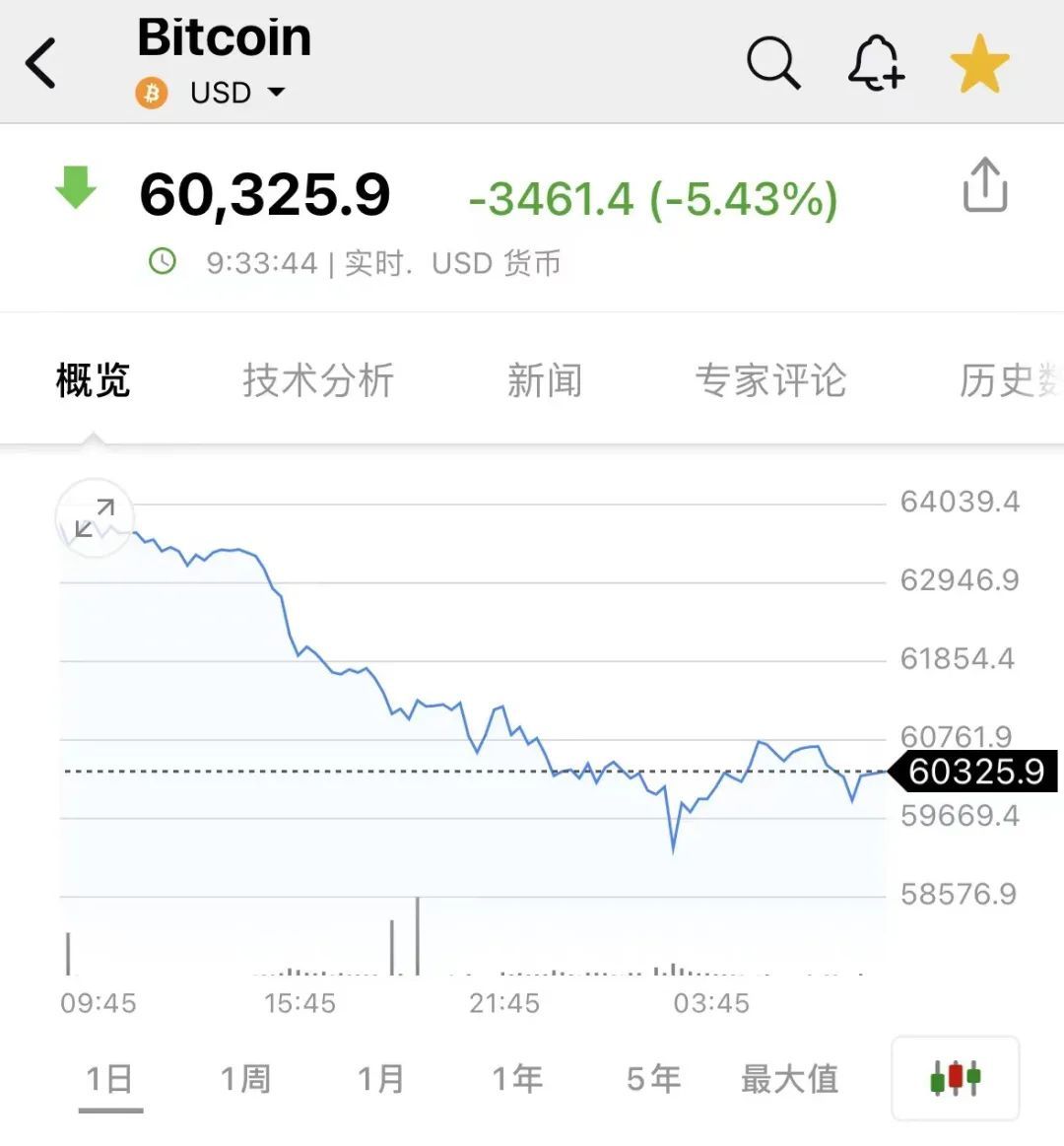

美股市场4月的最后一天,比特币价格跌破6万美元,创下近两年来最糟糕的单月表现。

On the last day of the United States stock market in April, bitcoin fell by $60,000, the worst single-month performance in nearly two years.

美股尾盘时,比特币盘中跌破6万美元,部分平台交易价跌至5.92万美元下方,较日高跌超5000美元、跌超8%。

The United States stock tail fell by $60,000 in the bitcoin disk, and some of the platform's trading prices fell below $592 million, dropping by over $5,000 and over 8 per cent on a daily basis.

图片来源:英为财情截图

Source: English as a financial screenshot.

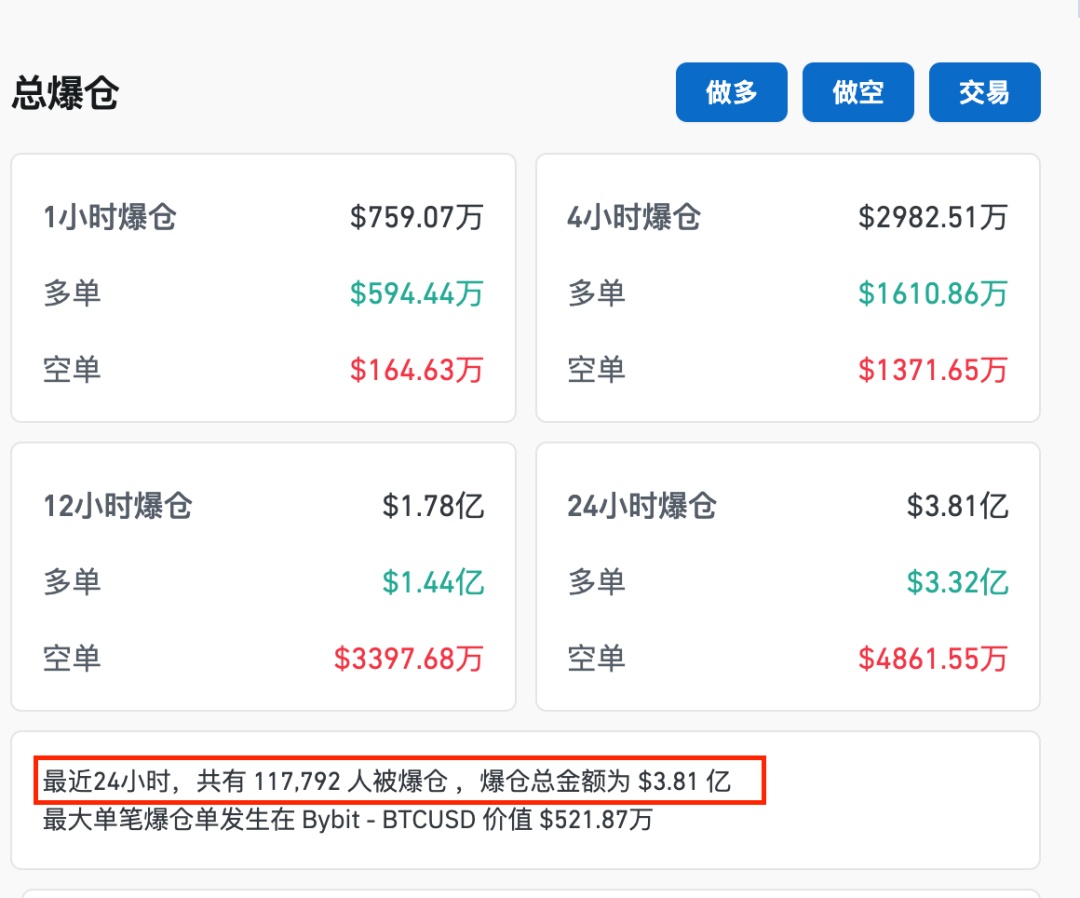

根据加密货币检测网站coinglass数据,最近24小时有约11.7万人爆仓,爆仓总金额为3.81亿美元。

According to the encrypted currency testing website coinglass, there have been approximately 117,000 explosions in the last 24 hours, with a total of $381 million.

图片来源:网页截图

Photo source: Webshot

4月累跌约16%

It fell by about 16% in April.

比特币减半影响未达预期

The half-percent impact of Bitcoin has fallen short of expectations.

事实上,比特币4月跌去超过1万美元,累跌约16%,是2022年11月以来表现最糟糕的一个月。

In fact, Bitcoin fell by more than $10,000 in April, falling by about 16 per cent, the worst month of performance since November 2022.

市场曾非常期待四年一度的比特币减半,但自4月19日发生以来,其影响似乎微乎其微,并未如预期一般持续推高比特币的价格。

The market had very much expected to halve the four-year bitcoin, but since 19 April its impact had seemed minimal and had not consistently pushed the price of bitcoin up as expected.

比特币减半是指“挖掘”比特币交易的奖励减半,以确保其稀缺性、价值保持以及作为一种数字货币的长期可持续性。

The halving of bitcoin refers to the halving of incentives for “digging” bitcoin transactions to ensure its scarcity, preservation of value and long-term sustainability as a digital currency.

比特币减半事件通常被看作是推动比特币牛市的积极因素。然而,对于这次比特币减半,摩根大通的分析师团队依据比特币当前价格测算的减半以后矿工的成本开销,当期期货未平仓合约数量,以及比特币与黄金的横向对比等几个因素,作出了减半后比特币价格可能暴跌的预判。

The halving of bitcoin is often seen as a positive push for bitcoin. However, the reduction of bitcoin by half this time, Morgan Chase's team of analysts charged the cost of mining workers after halving the price currently measured by bitcoin, the unsettled volume of contracts for current futures, and the horizontal comparison of bitcoins with gold, have made a prognosis that bitco prices may fall sharply after halving.

根据比特币协议的设计,减半事件发生在大约每210000个区块被开采之后,这个时间间隔大约是四年。自2009年诞生以来,比特币已经成功完成了四次减半。

According to the Bitcoin agreement, the half-percent event took place after approximately 210,000 blocks were mined, at a time interval of about four years. Since its inception in 2009, Bitcoin has successfully halved four times.

“停滞性通胀”似乎是本月比特币暴跌的重要原因。加密货币交易公司QCP Capital在研究报告中指出,“停滞性通胀”的威胁是非常真实的。报告写道,美国GDP数据弱于预期表明经济增长放缓,而核心个人消费支出(PCE)指数偏高则意味着,通胀问题仍将是联准会(Fed)的眼中钉。

The threat of stagnating inflation is very real, as QCP Capital, an encrypted money-trading company, pointed out in its study. The report wrote that US GDP data were weak than expected to indicate a slowdown in economic growth, while the high core personal consumption expenditure (PCE) index meant that inflation would remain at the center of Fed’s eyes.

根据《BeInCrypto》报道,比特币分析师Murad Mahmudov预测,比特币震荡的走势可能会持续到夏天。在这段期间,投资者将找寻线索,以判断当前的走势是筑底还是已经触顶。

According to BeinCrypto, a Bitcoin analyst, Murad Mahmudov, predicts that the trend of a Bitcoin shock may continue into the summer. During this period, investors will look for clues to determine whether the current trend is at the bottom or at the top.

投资者将目光转向香港市场加密货币产品

Investors turn their eyes to the encrypted currency products of the Hong Kong market.

尽管一些分析师提出了悲观预测,但知名比特币企业家Lark Davis仍看好后市产业发展。他援引Morgan Stanley参与比特币现货ETF的新闻指出,传统金融机构对加密货币的接受度越来越高。

Despite pessimistic predictions by some analysts, the well-known Bitcoin entrepreneur, Lark Davis, is still looking at post-market industrial development. Citing Morgan Stanley’s involvement in Bitcoin’s spot ETF news, he noted that traditional financial institutions were becoming more receptive to encrypted money.

他还认为,香港核准比特币与以太币现货ETF上市交易,可能会引起亚洲机构投资者的巨大兴趣。Davis表示,如果你仍然感到悲观,你需要知道这一点,越来越多的机构投资者正在加入。

He also argued that Hong Kong’s approval of a spot exchange between bitcoin and ETF could be of great interest to Asian institutional investors. Davis said that if you still feel pessimistic, you need to know this, and more and more institutional investors are joining.

据港交所数据,截至4月30日,6支香港首批发行的虚拟资产现货ETF的总交易量约为8758万港元,其中华夏产品占比近57%。比特币(BTC)现货ETF交易方面,华夏旗下ETF交易量为3716万港元,嘉实1789万港元,博时1244万港元。以太币(ETH)ETF交易方面,华夏旗下ETF交易量为1266万港元,嘉实录得495万港元,博时为248万港元。

As at 30 April, the total volume of six of Hong Kong’s first-distributed real-asset spot ETF transactions was approximately HK$87.58 million, of which China’s summer products accounted for nearly 57%. In respect of the Bitcoin (BTC) spot ETF transactions, the amount of ETF transactions under China’s flag was HK$37.16 million, HK$17.89 million, and HK$12.44 million at Bo. In the case of the ETF transactions under China’s flag, HK$12.6 million, and HK$4.95 million and HK$2.4 million at Bo.

香港交易所表示,虚拟资产现货ETF的推出将会增加香港市场的产品种类,为投资者提供更加丰富的选择,巩固香港作为亚洲领先ETF市场的地位。

The Hong Kong Exchange indicated that the introduction of the virtual assets spot ETF would increase the range of products in the Hong Kong market, provide investors with more options and consolidate Hong Kong's position as the leading Asian ETF market.

彭博智库分析师Rebecca Sin预计,香港上市的加密资产ETF可能在未来两年内能够积累10亿美元。

Rebecca Sin, an analyst for the Bloomberg think tank, expects that the encrypted asset ETF in Hong Kong may accumulate $1 billion over the next two years.

转自:中国经济网微信综合中国基金报、国际金融报

From: China Economic Network, Micro-Customs Consolidated China Fund Report, International Finance Report

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论