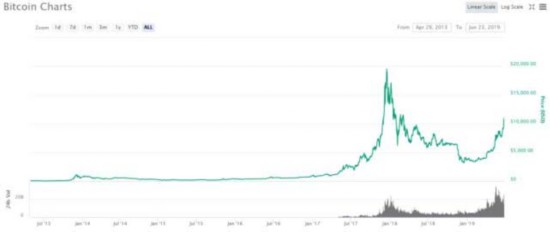

[摘要]比特币在2017年12月曾创下2万美元的最高纪录,但随之而来的整个2018年几乎都是在下跌中度过,最低时只剩3200美元,如今的价格相当于从小腿肚升回肚脐眼。

[Summary of ] Bitcoin had a record record of $20,000 in December 2017, but almost all of the years that followed were in decline, with only $3,200 at the lowest, and now prices are equivalent to coming back from the calves.

6月22日清晨,当人们正处于周末的放松状态时,比特币价格悄然突破了1万美元大关。虚拟货币报价网站CoinMarketCap的数据显示,比特币当日最高价为11157.35美元,比起今年年初的3768.84美元,上涨了196%。

Early in the morning of June 22, when people were relaxing on weekends, the price of

比特币价格走势图

比特币在2017年12月曾创下2万美元的最高纪录,但随之而来的整个2018年几乎都是在下跌中度过,最低时只剩3200美元,如今的价格相当于从小腿肚升回肚脐眼。

Bitcoin had a record record of $20,000 in December 2017, but almost all of 2018 was spent in decline, with only $3,200 at the bottom, and now prices are equivalent to coming back from the calves.

今年以来,随着种种消息刺激,比特币似乎重新引起了人们的注意力,开始了新一轮上涨。

Since the beginning of the year, with the stimuli of the news, it appears that Bitcoin has regained its attention and has begun a new upward spiral.

光是6月份就有三条重磅新闻:1.数字货币领域的投资人孙宇晨3000万拍下巴菲特午餐;2.比特易创始人惠轶做空比特币期货巨亏因而自杀;3.Facebook发布数字货币Libra。

In June alone, there were three heavy pounds of news: 1. Sun Woo, an investor in the digital currency field, took 30 million barfit lunches in the morning; 2. Huixiang, founder of Bitley, committed suicide by making a huge loss of airbitcoin futures; and 3. Facebook published a digital currency, Libra.

其中,Libra的发布,让数字货币行业的投资者尤其感到兴奋,因为终于有影响力巨大的公司加入了,对于数字货币来说,注意力就是市值。

Among them, the release of Libra was particularly exciting for investors in the digital money industry, as influential companies finally joined, and was the market value for digital money.

诺贝尔奖得主罗伯特?席勒早年曾这样形容比特币:泡沫一词作为一个比喻可能会引起误解,投机泡沫并不会就这样一下子结束掉,其实我认为叫做“投机性流行病”可能更好,因为我们知道病毒会变异,可能会重新爆发。

Robert Schiller, Nobel Laureate, described Bitcoin as he did in the early years: the word bubble, as a metaphor, could be misleading, and the speculative bubble would not just end, as I call it & ldquao; the speculative epidemic & rdquao; it might be better because we knew that the virus would change and could explode again.

正如席勒教授所说,比特币又开始让世界陷入流行性感冒了。那么,为何比特币近期不断上涨?普通人该如何看待比特币?Facebook推出的数字货币Libra又会对比特币造成什么样的影响?来看看大头的观点。

As Professor Schiller said, Bitcoin is starting to plunge the world into a cold. So, why is bitcoin rising lately? What do ordinary people think of bitcoin? What does Facebook's digital currency, Libra, have to do with bitcoin?

比特币近期的上涨首先跟它自己的周期有关系,因为它疯涨过,同时也暴跌过。所以如果从周期的角度看,它现在的上涨是跟前期的下跌周期对应的。

Bitcoin's recent rise is first and foremost related to its own cycle, because it's going crazy and falling. So if you look at it from a cycle point of view, it's going up the same way as it's going down.

第二就是国际贸易问题。中美贸易、多边贸易问题相对比较复杂,而且复杂当中负面的因素比较多,大家对经济和金融市场的前景都看不太清,很难把握,加上汇率市场又处于波动当中,这时比特币就有了一些投机的机会。

The second is the issue of international trade. Trade between China and the United States is relatively complex, and there are a number of negative factors in the complexity. The outlook for economic and financial markets is uncertain, and exchange-rate markets are in a state of volatility, which gives Bitcoin some opportunity for speculation.

同样是上涨,但比特币跟黄金不一样,黄金是金融属性,比特币投机属性更强一点。

The same rise, but unlike gold, 对于普通投资者来说,不赞成参与比特币。因为比特币本身的复杂性,跟其他的投资产品不一样。比特币的知识结构和它的技术掌握难度比较大,而且比特币还有一个问题是没有风险归属。 For ordinary investors, participation in bitcoin is not favoured. Bitcoin itself is not as complex as other investment products. Bitcoin's knowledge structure and its technical mastery are more difficult, and there's one problem in bitcoin that there's no risk attribution. 去投资美元,美元的风险可能跟美国经济有关,跟美国的债务有关;去投资黄金,可能是跟美元的走势相反,跟央行的政策有关;但是比特币的风险归属地到底在哪?你很难找到。风控点没有的话,就无法做出对应的措施进行对冲。 To invest in dollars, the dollar risk may be related to the US economy, to US debt; to invest in gold, probably contrary to US dollar trends, and to central bank policy; but where exactly is Bitcoin's risk attribution? You're hard to find. You can't hedge without the strong. 对于Facebook最近推出的数字货币,我觉得它也是一个网络的产品,跟比特币有相似的地方。我们讨论货币的时候,它一定有归属国,它一定有属地。但是数字货币它是一个网络,网络是全球共通的,它最终的风险归宿是无法控制的。 For Facebook's recently launched digital currency, I think it's also a product of the web, something similar to bitcoin. When we talk about the currency, it must belong to the country and it must be dependent. But the digital currency is a network, the network is global, and its ultimate risk destination is beyond control. Libra是一个跟科技网络连在一起的东西,Facebook科技属性更强,金融属性弱一些,它做不了这个货币。 Libra is a thing connected to a technology network, and Facebook is stronger, less financial, and it can't do this currency. 其实比特币的热炒跟当前整个市场的环境有特别重要的关系,风险在加大的同时趋势性不明朗,所以总会找一个点来炒一把,而这个时候Facebook正好把这个点推出来了,就这么简单。 In fact, Bitcoin's fever is particularly relevant to the current market environment, where the risk of `strong' is increasing while the trend is uncertain, so there's always a point to fire 其实在Facebook的数字货币Libra白皮书公布之前,比特币就已经是今年以来表现最好的大类资产了(或许传统投资圈并不把它视为大类资产的一种)。 Indeed, before the publication of the Facebook digital currency Libra White Paper, Bitcoin had been the best-performing class of assets since this year (perhaps the traditional investment circle does not see it as a class of assets). Libra只是为比特币突破一万美元加了一把柴火。结合近期监管侧的许多要闻,投资者对数字资产的情绪一下子就被点燃了。 此前英国央行发布了一份未来金融的研究报告,英国央行行长卡尼在评论这份研究报告的演讲中提到,或许会给新型的支付机构(包括Libra)开绿灯,将这类机构直接接入央行的支付体系和存款账户。 Earlier, the British Central Bank had published a study on future finance, and British Central Bank Governor Carney, in a speech commenting on the study, had mentioned that perhaps a green light might be given to new payment agencies, including Libra, which would have direct access to the central bank’s payment system and deposit accounts. 这意味着只要支付机构接受和银行同样的严苛监管,就可以加入到银行业务中去,此外法国中央银行行长也表态该国正在设立一个G7特别工作组,研究中央银行如何确保像Libra这样的加密货币受到各种法规的监管。 This means that as long as payment agencies are subject to the same stringent supervision as banks, they can be included in banking operations, and the Governor of the Central Bank of France has indicated that a G7 task force is being set up in the country to study how the Central Bank can ensure that encrypted currencies such as Libra are regulated by various regulations. 另外,在上周,美联储暗示即将开始降息,黄金也借机突破了前期的压力位,比特币圈内向来将比特币视为数字黄金,在诸多事件的刺激下促成了此轮上涨。 Also, last week, the Fed hinted that interest reductions were about to begin, that gold had taken the opportunity to break through the pressure position of the previous period, and that Bitcoin was traditionally seen as digital gold in the Bitcoin circle, which was spurred by events that contributed to the rise. 我认为,普通投资者是否入场,取决于他是否明确认识到了比特币的波动风险(参考上一轮的暴涨暴跌),我个人不太方便给出投资建议。 I believe that the entry of 另外,对于Libra来说,我认为它不像比特币,更像是法定货币附庸。Libra作为一种新的货币发行,其支撑的资产是银行存款和短期政府债券。市面上有许多和这类所谓的“真实资产储备”结构近似的金融产品,比如美国的政府型货币基金和我们大家都熟知的余额宝。 In addition, for Libra, Facebook发布的白皮书提到,如需创造新的Libra币,则必须使用法定货币按1:1比例购买Libra,并将该法定货币转入储备。简而言之,对投资者和用户而言,只有一种方法可以创造更多的 Libra,那就是使用法定货币购买。 The White Paper published on Facebook mentions that if a new Libra currency is to be created, Libra must be purchased at a ratio of 1:1 in the statutory currency and transferred to the reserve. , in short, there is only one way for investors and users to create more Libra, which is to buy in the statutory currency. 实际上,当我们把人民币现钞存入银行的时候,就是使用法定货币按1:1比例购买了“人民币存款”。然后银行把收到的现钞转入储备(准备金或库存现金)。 In fact, when we put the currency in the bank, we buy &ldquao in the legal currency at 1:1 ratio; &rdquao deposits in the renminbi; and then the bank transfers the money received into reserves (reserves or cash on hand). 今年早些时候,扎克伯格在开发者大会上强调,支付将是Facebook的重要领域。于是Facebook发行了自己的加密货币。 Earlier this year, Zuckerberg stressed at the Developer Congress that payment would be an important area of Facebook. So Facebook released its own encrypted currency. 那么Facebook的加密货币,与一般意义上的虚拟货币有什么区别呢? So what's the difference between Facebook's encrypted currency and virtual currency in general? 简单说来,Libra是一个基于区块链底层、有100%储备资产支持、币值波动较小的无国界稳定数字代币。 Simply put, Libra is a stable, borderless digital token based on the bottom of the block chain, supported by 100% reserve assets and less volatile currency. 由此也就不难看出Libra与比特币等虚拟货币的根本区别之所在。对于任何一种通行货币而言,币值的稳定可以说是基本要求,但是像比特币那样一日一价甚至一时一价,投机属性远远超过了其作为一般等价物的交易属性。 So it is easy to see the fundamental difference between Libra and virtual currencies such as Bitcoin. For any of the prevailing currencies, currency stability can be said to be a basic requirement, but, as in Bitcoin, speculative attributes far exceed their trading attributes as generic equivalents. 但作为一种稳定币的Libra其实算不上是什么新东西,在此之前,Gemini公司已经发行过GUSD,摩根大通也发行过JPMcoin,也曾一度引发诸多联想,但时至今日,还未看到它们在全球支付体系中掀起什么滔天巨浪。 But Libra, as a stable currency, is not really new, as Gemini had already issued GUSD and Morgan Chase JPMcoin, and there had been a number of connections. To date, it has not been seen that they have created a huge wave in the global payment system. 不管虚拟货币被描述得如何具有革命性意义,其能量的发挥还是要依赖于应用场景。没有足够广阔的应用场景,最终的结局恐怕也只能是不了了之。就目前而言,美元体系尚不能满足区块链世界难篡改、可溯源、公开透明等要求,那么需要用美元(以及其他篮子内货币)转换之后才能使用的Libra,其满足需要的能力会更强吗? No matter how revolutionary the virtual currency is described, its energy depends on the application scenario. 同时,Libra仍然只是一种在特定网络社区或商圈内使用的专用代币,既然是代币,那么去谈它取代法定货币的可能性,则未免过于理想化了。 At the same time, Libra is still only a special token for use within a particular network community or business community, and it would be too ideal to talk about the possibility of replacing the legal currency. 另一方面,从加密货币角度说,不会上升为主权货币并不影响投资价值。中国虽然不能交易,但在居民海外资产配置过程中不必妖魔化比特币,比特币等加密货币或代表了新的避险资产,比房地产、黄金等资产更具便捷性,可以作为海外资产配置的组合选项之一。 On the other hand, from an encrypt currency perspective, does not rise to a sovereign currency without affecting the value of investment. China, although it cannot trade, does not have to demonize bitcoin in the case of residents' overseas asset allocation, encrypted currency, such as bitcoin, or represents a new hedge asset, which is easier than real estate, gold, etc., and can be one of the portfolio options for overseas asset allocation. 经济学中依据货品供求关系,有这么一条原则:产量大而生产成本低的货品价格恒低于产量小而生产成本高的货品价格。(水和钻石就是一个很好的案例,这里没有强调产品的效用问题)。 Economics is based on the supply and demand of goods, and there is a principle that the price of 据说,现在每枚比特币的成本已经超过2000美金。我想,加上全球财富配置需求等因素,相对应的价格应该会在1万美元附近。 It is said that the cost of each bitcoin is now over $2,000. I think, together with factors such as the global need for wealth allocation, the corresponding price should be around $10,000. 不过,需要提醒的是,加密货币投资具有高风险性,事实上,从最高峰到现在几乎跌去一半,如果配置比重过高,这恐怕也不是很多投资者能够承受的。因此,比特币只能作为资产组合配置的一部分。 It should be recalled, however, that encrypt currency investments are high-risk and, in fact, almost halved from their peak to now, which is not likely to be acceptable to many investors if the configuration is too high. So bitcoins can only be part of the portfolio. 投资比特币需要注意两点:一是要把握准进入的窗口时间,比特币对避险事件、大国态度等政治、政策影响十分敏感,很容易出现价格过山车现象,切莫出现高买低卖等踩错节点的情况,否则很容易类似于买黄金的“中国大妈”,数年难以解套。二是首选投资比特币等少数头部加密货币,安全性相对高一些。 Investing in Bitcoin requires two things: , which is about time to get into the window, and , which is sensitive to political and policy influences such as risk avoidance events, attitudes of major Powers, etc., makes it easy to overprice the mountain, and does not allow for high-buying, low-selling, etc., which could easily be similar to buying “ Chinese Grandmother & rdquao; and for years, it is difficult to solve. is the preferred investment in a small number of front-head encrypted currencies such as Bitcoin , with a relatively high level of security.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论