Hashdex 在 6 月 18 日向美国证券交易委员会 (SEC) 提交的文件中提议在纳斯达克交易所创建一只混合现货比特币 (BTC) 和以太币 (ETH) 交易所交易基金 (ETF)。

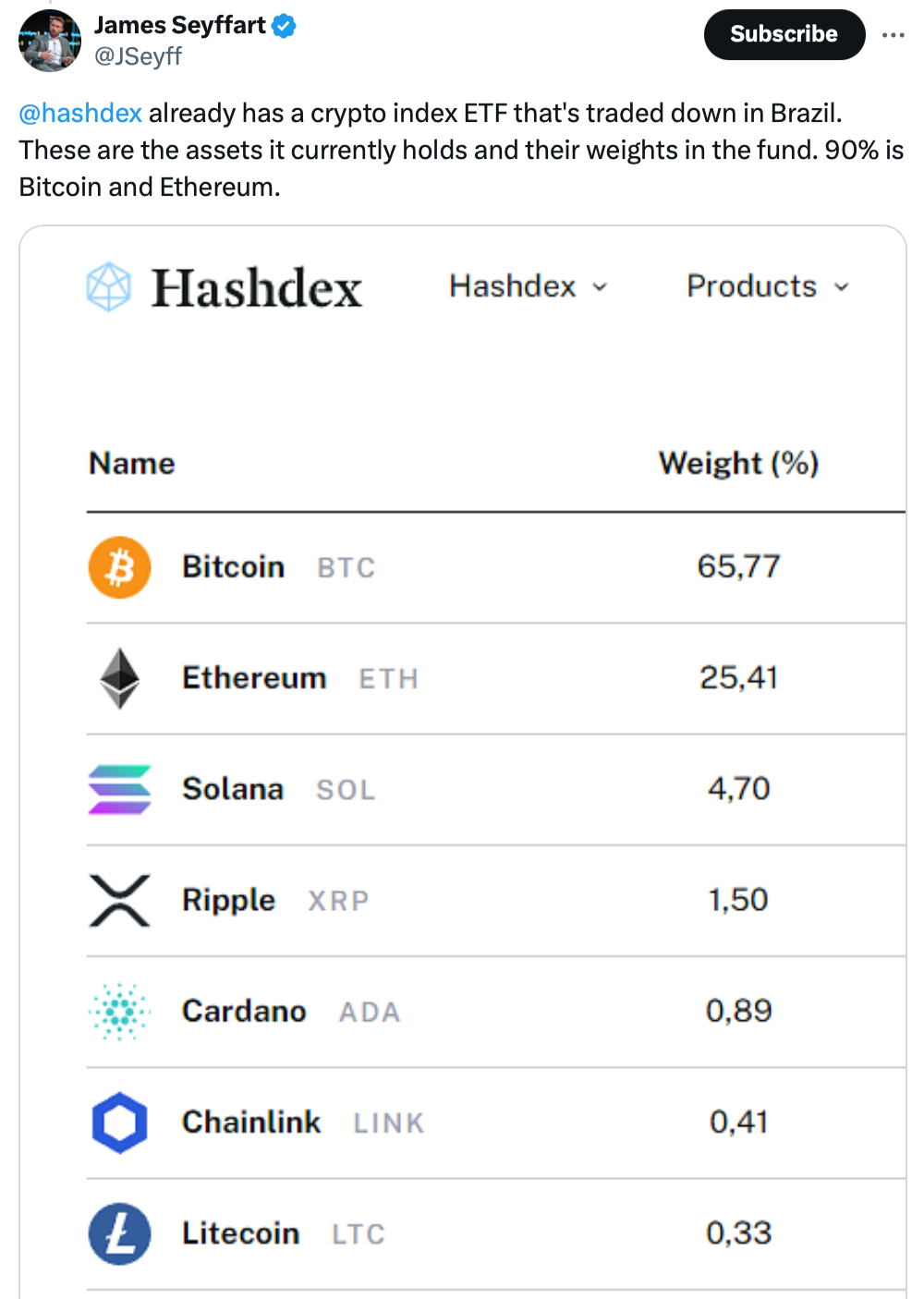

In a submission to the United States Securities and Exchange Commission (SEC) in June 18, Hashdex proposed the creation of a mixed spot ( BTC) and the `tetble' 拟议的 ETF 将根据加密资产的市值来平衡它们,其中比特币占 70.54% 以及 29.46% 的以太坊,5 月 27 日。其被动投资策略将跟踪纳斯达克加密货币美国结算价格指数的每日市场走势,而不会试图打败它。 The proposed ETF will balance the market value of encrypted assets with 分析师 James Seyffart表示,混合资产 ETF 非常有意义。该 ETF 不会投资除 BTC 和 ETH 之外的其他现货资产。不过,如果包含任何其他加密资产(比特币或以太币除外),或有资格纳入指数成分股,则发起人将转变信托的投资策略,其中只有比特币和以太币的比例由指数确定。 The analyst James Seyffart states that the hybrid asset ETF is very interesting. The ETF will not invest in other current assets other than BTC and 文件称,根据一系列规则,加密资产有资格被纳入,包括目前在受美国监管的数字资产交易平台上上市,或作为在美国监管的衍生品平台上上市的衍生工具的标的资产。 The document states that encrypted assets are eligible for inclusion under a series of rules, including assets currently listed on digital asset trading platforms that are subject to United States regulation, or as the subject of derivative instruments that are listed on derivative platforms that are subject to United States regulation. Coinbase 和 BitGo 都将担任 BTC 和 ETH 资产的托管人。他们将为个人股东提供独立账户。 Coinbase and BitGo will both serve as trustees for BTC and ETH assets. 巴西投资管理公司 Hashdex 向美国证券交易委员会提交了创建 ETH ETF 的申请,但后来撤回了申请。其在巴西交易的指数化加密货币 ETF 包含九种货币,其中 BTC 和 ETH 占价值的近 92%。其在美国交易的现货 BTC ETF包含高达 5% 的BTC 期货合约,并在 CME 上收购现货资产。 The Brazilian Investment Management Corporation, Hashdex, submitted an application for the creation of ETH ETF to the United States Securities and Exchange Commission, but later withdrew the application. Its indexed encrypted currency, ETF, traded in Brazil, contained nine currencies, of which BTC and ETH accounted for nearly 92 per cent of its value. Its current BTC ETF, traded in the United States, contained up to 5 per cent of BTC futures contracts and acquired off-the-shelf assets on CME. Hashdex 仍需提交 S-1 申请并获得美国证券交易委员会的批准。该机构有 90 天的时间对 19-b4 做出回应,在此期间它将接受公众和其他金融机构对该提案的评论。根据 Seyffart 的说法,美国证券交易委员会对该基金的最终决定应不迟于 2025 年 3 月做出。 Hashdex has 90 days to respond to 19-b4, during which time it will receive comments from the public and other financial institutions on the proposal. According to Seyffart, the final decision of the United States Securities and Exchange Commission on the Fund should be made no later than March 2025. 文章标题:Hashdex向美国证券交易委员会提交了合并现货比特币和以太坊ETF的文件 Title of article: Hashdex submitted to the United States Securities and Exchange Commission documents combining spot Bitcoin and Ether Ether 文章链接:https://www.btchangqing.cn/658572.html 更新时间:2024年06月19日 Update: 19/06/2024

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论