金”。至于来自零售投资者或者金融顾问的需求,可能要等到更多交易员把这些ETF纳入他们的交易平台后,才看得出是否有需求。

The ETF analyst from Bloomberg's think tank said that the demand for the current spot ETF market in Bitcoin might come from “seed money” arranged earlier by the Fund's issuers. As for the demand from retail investors or financial advisers, it may not be possible to see if there is a demand until more traders have incorporated the ETF into their trading platforms.

美国证交会主席发声:

President of the SEC:

虽批准ETF上市,但未批准或认可比特币

did not approve or approve the listing of ETF

当地时间1月10日,在美国证交会(SEC)批准比特币现货ETF发行之后,美国证交会主席根斯勒在SEC网站发布了关于批准比特币现货ETF的声明。

On 10 January local time, following approval by the United States SEC of the release of the Bitcoin spot ETF, the Chairman of the SEC, Gensler, published a statement on the SEC website concerning the approval of the Bitcoin spot ETF.

根斯勒表示,尽管在周三批准了一些比特币现货ETF的上市和交易,但并未批准或认可比特币。比特币是一种投机性、波动性较大的资产。比特币现货ETF的获批将带来更多监管。

Gensler said that although some of the Bitcoin spot ETF listings and transactions were approved on Wednesdays, bitcoins were not approved or approved. bitcoins are a more speculative and volatile asset. The approval of Bitcoins spot ETFs will result in more regulation.

根斯勒表示:“这些产品将在注册的国家证券交易所上市交易。这些受监管的交易所必须制定旨在防止欺诈和操纵的规则,我们将密切监控它们,以确保它们执行这些规则。此外,委员会将全面调查证券市场中的任何欺诈或操纵行为,包括使用社交媒体平台的计划。”

According to Gensler: “These products will be traded on registered national stock exchanges. These regulated exchanges must have rules designed to prevent fraud and manipulation, which we will monitor closely to ensure that they implement. In addition, the Commission will investigate comprehensively any fraud or manipulation in the securities market, including plans to use social media platforms.”

近期,根斯勒已多次提示虚拟货币的投资风险。

当地时间8日,根斯勒表示,提供虚拟货币资产投资或服务的个体可能违反适用法律,包括联邦证券法。投资者参与虚拟货币投资的时候应该了解,他们可能会失去与其投资相关的关键信息和其他重要保护。此外,投资虚拟货币资产也可能伴随极高的风险,通常存在剧烈波动。

On the 8th of local time, Gensler said that individuals who provide investments or services in virtual currency assets could violate applicable laws, including federal securities laws. Investors should learn when participating in virtual currency investments that they may lose key information and other important protections related to their investments.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论